Idaho Self-Employed Seamstress Services Contract

Description

How to fill out Self-Employed Seamstress Services Contract?

Have you ever found yourself in a situation where you require documents for various business or specific purposes almost daily.

There is a multitude of legitimate document templates accessible online, yet locating reliable versions can be challenging.

US Legal Forms offers an extensive array of template forms, including the Idaho Self-Employed Seamstress Services Contract, which can be tailored to meet federal and state regulations.

Once you have found the appropriate form, click on Acquire now.

Choose the pricing plan you prefer, enter the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy. Find all the document templates you have purchased in the My documents section. You can download an additional copy of the Idaho Self-Employed Seamstress Services Contract at any time, if needed. Just access the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent errors. This service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Idaho Self-Employed Seamstress Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/county.

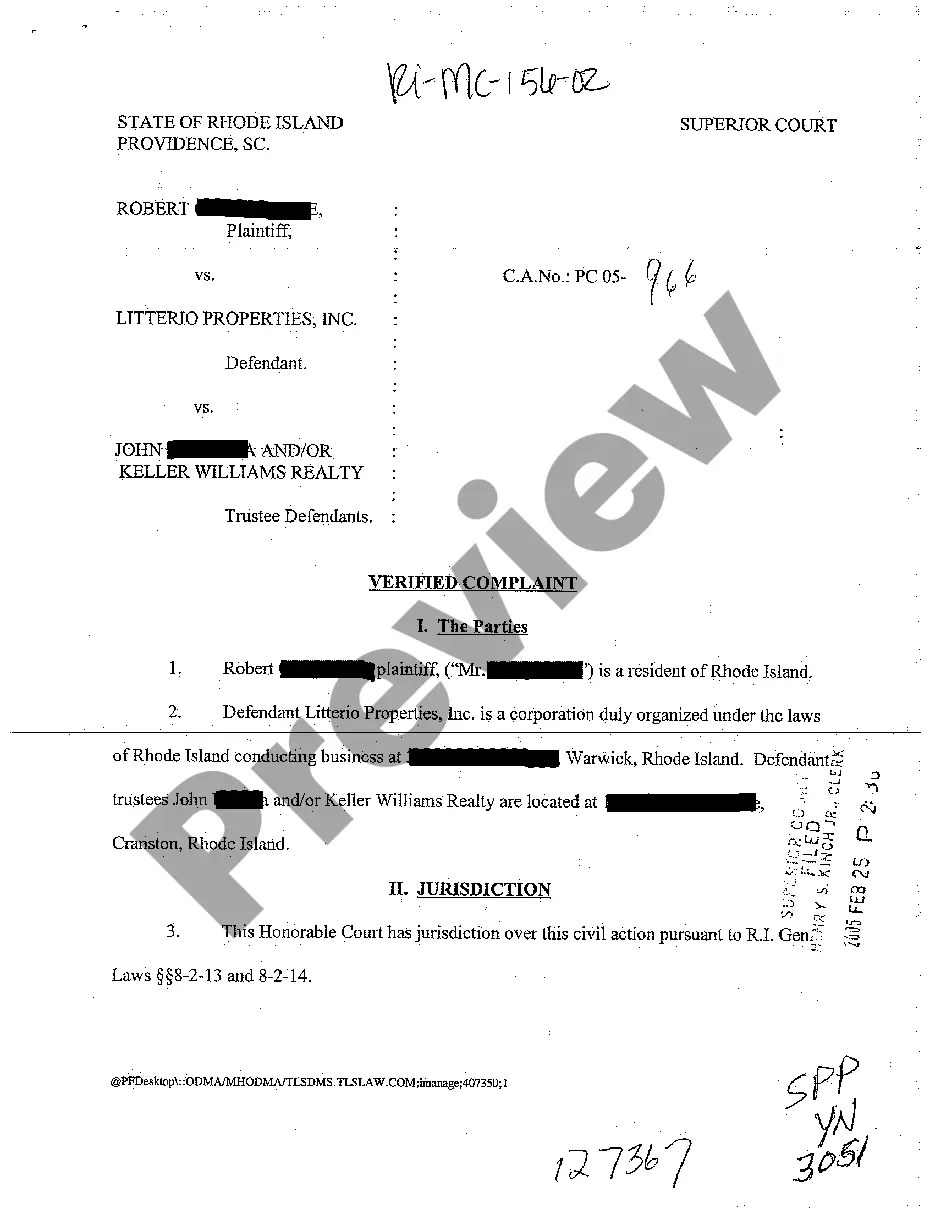

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form does not match what you are looking for, use the Search box to find the form that suits your needs.

Form popularity

FAQ

Yes, if you are contracted to provide services for clients, you are considered self-employed. This classification allows you to operate your own business while fulfilling specific project requirements. Having an Idaho Self-Employed Seamstress Services Contract in place can help clarify your status and outline your responsibilities.

In Idaho, the amount of work you can perform without a contractor's license varies based on the type of work. For most service-related jobs, including sewing, you may not need a license as long as you stay within certain financial thresholds. However, it's wise to consult local regulations to ensure compliance. An Idaho Self-Employed Seamstress Services Contract can help you navigate these requirements.

In Idaho, a contract is legally binding when it includes essential elements like offer, acceptance, consideration, and mutual consent. Both parties must agree to the terms and demonstrate their intent to enter into the contract. For self-employed seamstresses, ensuring these elements are present in your Idaho Self-Employed Seamstress Services Contract is vital for legal protection.

While related, contract work and self-employment are not identical. Contract work refers to the specific arrangement between a client and a worker, while self-employment describes the broader category of individuals working independently. Many self-employed individuals work under contracts, such as an Idaho Self-Employed Seamstress Services Contract, to outline their agreements.

Absolutely, a self-employed person can and should have a contract. Contracts provide clarity on the terms of service, payment, and expectations between the freelancer and the client. For those in the sewing industry, an Idaho Self-Employed Seamstress Services Contract is essential for protecting both parties involved.

Yes, contract employees are typically viewed as self-employed individuals. They often work on a project basis for various clients, rather than being tied to a single employer. This flexibility allows them to diversify their workload and income sources. Creating an Idaho Self-Employed Seamstress Services Contract can help clarify your working terms.

To be classified as self-employed, you must run your own business or work independently for clients. This status includes freelancers, independent contractors, and sole proprietors. The key factor is that you control your work and earn income without a traditional employer-employee relationship. An Idaho Self-Employed Seamstress Services Contract can formalize your business operations.

Yes, contract workers are generally considered self-employed. They operate independently and provide services based on a contract with clients. This arrangement allows them to set their own hours, choose their projects, and manage their income. If you're looking to draft an Idaho Self-Employed Seamstress Services Contract, understanding this classification is crucial.

While Idaho does not legally require an operating agreement for Limited Liability Companies (LLCs), having one is highly recommended. An operating agreement outlines the management structure and operating procedures of your LLC, providing clarity and protection for all members. This can be particularly beneficial when entering into an Idaho Self-Employed Seamstress Services Contract, as it helps define roles and responsibilities.

Idaho does require contractors to be licensed to ensure that they meet specific standards and qualifications. This licensing process helps protect consumers and maintain industry integrity. If you plan to operate under an Idaho Self-Employed Seamstress Services Contract, securing the proper license is essential for your business's legal standing.