Idaho Memorandum of Oil and Gas Lease

Description

How to fill out Memorandum Of Oil And Gas Lease?

You are able to invest hrs online searching for the legitimate record template that suits the federal and state specifications you want. US Legal Forms provides 1000s of legitimate varieties which are evaluated by professionals. It is simple to download or print the Idaho Memorandum of Oil and Gas Lease from our support.

If you already have a US Legal Forms bank account, you can log in and then click the Acquire option. Following that, you can comprehensive, edit, print, or signal the Idaho Memorandum of Oil and Gas Lease. Every single legitimate record template you get is your own property permanently. To acquire yet another backup of any bought develop, go to the My Forms tab and then click the related option.

Should you use the US Legal Forms web site the first time, stick to the simple instructions beneath:

- Initially, make certain you have selected the correct record template for that region/city of your choice. Look at the develop information to make sure you have selected the appropriate develop. If available, use the Preview option to check from the record template at the same time.

- If you want to get yet another variation of your develop, use the Search area to find the template that fits your needs and specifications.

- When you have located the template you would like, simply click Purchase now to move forward.

- Pick the rates plan you would like, type in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal bank account to pay for the legitimate develop.

- Pick the file format of your record and download it in your device.

- Make alterations in your record if possible. You are able to comprehensive, edit and signal and print Idaho Memorandum of Oil and Gas Lease.

Acquire and print 1000s of record templates making use of the US Legal Forms website, which provides the most important selection of legitimate varieties. Use skilled and condition-particular templates to deal with your small business or individual demands.

Form popularity

FAQ

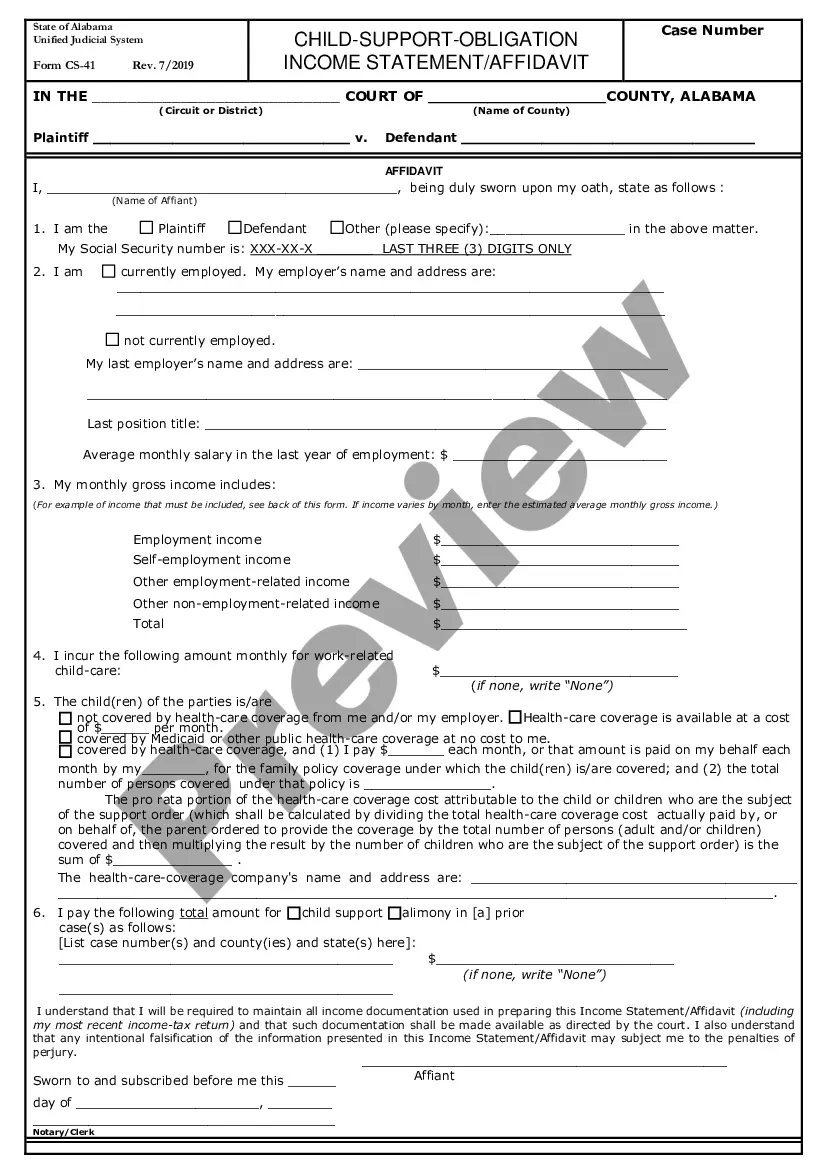

The memorandum of lease is a short form version of the oil and gas lease. The memorandum of lease is recorded. The full lease will not be recorded. You may also receive an addendum.

The BLM issues competitive leases for oil and gas exploration and development on lands owned or controlled by the Federal government.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Memorandum of Lease. (Oil Gas) This form is a memorandum of lease that summarizes an oil and gas lease without disclosing confidential information contained in the lease itself. It is filed in the county in which the leased property is located to put third parties on notice that a lease exists.

Contact Central Records at ims@rrc.texas.gov or 512-463-6800.

Oil and gas lessees retain royalties on all production from their lease. The mineral rights owners receive a royalty interest since drilling and production costs are not deducted from it. Most oil and gas royalty interests are expressed as fractions or percentages.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

As long as the lessee pays the annual rent, the lease remains in effect. This definite period of time is called the primary term. When a company fails to start production, the lease expires after the primary term. When the company starts drilling for oil and gas, the lease will remain in effect past the primary term.