Idaho Generator Installation And Repair Services Contract - Self-Employed

Description

How to fill out Generator Installation And Repair Services Contract - Self-Employed?

If you desire to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the primary collection of legal forms, accessible online.

Employ the site’s straightforward and convenient search feature to locate the documents you require.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, select the Buy now button. Choose your preferred payment plan and enter your information to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Idaho Generator Installation And Repair Services Contract - Self-Employed. Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again. Complete and obtain, and print the Idaho Generator Installation And Repair Services Contract - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to find the Idaho Generator Installation And Repair Services Contract - Self-Employed with a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click on the Download button to obtain the Idaho Generator Installation And Repair Services Contract - Self-Employed.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the correct city/state.

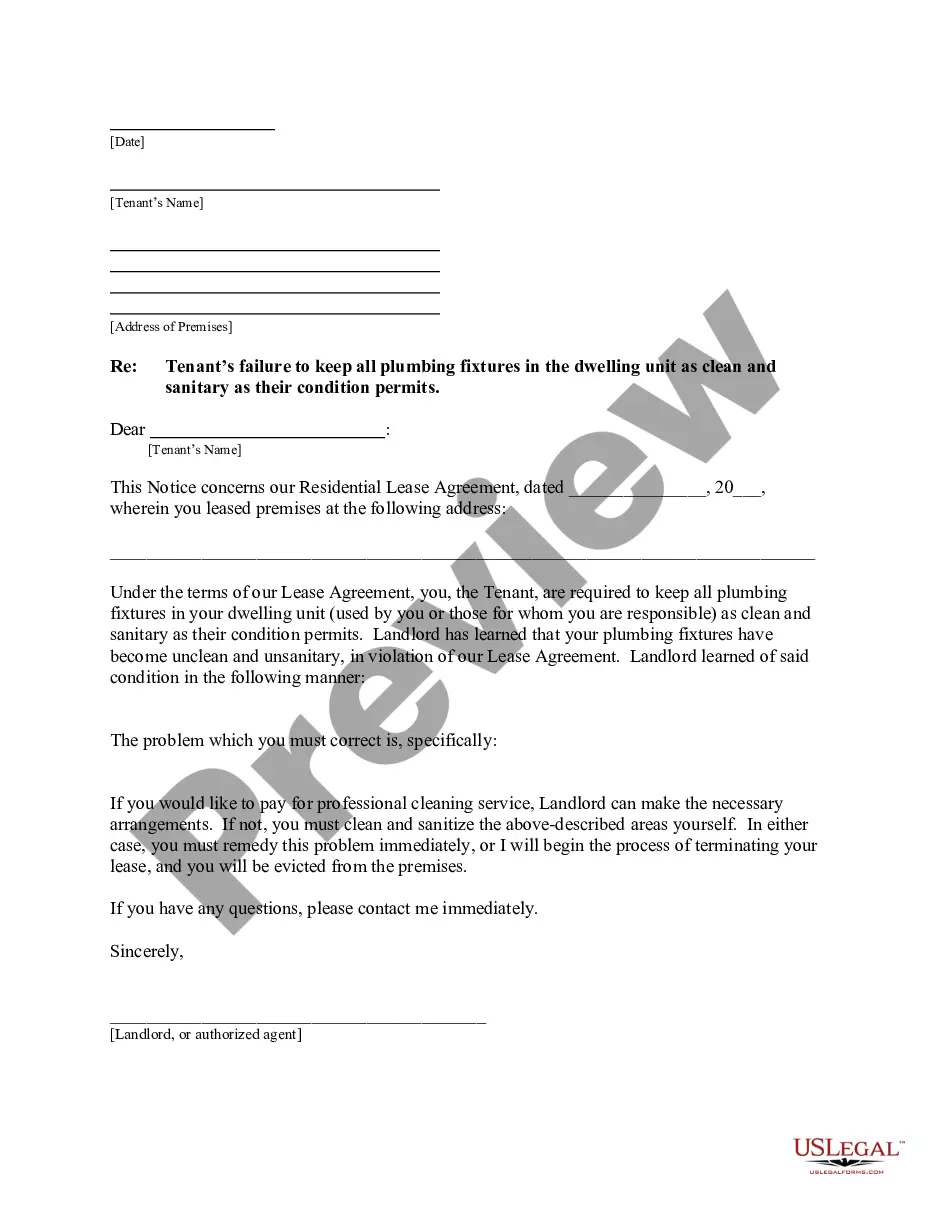

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Starting a generator repair business requires a solid business plan, technical knowledge, and the right tools. Begin by acquiring necessary certifications and licenses while gathering experience through apprenticeships or working for established companies. Additionally, consider an Idaho Generator Installation And Repair Services Contract - Self-Employed as it can help you create a reliable customer base and ensure repeat business through trusted service.

Qualified technicians for generator repair typically hold relevant certifications and have experience working with various generator brands. It is essential to choose someone knowledgeable to ensure your generator is safely and effectively serviced. An Idaho Generator Installation And Repair Services Contract - Self-Employed connects you with skilled professionals who understand the intricacies of your generator model.

Yes, a generator maintenance contract is often worth the investment. Regular upkeep can prevent major failures and help you avoid expensive repair bills down the line. An Idaho Generator Installation And Repair Services Contract - Self-Employed not only offers routine maintenance but also gives you access to qualified technicians who ensure your generator operates efficiently when it matters most.

As an independent contractor in Idaho, you are responsible for reporting your income and paying self-employment taxes. This includes Social Security and Medicare taxes on your earnings from the Idaho Generator Installation And Repair Services Contract - Self-Employed. Keeping accurate records of income and expenses will help simplify your tax filing process and ensure compliance.

Yes, independent contractors in Idaho typically need a business license, especially if you operate under your own business name. This requirement applies to those working under the Idaho Generator Installation And Repair Services Contract - Self-Employed. Obtaining a business license ensures that you operate legally and can positively affect your reputation with clients.

In Idaho, several specific services are taxable, including services related to repair, improvement, or installation of tangible personal property. This means that your work under the Idaho Generator Installation And Repair Services Contract - Self-Employed might fall into this category. Always check current state tax laws or seek advice from a tax consultant to stay updated about taxable services.

When issuing an invoice for your Idaho Generator Installation And Repair Services Contract - Self-Employed, it is generally advisable to consider sales tax. In Idaho, certain services may be subject to sales tax, so reviewing the tax guidelines is crucial. Consulting with an experienced tax professional can help you determine the correct approach for your specific services.