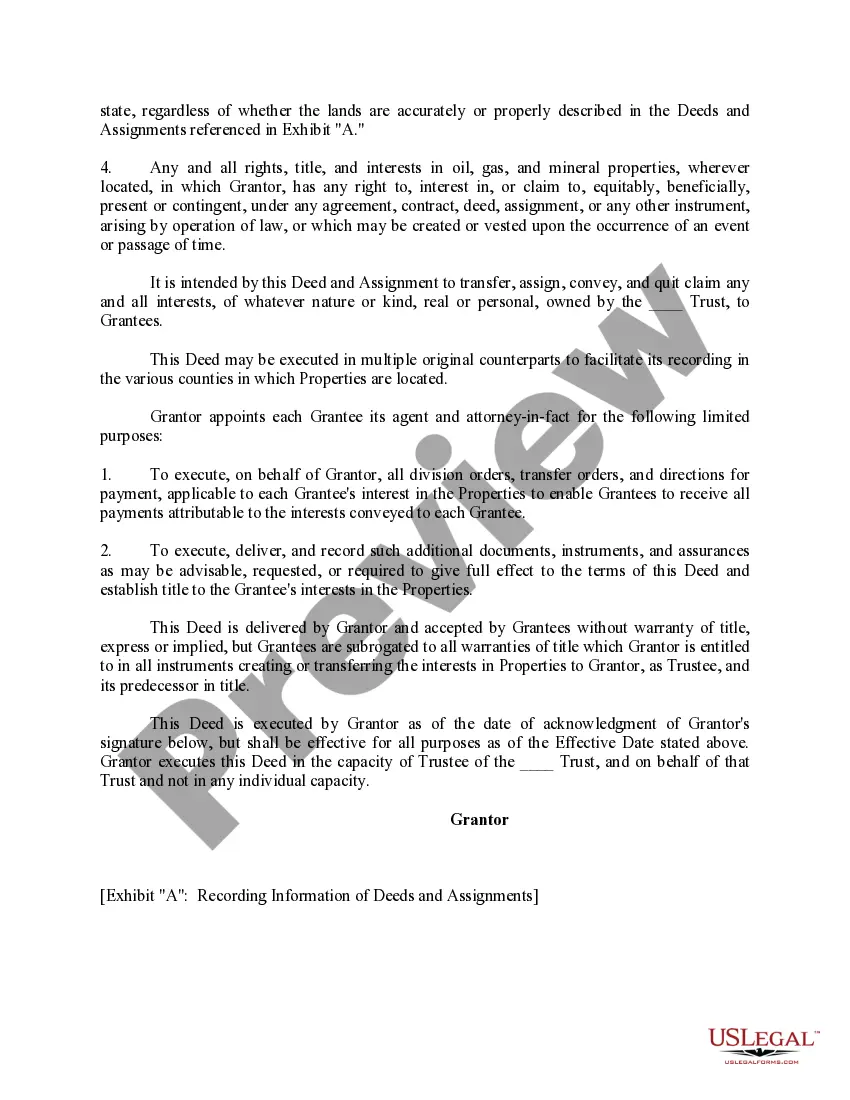

This form is used when a Trust has terminated by the terms of the Agreement creating the Trust and pursuant to the terms of the Agreement creating the Trust, upon its termination, the then acting Trustee is to distribute all of the Properties in the Trust to the beneficiaries named in the Trust Agreement.

Idaho Trustee's Deed and Assignment for Distributing Properties Out of Trust

Description

How to fill out Trustee's Deed And Assignment For Distributing Properties Out Of Trust?

Choosing the best lawful record template can be a struggle. Of course, there are tons of web templates available on the net, but how can you find the lawful kind you will need? Utilize the US Legal Forms website. The support gives a huge number of web templates, for example the Idaho Trustee's Deed and Assignment for Distributing Properties Out of Trust, that you can use for enterprise and personal requirements. Each of the forms are inspected by pros and satisfy state and federal demands.

When you are presently listed, log in to the account and click the Acquire key to obtain the Idaho Trustee's Deed and Assignment for Distributing Properties Out of Trust. Make use of your account to appear with the lawful forms you possess ordered formerly. Check out the My Forms tab of your account and obtain another duplicate in the record you will need.

When you are a new customer of US Legal Forms, allow me to share simple guidelines for you to stick to:

- Initially, make sure you have selected the proper kind for your personal metropolis/area. You can look over the shape using the Preview key and study the shape information to make sure it is the best for you.

- If the kind will not satisfy your preferences, take advantage of the Seach discipline to find the proper kind.

- Once you are certain the shape is suitable, click on the Get now key to obtain the kind.

- Select the pricing program you need and enter the required details. Design your account and purchase the transaction utilizing your PayPal account or Visa or Mastercard.

- Select the submit format and download the lawful record template to the product.

- Complete, modify and print out and signal the attained Idaho Trustee's Deed and Assignment for Distributing Properties Out of Trust.

US Legal Forms is the largest library of lawful forms in which you can see a variety of record web templates. Utilize the service to download expertly-manufactured papers that stick to state demands.

Form popularity

FAQ

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

What Is Assignment in a Deed of Trust? In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Beneficiaries of a trust typically pay taxes on the distributions they receive from a trust's income rather than the trust paying the tax. However, beneficiaries aren't subject to taxes on distributions from the trust's principal, the original sum of money put into the trust.

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.

A trustee deed?sometimes called a deed of trust or a trust deed?is a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage.

A trust distribution is the process of transferring assets from a trust to its designated beneficiaries. During the distribution, the trustee must ensure that the trust creator's intentions are fulfilled and that the beneficiaries receive their correct share of the trust assets.

Average Time for Trust Distribution Generally, a trustee must distribute assets within a 'reasonable' time. However, what is 'reasonable' can be confusing. Typically, it takes twelve to eighteen months after trust administration commences to fully distribute assets.