This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Idaho Minimum Royalty Payments

Description

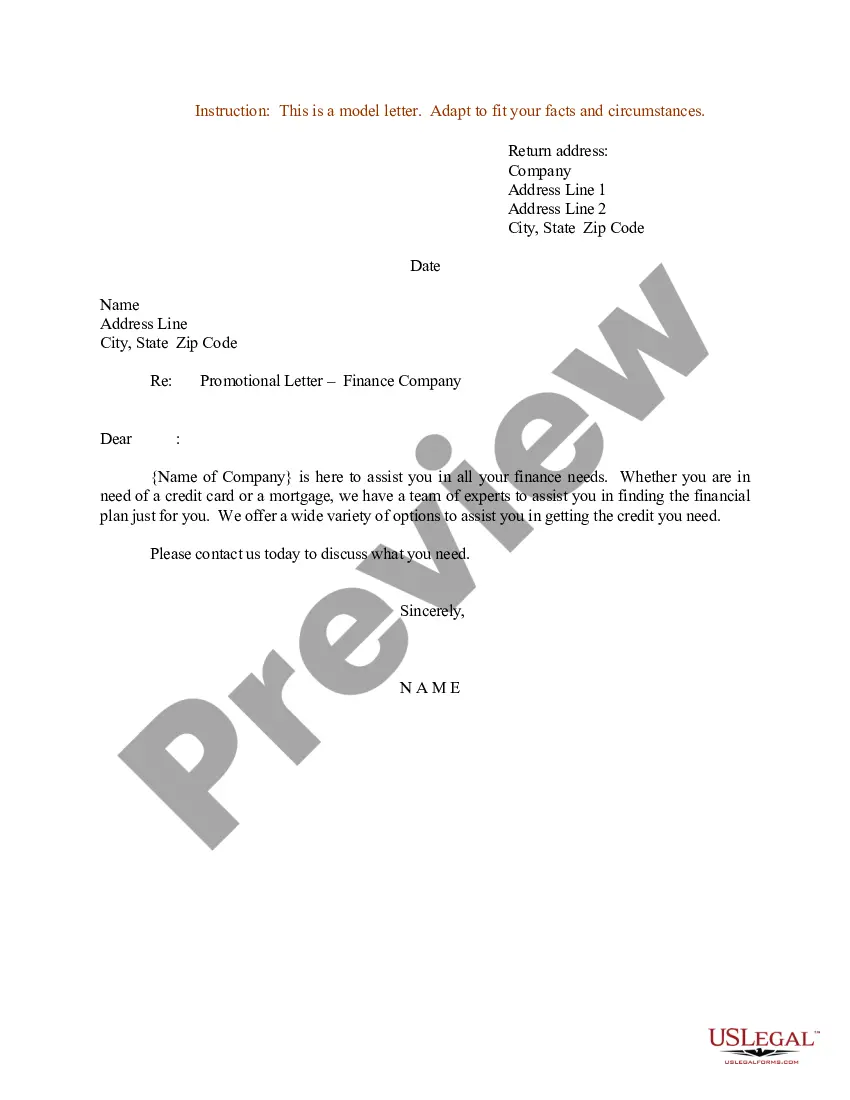

How to fill out Minimum Royalty Payments?

Discovering the right authorized papers format might be a battle. Obviously, there are a variety of layouts available online, but how can you find the authorized type you want? Make use of the US Legal Forms internet site. The service gives a huge number of layouts, such as the Idaho Minimum Royalty Payments, which you can use for enterprise and private requires. All of the kinds are checked out by professionals and satisfy federal and state needs.

In case you are presently authorized, log in to the profile and then click the Download option to find the Idaho Minimum Royalty Payments. Use your profile to check throughout the authorized kinds you possess purchased previously. Visit the My Forms tab of your profile and acquire one more duplicate of your papers you want.

In case you are a fresh end user of US Legal Forms, allow me to share simple recommendations that you should adhere to:

- Very first, be sure you have chosen the correct type for the city/region. You may check out the shape using the Review option and browse the shape outline to make sure this is basically the right one for you.

- If the type will not satisfy your expectations, utilize the Seach discipline to obtain the right type.

- When you are sure that the shape would work, go through the Buy now option to find the type.

- Select the prices plan you want and enter the required info. Make your profile and pay for the transaction with your PayPal profile or bank card.

- Pick the file file format and download the authorized papers format to the product.

- Complete, modify and print and indication the acquired Idaho Minimum Royalty Payments.

US Legal Forms will be the biggest catalogue of authorized kinds that you will find numerous papers layouts. Make use of the service to download appropriately-manufactured documents that adhere to condition needs.

Form popularity

FAQ

Pay from your bank account (free) or using a credit card (fee) through TAP, if you have a TAP account. (You can't file income tax returns in TAP.) Pay by check through the mail or in person. If you're mailing a payment without its return, complete and attach this form: Form ID-VP ? Income Tax Voucher Payment.

Log into your TAP account and make sure you see the balance due for income tax. Click More. Scroll down to the Payment Plans panel and choose Request a Payment Plan. Complete and submit your request.

The state not only owns the beds and banks of the navigable waterways below the ordinary high watermark, it also owns the mineral rights associated with this land. The Idaho Department of Lands (IDL), acting under the direction of the State Board of Land Commissioners manages the mineral estate of these lands.

Pay by Internet: Credit Card Payment Options: Pay On-line by credit card or e-check: Click on the ?Taxes Due? Link. If you are paying on a delinquent account, please call our office for the correct total at (208) 983-2801.