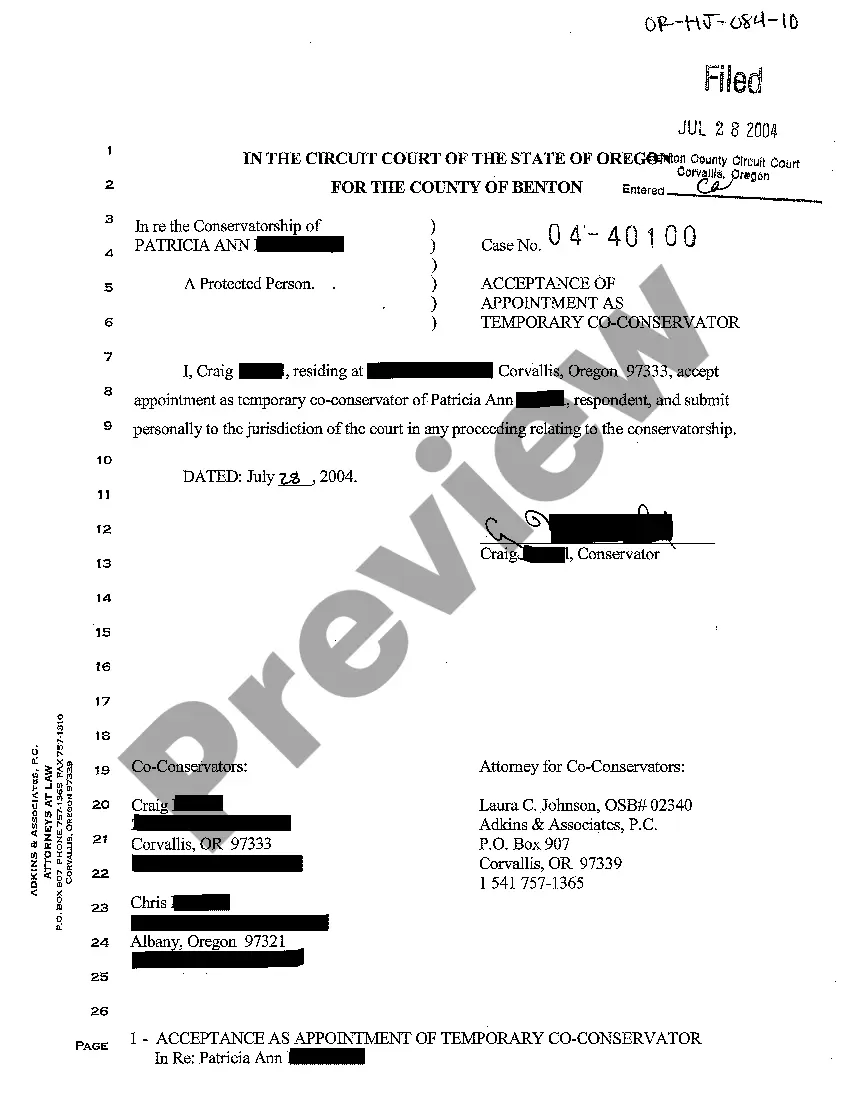

Idaho Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms like the Idaho Guaranty of Payment of Open Account within moments.

If you already have a subscription, Log In and download the Idaho Guaranty of Payment of Open Account from the US Legal Forms library. The Download button will be available on each form you view. You can access all previously downloaded forms in the My documents section of your profile.

If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred payment plan and provide your details to register for an account.

Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make changes. Fill out, edit, and print and sign the downloaded Idaho Guaranty of Payment of Open Account.

Every template you add to your account does not expire and is yours indefinitely. If you need to download or print another copy, just head to the My documents section and click on the form you wish to access.

- To use US Legal Forms for the first time, here are some simple instructions to help you get started.

- Ensure you have selected the correct form for your region/state.

- Click the Preview button to review the form's details.

- Check the form outline to confirm you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

Form popularity

FAQ

To make an Idaho extension payment, you must first estimate your tax liability and complete the required forms. You can then submit your payment electronically or by mail. The Idaho Guaranty of Payment of Open Account is crucial during this process, ensuring all financial obligations are satisfied. If you need guidance, uslegalforms can offer tools and resources to facilitate your payment and keep you compliant.

Filing a lien in Idaho involves a series of steps, starting with gathering the necessary information to create the lien. You must complete a lien form, have it notarized, and then file it with the county recorder. Understanding the Idaho Guaranty of Payment of Open Account will help you navigate the requirements more efficiently. Resources like uslegalforms offer support in ensuring your paperwork is accurate and timely.

Yes, you can file a lien without hiring a lawyer in Idaho, but it requires understanding the legal process. You need to fill out the necessary documents and submit them to the appropriate office. The Idaho Guaranty of Payment of Open Account plays a significant role in protecting your financial interests during this process. For assistance, uslegalforms can provide the necessary templates and guidance.

To place a lien on someone's property in Idaho, you must first obtain a judgment against the debtor. After securing the judgment, you can then file a claim with the county recorder's office. The Idaho Guaranty of Payment of Open Account can be a critical tool in ensuring that you receive payments owed to you. You can always rely on uslegalforms for documentation and filing procedures to ensure your lien is created correctly.

In Idaho, any partnership conducting business within the state must file a partnership return. This includes partnerships that have income, gains, losses, or deductions. Understanding the Idaho Guaranty of Payment of Open Account is essential, as it helps ensure financial responsibilities are met. Utilizing services like uslegalforms can simplify the return filing process for partnerships.

The grocery allowance in Idaho can vary based on income levels and household size. This allowance is designed to help residents afford essential food items. Understanding the Idaho Guaranty of Payment of Open Account may assist in budgeting for these expenses. To learn more about eligibility and specific amounts, contact local government agencies that administer such programs.

Idaho offers a tax credit for individuals and businesses that make charitable donations. This credit can reduce your taxable income and encourage local support. It's important to keep receipts and documentation for the donations you make under the Idaho Guaranty of Payment of Open Account. Consult with a tax advisor to receive guidance on maximizing your tax benefits for charitable contributions.

In Idaho, there is no set age at which you stop paying property tax, but there are exemptions available for senior citizens. Seniors may qualify for property tax reductions based on their income and residency. Understanding the Idaho Guaranty of Payment of Open Account can also help seniors manage their financial obligations effectively. It's always good to check with local authorities for specific exemptions available.

Residents and non-residents earning income from sources within Idaho are typically required to file an Idaho tax return. This includes individuals who have income exceeding a certain threshold. If you are engaged in business activities under the Idaho Guaranty of Payment of Open Account, you must file a return to report your transactions. It’s important to stay informed about filing requirements to avoid penalties.

The 967 form in Idaho is used for reporting specific financial information, particularly with respect to the Idaho Guaranty of Payment of Open Account. This form provides a clear structure for businesses and individuals to disclose their payment obligations. Completing this form accurately is crucial for maintaining compliance with state tax laws. You can easily find the 967 form on the Idaho State Tax Commission website.