Idaho Self-Employed Purchasing Agent Services Contract

Description

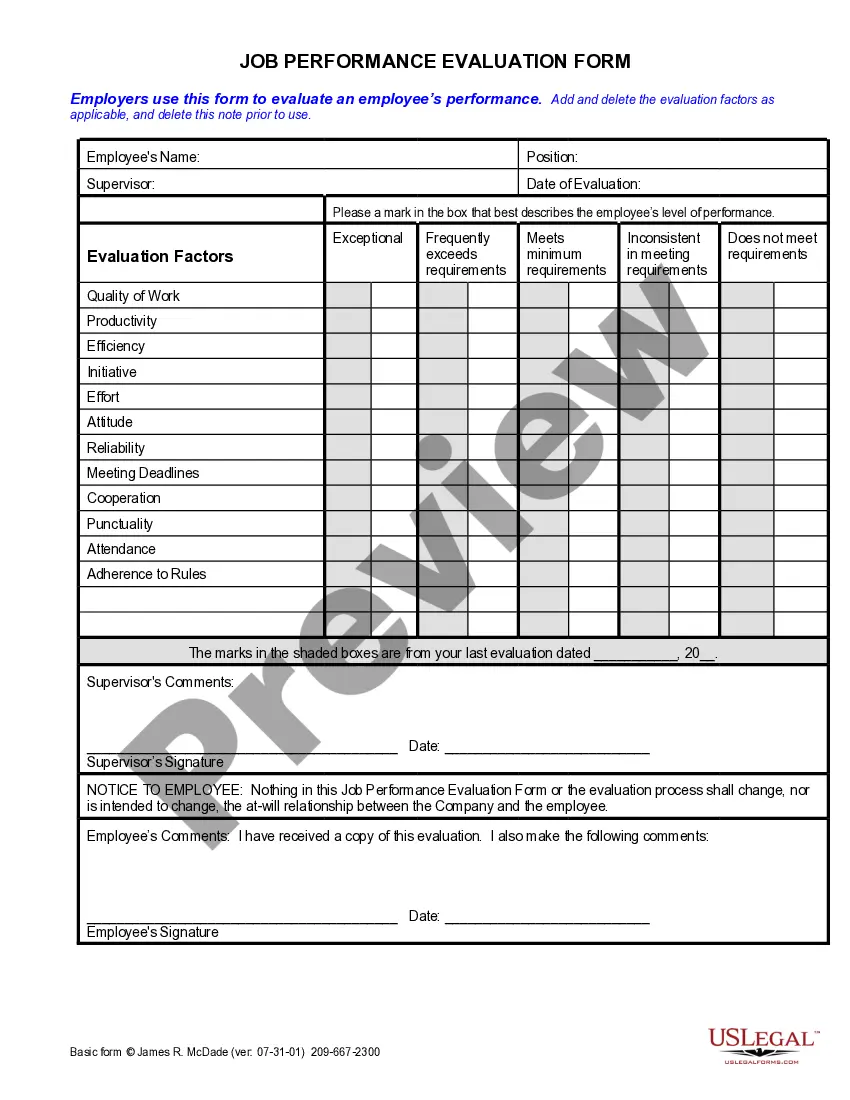

How to fill out Self-Employed Purchasing Agent Services Contract?

If you wish to acquire, obtain, or print valid document templates, utilize US Legal Forms, the largest compilation of legal forms, available online.

Take advantage of the site's user-friendly and efficient search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to access the Idaho Self-Employed Purchasing Agent Services Contract in just a few clicks.

If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

- If you are already a US Legal Forms user.

- log in to your account and then click the.

- Download button to receive the Idaho Self-Employed Purchasing Agent Services Contract.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Ensure you have selected the form for your correct city/state.

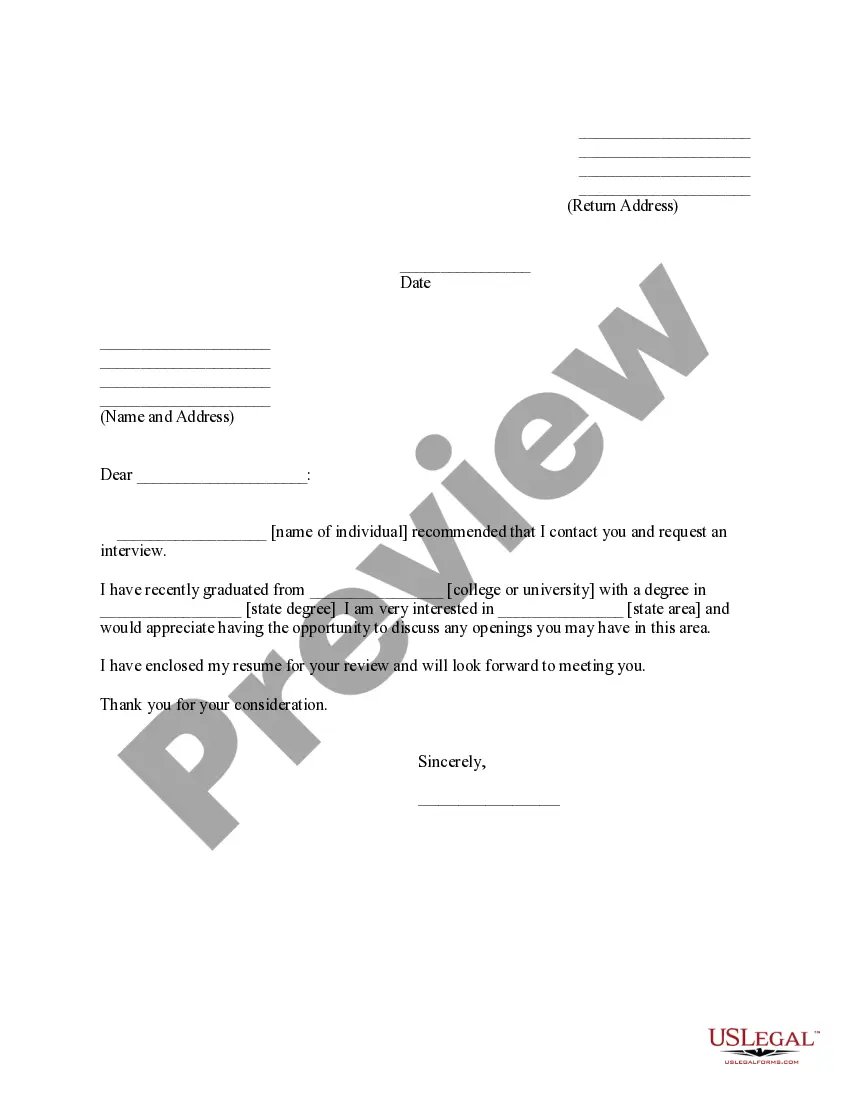

- Use the Preview option to review the form's details. Don't forget to read the summary.

Form popularity

FAQ

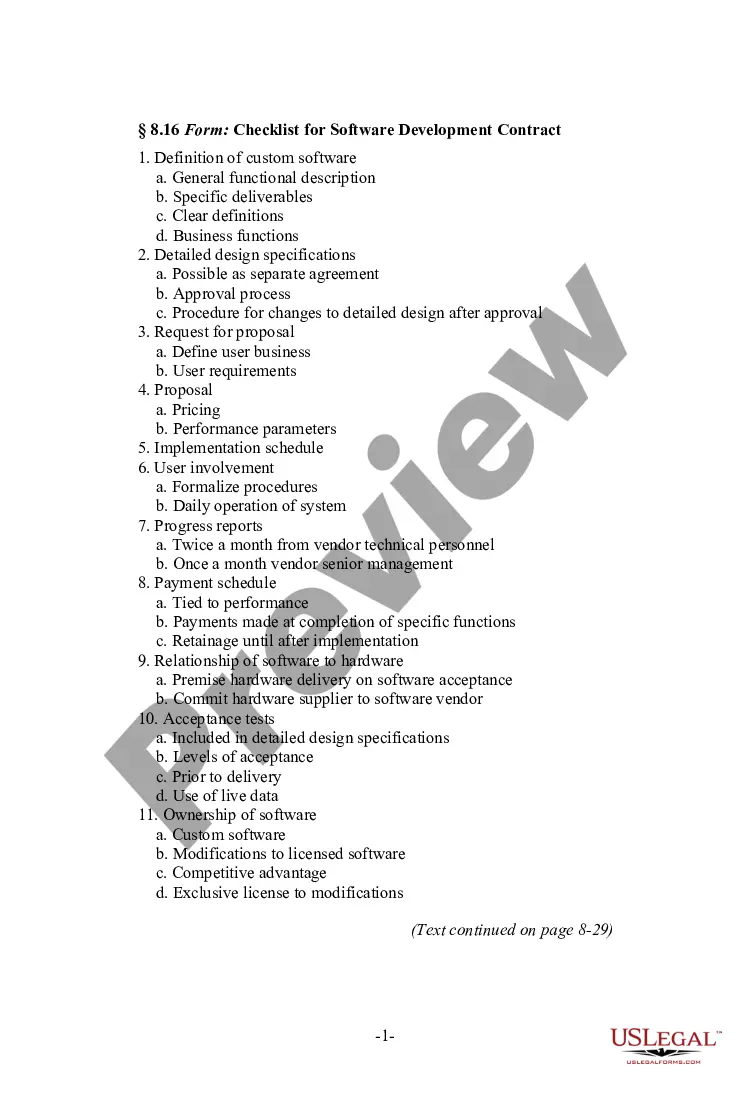

The four categories of procurement are direct procurement, indirect procurement, services procurement, and public procurement. Direct procurement involves purchasing goods directly related to production. Indirect procurement focuses on acquiring supplies that support business operations. Services procurement is about hiring external service providers, often managed through an Idaho Self-Employed Purchasing Agent Services Contract, ensuring efficiency and compliance in the procurement process.

The four main types of procurement include direct procurement, indirect procurement, services procurement, and goods procurement. Direct procurement focuses on acquiring raw materials and products essential for production. Indirect procurement involves purchasing items that support the operations of a business. Services procurement refers to hiring external services necessary for project completion, which can be facilitated through an Idaho Self-Employed Purchasing Agent Services Contract.

Idaho does not legally require an operating agreement for Limited Liability Companies (LLCs), but it is highly recommended. An operating agreement outlines the management structure and operating procedures of your LLC, which can be beneficial for clarity and protection. When you establish an Idaho Self-Employed Purchasing Agent Services Contract, having this document can enhance your professionalism and help prevent disputes. You can find templates and guidance on US Legal Forms to create an effective operating agreement tailored to your needs.

Yes, independent contractors in Idaho typically need a business license, depending on the nature of their work. When you operate under an Idaho Self-Employed Purchasing Agent Services Contract, you might also need specific permits related to your services. It is essential to check with local authorities to ensure compliance. Additionally, platforms like US Legal Forms can help you navigate the requirements and obtain the necessary documentation.

To write up a simple contract, start by clearly stating the purpose of the agreement and the parties involved. Outline the services to be provided, the payment details, and any timelines. It is also important to include a section on dispute resolution. For a straightforward solution, explore USLegalForms for an Idaho Self-Employed Purchasing Agent Services Contract template that simplifies the contract-writing process.

The 5 C's of a contract include clarity, completeness, consistency, consideration, and compliance. Each element plays a crucial role in ensuring that the contract is effective and legally binding. When drafting an Idaho Self-Employed Purchasing Agent Services Contract, focus on these principles to avoid ambiguities and protect all parties involved. USLegalForms can help you incorporate these elements seamlessly into your contract.

Writing up a contract for services involves detailing the agreement between parties. Begin with a clear title, such as Idaho Self-Employed Purchasing Agent Services Contract, followed by the identification of each party. Next, describe the services, payment terms, and deadlines. For assistance, consider using USLegalForms, where you can find ready-made templates that simplify this process.

To write a simple contract for services, start by outlining the key components, such as the parties involved, the services provided, and the payment structure. Make sure to specify the duration of the contract and any conditions for termination. For a tailored approach, you can utilize the Idaho Self-Employed Purchasing Agent Services Contract template from USLegalForms to ensure compliance with local regulations.

Yes, you can write your own service contract, including an Idaho Self-Employed Purchasing Agent Services Contract. However, it is essential to ensure that the contract includes all necessary elements, such as the scope of work, payment terms, and any legal provisions required by Idaho law. If you prefer a more streamlined process, consider using a platform like USLegalForms, which provides templates specifically designed for self-employed purchasing agents.

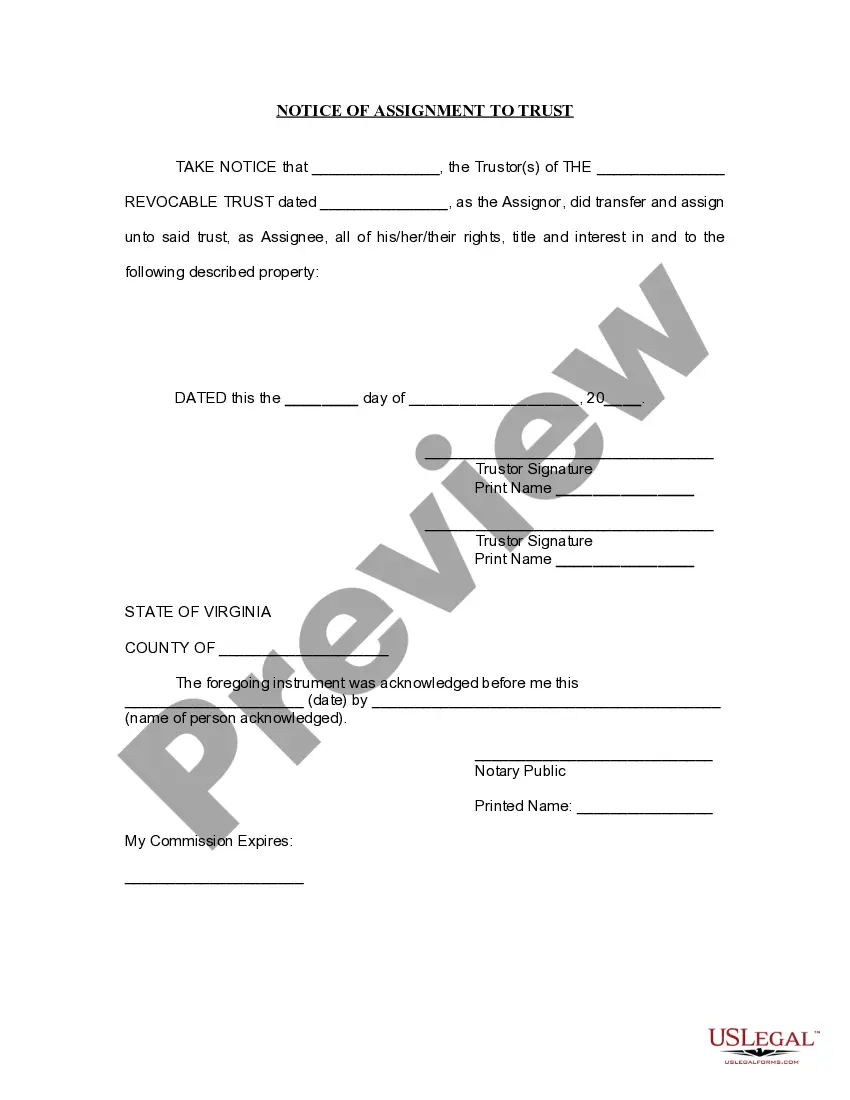

An Idaho broker may use their own name, the name of their brokerage, or the name of an authorized person to advertise real property. It is important that any advertisement accurately represents the broker's qualifications and authority. When forming an Idaho Self-Employed Purchasing Agent Services Contract, clarity in representation can prevent misunderstandings and enhance credibility.