This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Idaho Royalty Payments

Description

How to fill out Royalty Payments?

Choosing the right legal papers template can be quite a have a problem. Obviously, there are a lot of templates accessible on the Internet, but how do you get the legal type you will need? Take advantage of the US Legal Forms website. The service provides a large number of templates, like the Idaho Royalty Payments, which can be used for enterprise and personal needs. All the varieties are inspected by pros and meet state and federal needs.

In case you are currently registered, log in for your profile and click on the Acquire switch to find the Idaho Royalty Payments. Make use of your profile to check through the legal varieties you possess ordered in the past. Check out the My Forms tab of the profile and acquire one more version of your papers you will need.

In case you are a whole new customer of US Legal Forms, listed here are basic instructions so that you can adhere to:

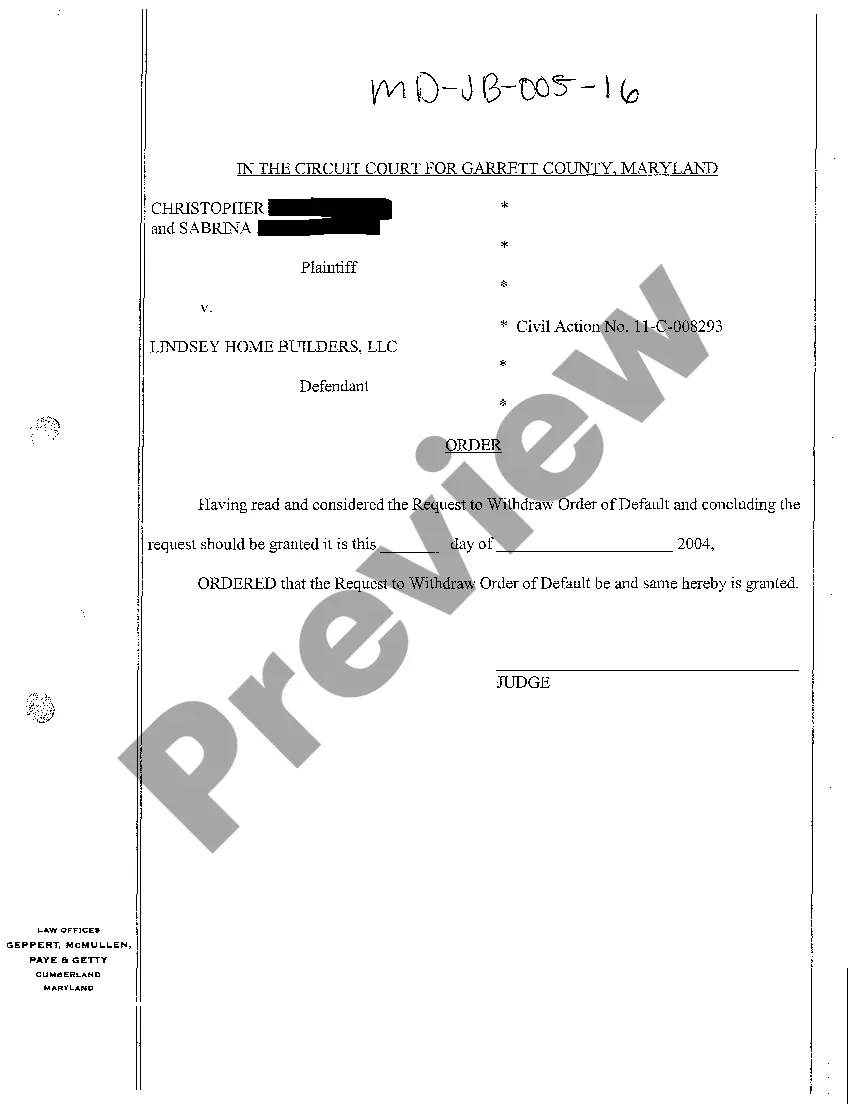

- First, make certain you have selected the correct type to your town/county. You may look through the form utilizing the Review switch and study the form explanation to guarantee it will be the best for you.

- In case the type does not meet your preferences, make use of the Seach field to obtain the right type.

- When you are certain that the form is proper, click the Buy now switch to find the type.

- Choose the prices program you want and type in the essential info. Create your profile and pay for an order utilizing your PayPal profile or Visa or Mastercard.

- Pick the document file format and download the legal papers template for your gadget.

- Total, change and produce and signal the attained Idaho Royalty Payments.

US Legal Forms is the biggest local library of legal varieties that you can discover a variety of papers templates. Take advantage of the service to download appropriately-made files that adhere to condition needs.

Form popularity

FAQ

The grocery tax credit offsets the sales tax you pay on groceries throughout the year. For most Idaho residents it averages $100 per person. You must be an Idaho resident to be eligible, and you might be able to claim a grocery credit for your dependents, too.

1. Complete Form 96 (or include a copy of IRS Form 1096). 2. Mail the form and your 1099s to: Idaho State Tax Commission, PO Box 36, Boise ID 83722-0410.

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. - the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount. The threshold in Idaho is $100,000 in annual sales.

Log into your TAP account and make sure you see the balance due for income tax. Click More. Scroll down to the Payment Plans panel and choose Request a Payment Plan. Complete and submit your request.

It is much easier to file these forms electronically in the first instance. If you have opted to send these forms in the mail, read on to find out where to send them. Send your forms to: Internal Revenue Service, Austin, Submission Processing Center, P.O Box 149213, Austin, TX 78714.