Illinois Warranty Deed from Corporation to Husband and Wife

Description

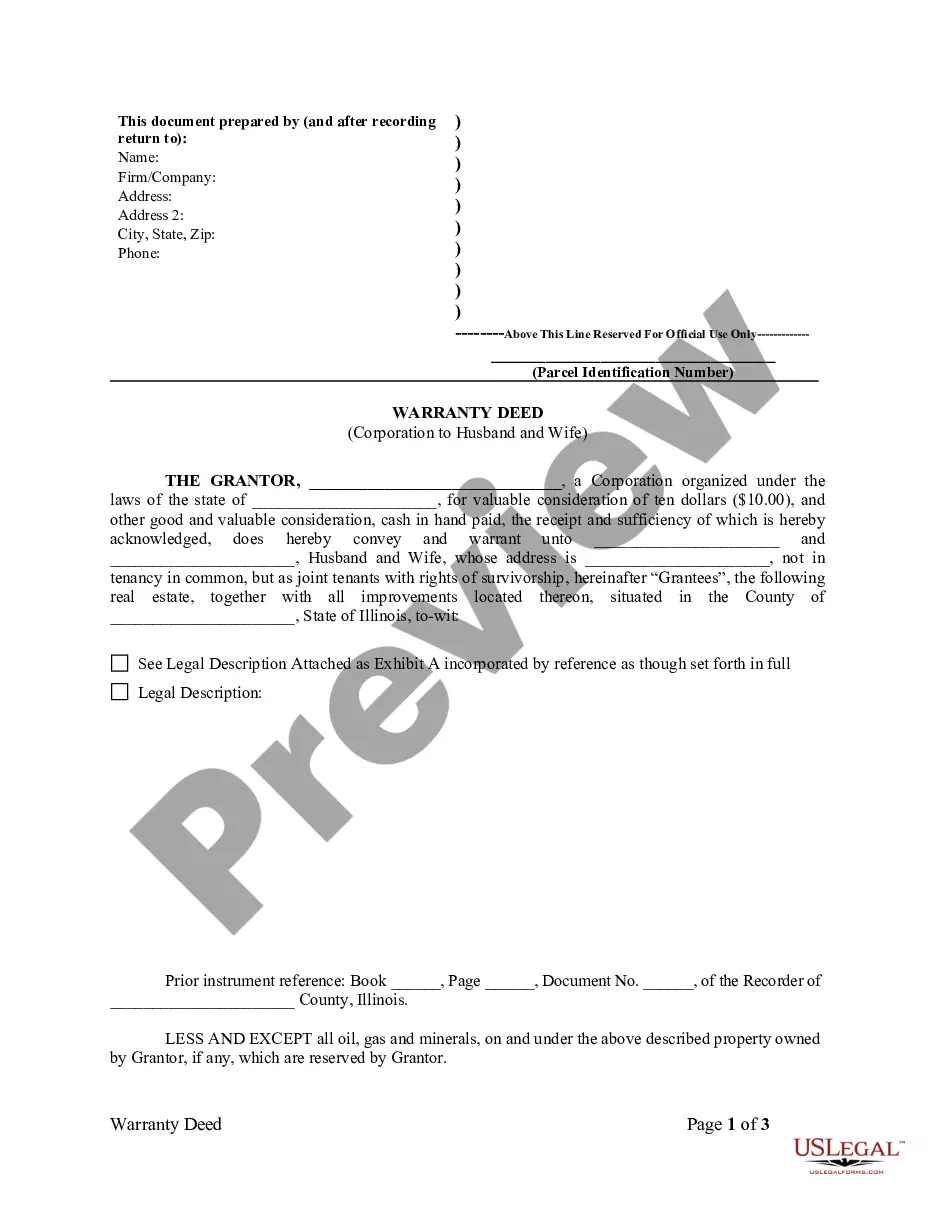

How to fill out Illinois Warranty Deed From Corporation To Husband And Wife?

Attempting to locate Illinois Warranty Deed from Corporation to Husband and Wife example and completing them could be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and find the appropriate example specifically for your state in just a few clicks.

Our legal experts prepare every document, so you merely have to fill them in. It's that simple.

You can print the Illinois Warranty Deed from Corporation to Husband and Wife template or complete it using any online editor. Don’t worry about making mistakes because your form can be used, submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the document.

- Your downloaded templates are stored in My documents and are accessible anytime for future use.

- If you haven’t signed up yet, you should create an account.

- Review our comprehensive guide on how to obtain your Illinois Warranty Deed from Corporation to Husband and Wife sample in just a few moments.

- To acquire a relevant sample, ensure its suitability for your state.

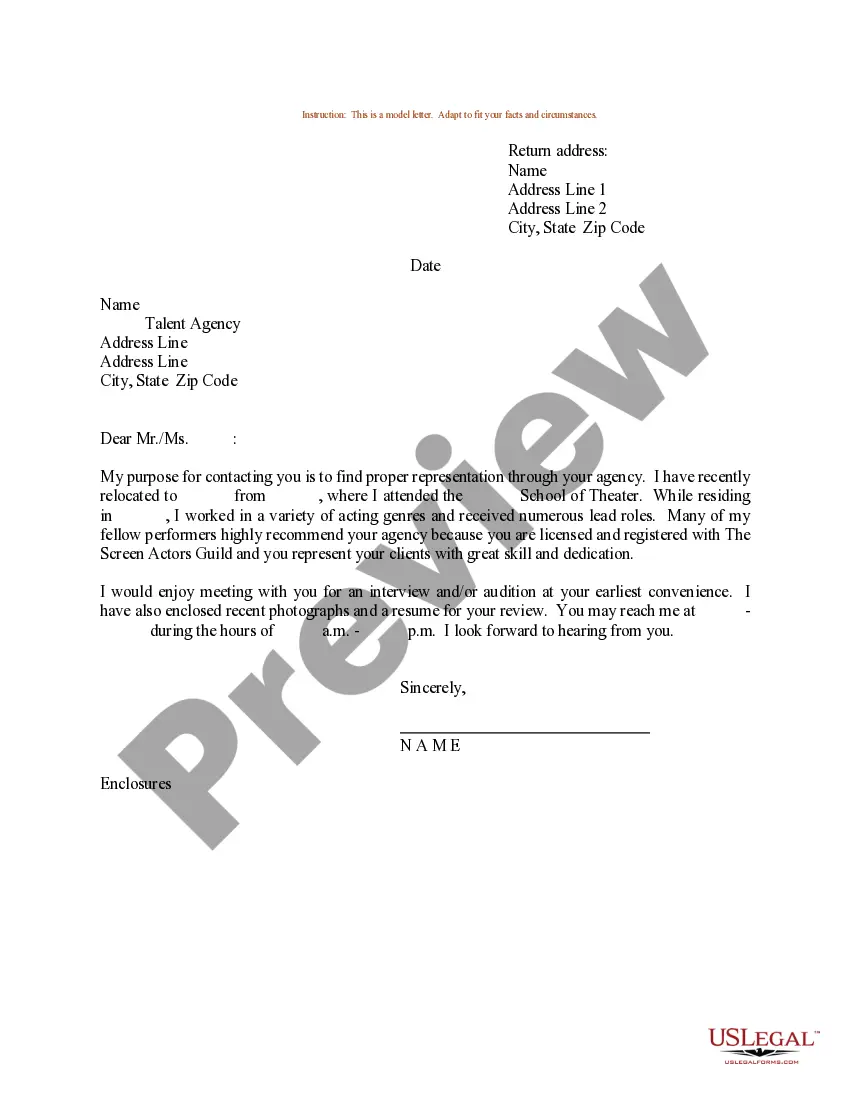

- Examine the form using the Preview option (if available).

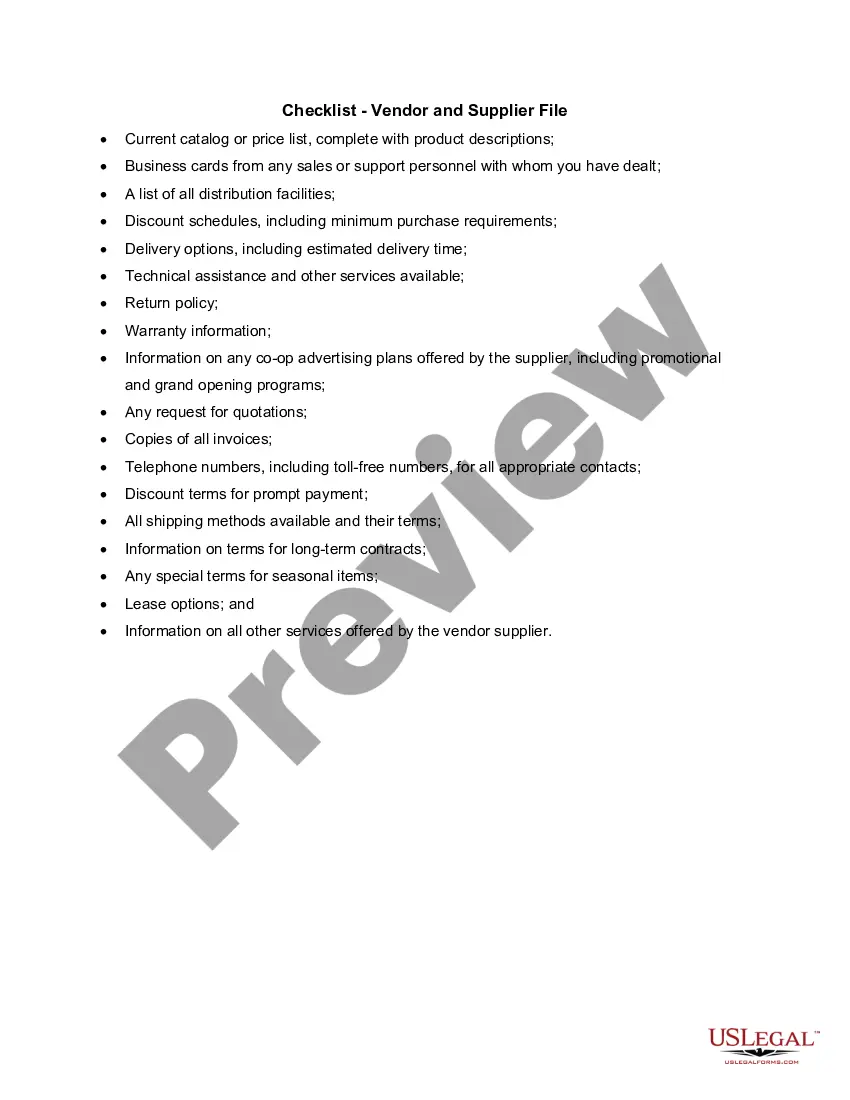

- If there's a description, read it to understand the specifics.

- Click on the Buy Now button if you found what you're searching for.

- Choose your plan on the pricing page and create your account.

- Indicate whether you prefer to pay by credit card or via PayPal.

- Download the file in your desired format.

Form popularity

FAQ

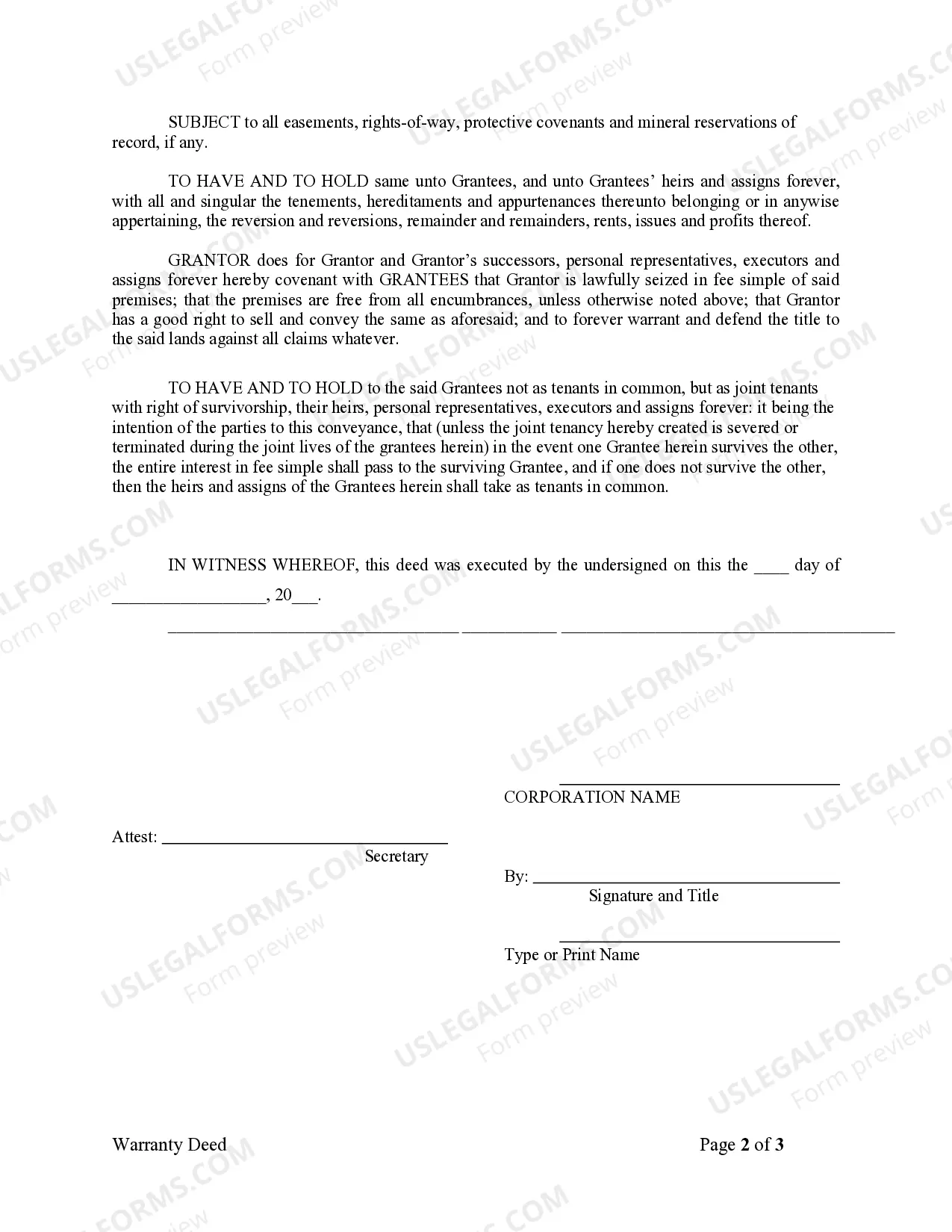

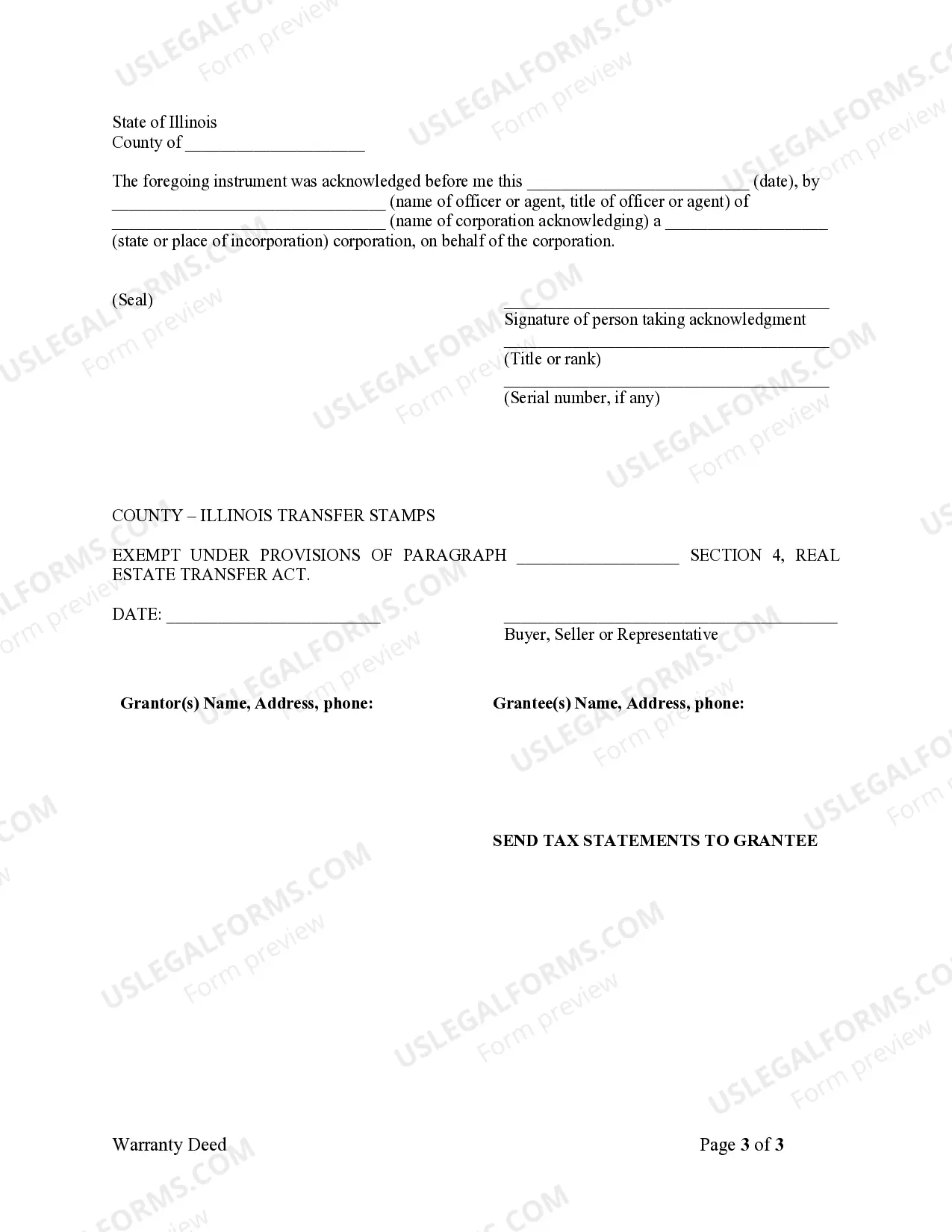

Yes, when a corporation transfers ownership of property, the deed must be signed by the authorized representatives of the corporation. This step is vital to ensure that the Illinois Warranty Deed from Corporation to Husband and Wife is valid and enforceable. Properly executed signatures prevent potential legal disputes regarding ownership or authority.

In Illinois, a special warranty deed transfers title in fee simple to the grantee with warranties and covenants of title that are limited to only the acts of the grantor or that result from the acts of the grantor and is the form of deed customarily used in commercial real estate transactions.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the Illinois land records.

The first common requirement is that the deed must be in writing and signed by the grantor(s). 765 ILCS 5/1. Generally, deeds conveying a homestead estate must also be signed by the grantor's spouse, except where one spouse conveys to the other. A few other exceptions to this rule are set forth at 735 ILCS 5/12-904.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.