Idaho Milker Services Contract - Self-Employed

Description

How to fill out Milker Services Contract - Self-Employed?

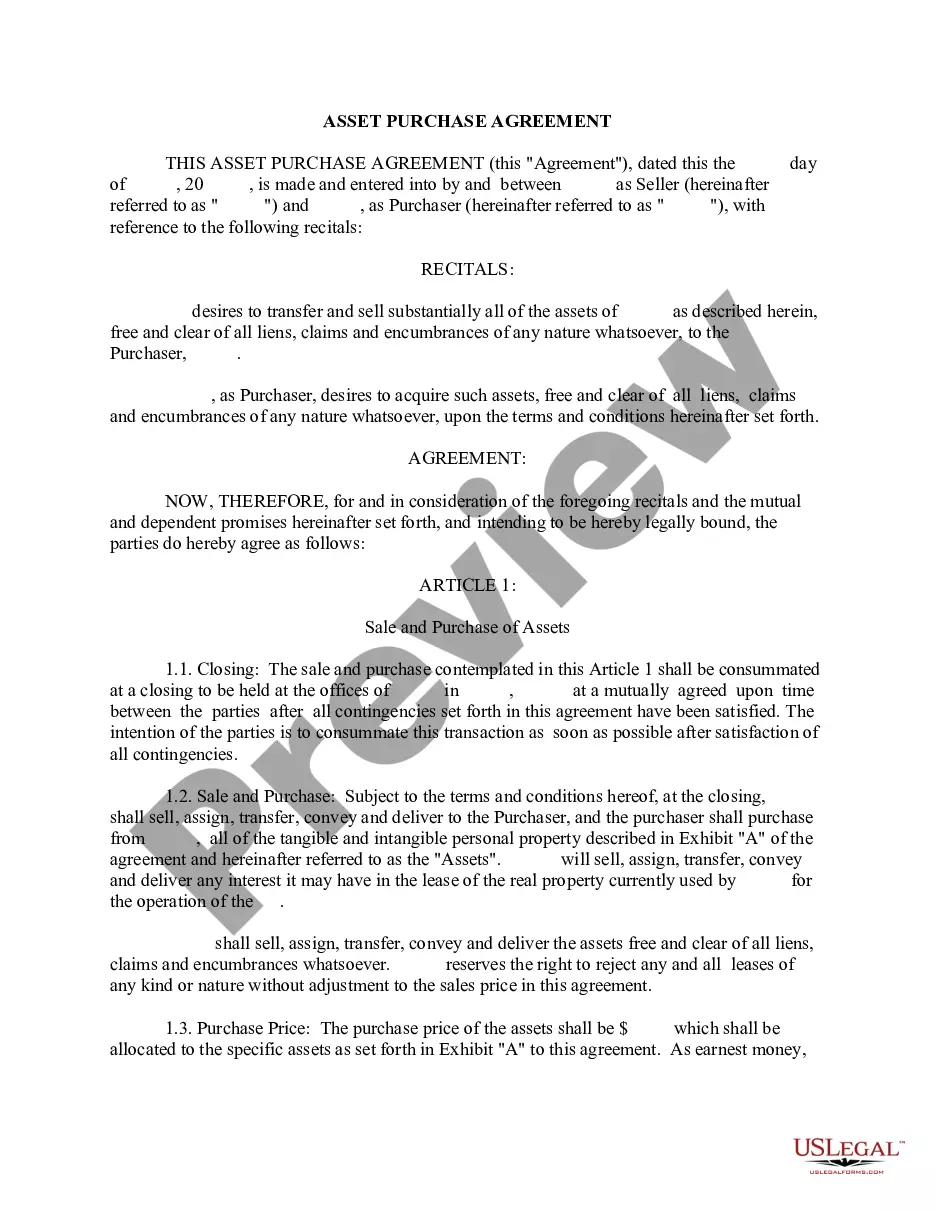

Selecting the optimal legal document template can be challenging. Clearly, there are numerous designs available online, but how can you find the legal form you need? Utilize the US Legal Forms website. The service provides thousands of templates, such as the Idaho Milker Services Contract - Self-Employed, which you can use for business and personal purposes. All of the forms are vetted by experts and meet state and federal requirements.

If you are already registered, Log In to your account and click on the Download button to obtain the Idaho Milker Services Contract - Self-Employed. Use your account to access the legal forms you have purchased previously. Navigate to the My documents section of your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your town/county. You can browse the form using the Preview button and review the form details to confirm this is indeed the right one for you. If the form does not meet your needs, use the Search field to find the appropriate document. When you are confident that the form is correct, click on the Buy now button to acquire the form. Choose the pricing plan you desire and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Idaho Milker Services Contract - Self-Employed.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to download professionally-crafted papers that comply with state regulations.

- Make sure to confirm the form's suitability for your specific needs before proceeding.

- Explore the options available to ensure you have the correct legal documentation.

- Access your previous purchases easily through your account.

- Follow the straightforward instructions to navigate through the process.

Form popularity

FAQ

A person qualifies as an independent contractor if they provide services under a contract and maintain control over how those services are delivered. This includes having the freedom to choose methods, tools, and schedules. For those in the milking services industry, an Idaho Milker Services Contract - Self-Employed clearly outlines these parameters, ensuring compliance with local regulations.

Several factors determine if someone qualifies as an independent contractor, including the level of control exerted over their work and the nature of their relationship with the employer. Typically, independent contractors operate independently without daily oversight. An Idaho Milker Services Contract - Self-Employed may provide clarity on these factors, helping to establish your status.

To qualify as an independent contractor in Idaho, you must meet certain criteria, such as controlling how and when you perform your work. This includes managing your own schedule and using your own tools. When handling an Idaho Milker Services Contract - Self-Employed, it is crucial to demonstrate your autonomy to establish your status clearly.

Yes, independent contractors in Idaho may need a business license depending on their specific line of work. It is important to check local regulations because some cities or counties require a license to operate. Additionally, obtaining an Idaho Milker Services Contract - Self-Employed can help you navigate these requirements effectively.

Yes, if you aim to operate as an independent contractor in Idaho, registering your business is a good practice. This helps you formalize your operations and may be a requirement under an Idaho Milker Services Contract - Self-Employed. Registering ensures legal compliance and may offer additional benefits and protections in your business dealings.

In Idaho, specific rules dictate how much work you can perform without requiring a contractor license. Generally, if your projects total less than a designated dollar amount within a year, you may not need a license. However, it’s best to check with local regulations and consider an Idaho Milker Services Contract - Self-Employed, which may have specific stipulations about licensing and responsibilities.

Contract work does count as employment, but with different implications compared to traditional employee roles. If you work under an Idaho Milker Services Contract - Self-Employed, you have the unique opportunity to shape how and when you work, while also being responsible for your own taxes and benefits. The nuances of contract work can create both opportunities and challenges for various professionals.

Yes, contract workers are often considered self-employed, as they typically provide services under their own terms. If you’re operating under an Idaho Milker Services Contract - Self-Employed, you operate independently and handle your own business affairs. This arrangement allows contract workers to enjoy greater autonomy and flexibility in their professional lives.

Contract work and self-employment are closely related but are not always the same. A self-employed individual may engage in contract work but can also offer other services. An Idaho Milker Services Contract - Self-Employed specifically outlines the self-employed nature of the agreement, highlighting the independence and responsibilities involved in such roles.

Contract employees typically fall under the category of self-employed individuals, especially if they manage their own work and clients. For those using an Idaho Milker Services Contract - Self-Employed, this classification provides various benefits, including more flexibility in how they operate. However, it’s vital to understand the specifics of your contract to clarify your employment status.