Idaho Self-Employed Lighting Services Contract

Description

How to fill out Self-Employed Lighting Services Contract?

Are you presently in the situation where you need documentation for certain companies or specific purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones isn't simple.

US Legal Forms provides a vast array of form templates, like the Idaho Self-Employed Lighting Services Agreement, that are designed to meet federal and state regulations.

Once you find the right form, click Purchase now.

Select the payment plan you prefer, fill in the necessary information to create your account, and finalize the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Idaho Self-Employed Lighting Services Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

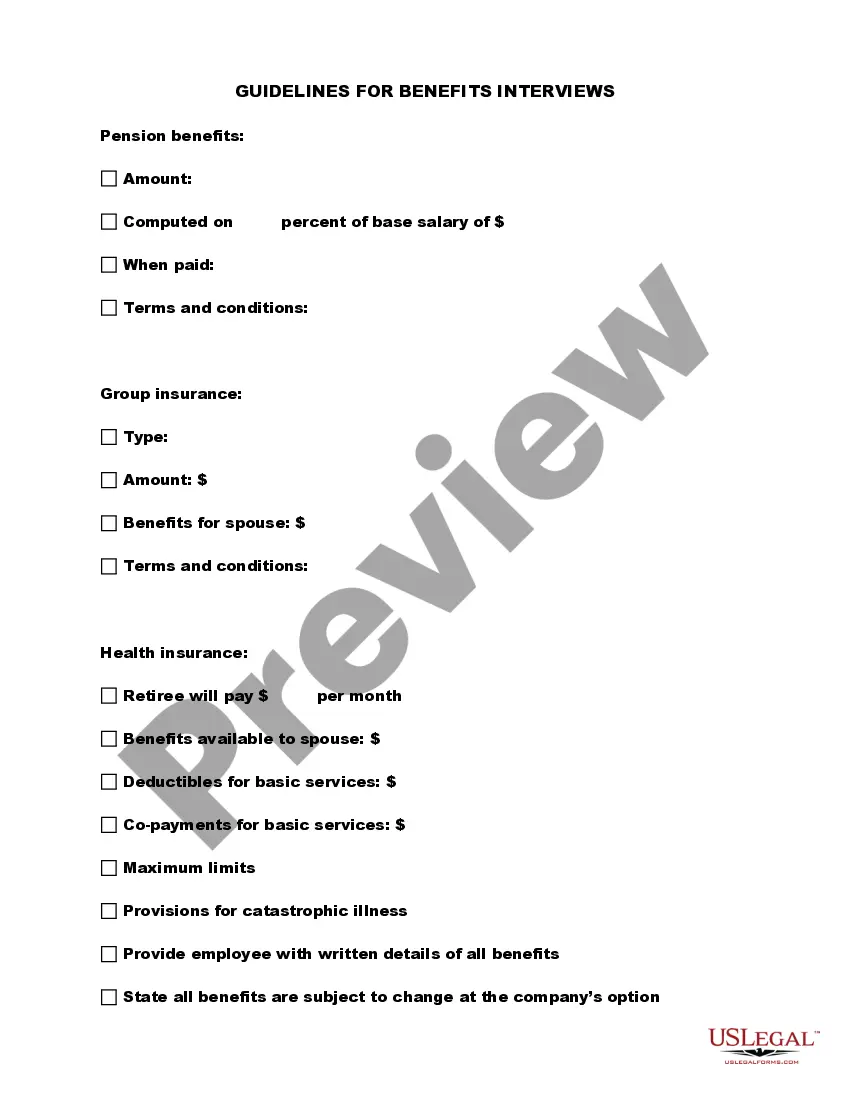

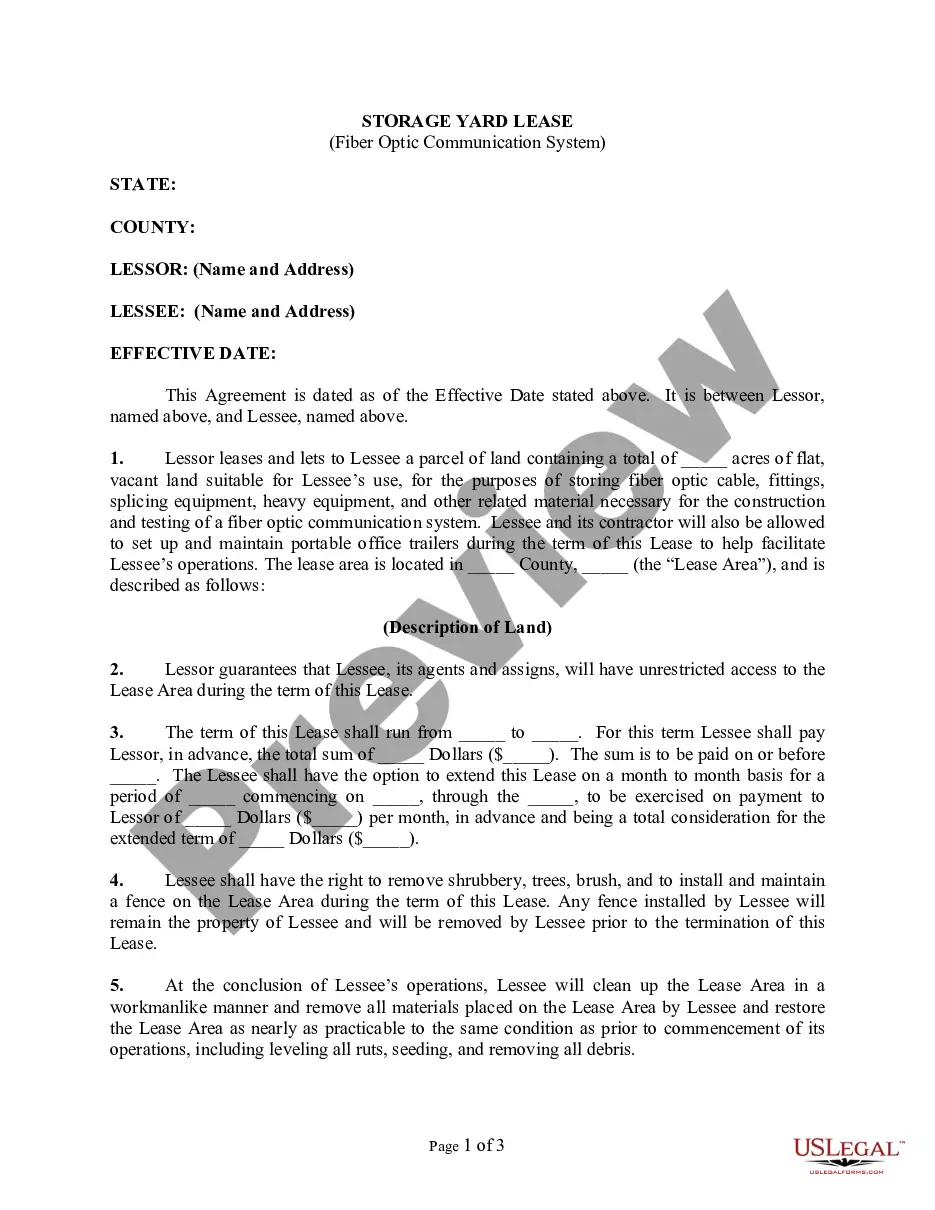

- Use the Preview button to view the form.

- Read the description to confirm you have selected the correct form.

- If the form isn't what you are looking for, use the Search section to find a form that suits your requirements.

Form popularity

FAQ

To write an independent contractor agreement, begin with a clear title and the names of the parties involved. Define the scope of work, payment terms, and project deadlines in straightforward language. Including a clause that references the Idaho Self-Employed Lighting Services Contract will help ensure all legal bases are covered. Finally, review the agreement with both parties to confirm understanding and agreement before signing.

Filling out an independent contractor agreement involves several key steps. Start by identifying the parties involved, outlining the specific services to be provided, and detailing the payment structure. Incorporating elements from an Idaho Self-Employed Lighting Services Contract can enhance clarity and legal protection. Lastly, make sure both parties sign and date the agreement to validate it.

In Idaho, individuals can perform up to $2,000 worth of work in a year without a contractor license. This limit applies to various services, including lighting installation and repairs. However, for larger projects, it is essential to use an Idaho Self-Employed Lighting Services Contract and obtain the necessary licensing to stay compliant with state laws. Always check local regulations to ensure you meet any additional requirements.

To fill out an independent contractor form, start by providing your personal details such as name, address, and contact information. Next, include the specifics of the work arrangement, including the scope of services, payment terms, and deadlines. You should also reference the Idaho Self-Employed Lighting Services Contract to ensure compliance with state regulations. Finally, review the form carefully before submitting it to avoid any errors.

Yes, Idaho recognizes verbal contracts, but they can be difficult to enforce. In many situations, especially for an Idaho Self-Employed Lighting Services Contract, having a written document is best practice. A written contract helps clarify terms and can serve as evidence in case of a dispute. Therefore, using a reliable platform like uslegalforms can guide you in creating a solid written contract that meets Idaho’s legal standards.

The five essential elements required for a legally binding contract in Idaho include offer, acceptance, consideration, capacity, and legality. First, one party makes an offer, and the other accepts it. Next, both parties must provide consideration, which is something of value exchanged. Additionally, both parties must have the legal capacity to contract, and the contract's purpose must be lawful, which is especially important in an Idaho Self-Employed Lighting Services Contract.

For a contract to be legally binding in Idaho, it must meet certain criteria. The essential elements include mutual agreement, consideration, the capacity of the parties, a lawful purpose, and the ability to create an Idaho Self-Employed Lighting Services Contract. When all these elements are present, the contract is enforceable. Having a clear and concise written agreement helps ensure compliance with these requirements.

In Idaho, a verbal agreement can be legally binding, but it often depends on the circumstances. For an Idaho Self-Employed Lighting Services Contract, it is advisable to have a written contract to clearly outline the terms and responsibilities. This reduces misunderstandings and provides a tangible reference for both parties. If disputes arise, proving the terms of a verbal agreement can be challenging.