Idaho Self-Employed Tailor Services Contract

Description

How to fill out Self-Employed Tailor Services Contract?

If you need to finish, obtain, or create authentic document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the site’s easy and efficient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Once you have found the form you need, click the Buy now option. Choose the pricing plan you prefer and provide your information to register for an account.

Complete the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Idaho Self-Employed Tailor Services Agreement. Each legal document template you obtain is yours permanently. You can access every form you downloaded within your account. Click on the My documents section and select a form to print or download again. Compete and acquire, and print the Idaho Self-Employed Tailor Services Agreement with US Legal Forms. There are thousands of professional and state-specific templates available for your business or personal needs.

- Use US Legal Forms to find the Idaho Self-Employed Tailor Services Agreement within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to access the Idaho Self-Employed Tailor Services Agreement.

- You can also view forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Make sure you have selected the form for the correct city/state.

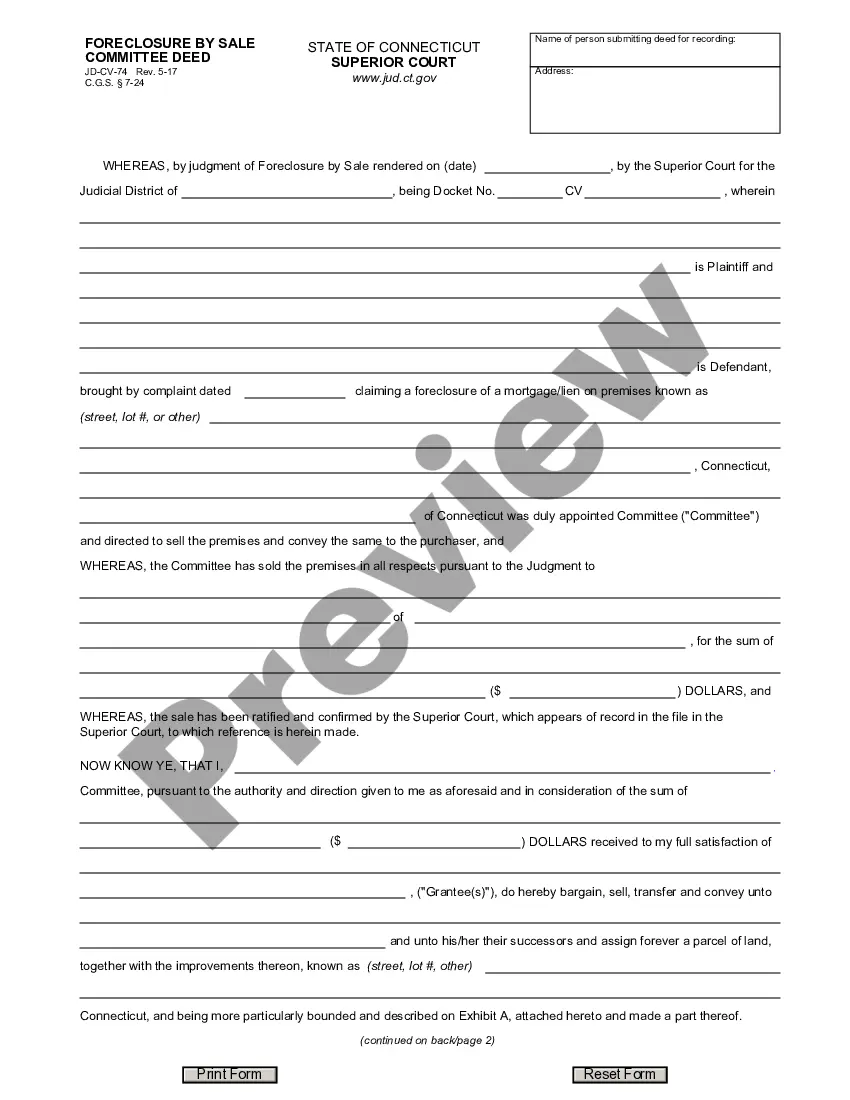

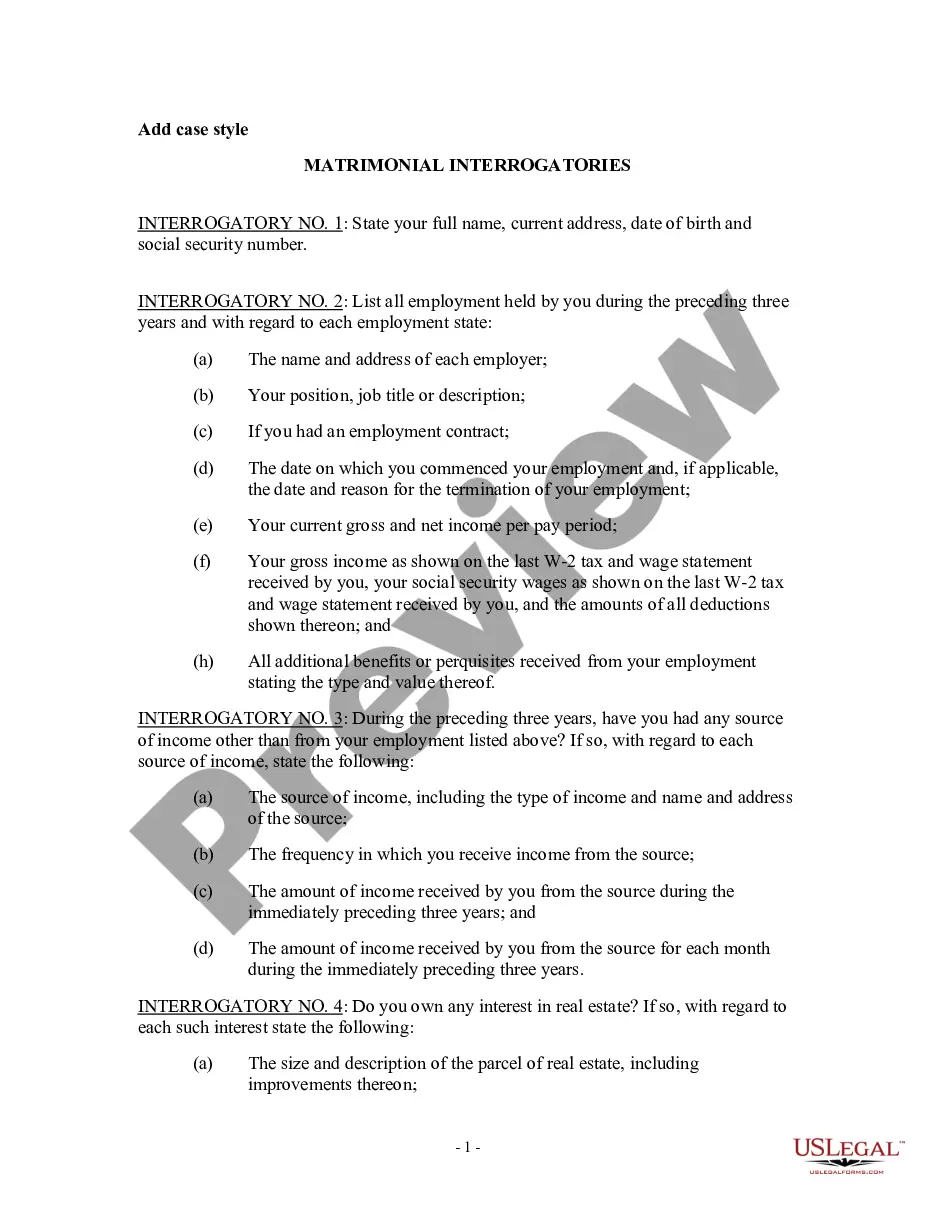

- Use the Review option to examine the form’s content. Don’t forget to check the summary.

- If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A legally binding contract must contain five essential elements: offer, acceptance, consideration, capacity, and legality. When you create an Idaho Self-Employed Tailor Services Contract, ensure that both parties agree to the terms and that there is something of value exchanged. Additionally, both parties must have the legal capacity to enter into the contract, and the contract's purpose must be legal. Using uslegalforms can help ensure that you include all necessary elements in your contracts.

In Idaho, the amount of work you can perform without a contractor license depends on the type of services you provide. For certain tasks, such as tailoring, you may not need a specific license if you are operating as a self-employed individual under an Idaho Self-Employed Tailor Services Contract. However, it is important to check local regulations to ensure compliance. When in doubt, consult with uslegalforms for guidance on the necessary requirements.

In Idaho, a verbal agreement can be legally binding, but it is often harder to enforce than a written one. While you can create an Idaho Self-Employed Tailor Services Contract verbally, having a written document provides clarity and proof of the terms. It is always best to have contracts in writing to avoid misunderstandings and disputes down the road. Consider using uslegalforms to draft your contracts easily.

To set yourself up as an independent contractor, start by defining your services, such as those outlined in an Idaho Self-Employed Tailor Services Contract. Next, register your business with the appropriate authorities and obtain any necessary licenses. You should also set up a separate business bank account to keep your finances organized. Finally, consider using platforms like uslegalforms to create contracts and manage your business needs.

Yes, contract employees are typically considered self-employed. When you enter into an Idaho Self-Employed Tailor Services Contract, you work independently, rather than as an employee of a company. This means you manage your own business operations and finances, which grants you more flexibility and control over your work. However, you must also handle your own taxes and benefits.

When writing a contract for a 1099 employee, focus on the services they will provide and the payment terms. Establish the nature of the working relationship, ensuring it reflects their independent contractor status. An Idaho Self-Employed Tailor Services Contract can be an effective tool for structuring this type of agreement.

To write a contract agreement for services, start by specifying the services provided and the agreed-upon compensation. Include terms for payment schedules, deliverables, and any other relevant conditions. A well-structured Idaho Self-Employed Tailor Services Contract can help you outline these details clearly.

Yes, you can write your own legally binding contract as long as it meets the legal requirements of your state. Ensure that the contract includes essential elements such as an offer, acceptance, and consideration. Using an Idaho Self-Employed Tailor Services Contract template from a reputable platform like USLegalForms can guide you in creating a valid agreement.

Writing a self-employment contract involves detailing the scope of work and payment arrangements. Clearly outline any project timelines and deliverables to avoid misunderstandings. Incorporating an Idaho Self-Employed Tailor Services Contract template can help you cover all necessary aspects efficiently.

A simple employment contract should include essential information like job title, duties, and compensation. Additionally, outline the duration of employment and any benefits that come with the role. For a self-employed tailor, an Idaho Self-Employed Tailor Services Contract can serve as a straightforward framework for your agreement.