Idaho Mismatched Social Security Number and Name Form

Description

How to fill out Mismatched Social Security Number And Name Form?

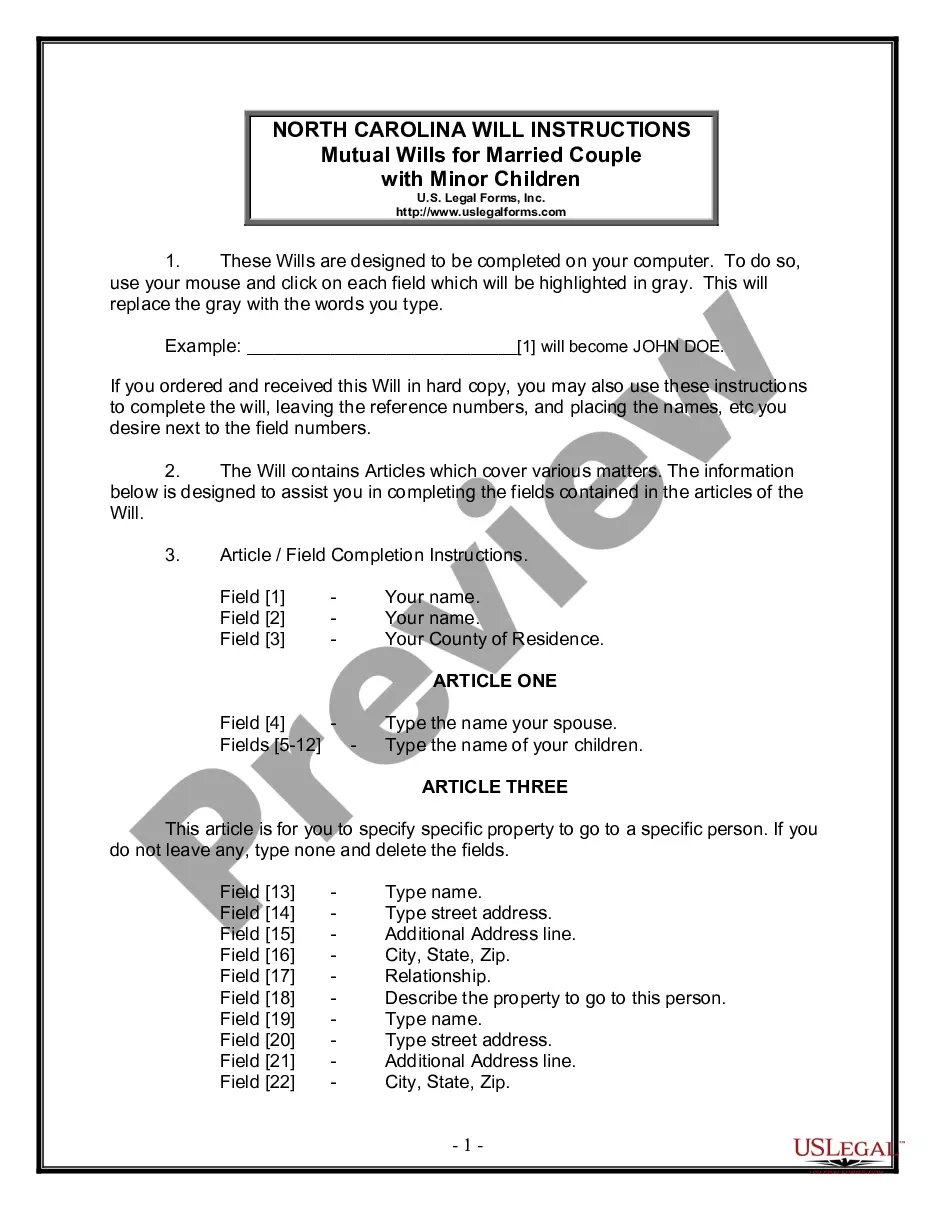

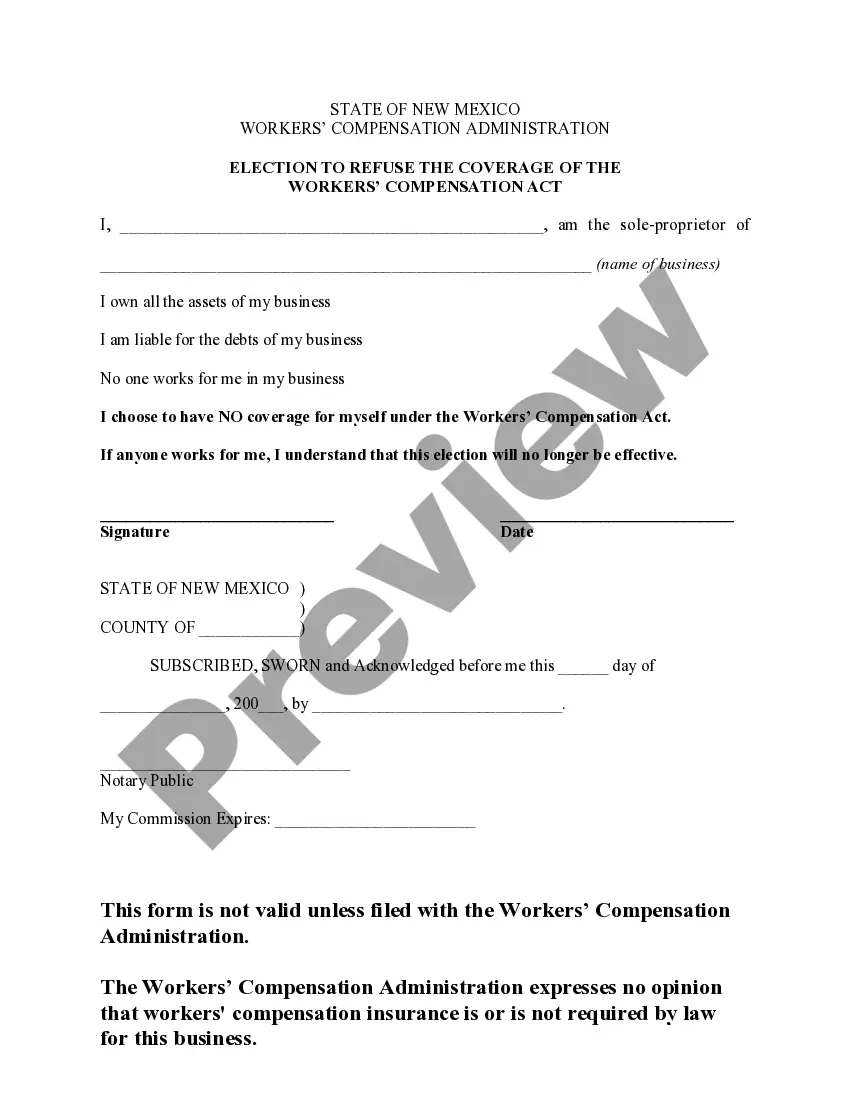

You can devote hours online trying to find the authorized papers format that suits the federal and state demands you will need. US Legal Forms offers 1000s of authorized types that are reviewed by experts. It is possible to download or print out the Idaho Mismatched Social Security Number and Name Form from our support.

If you have a US Legal Forms accounts, you are able to log in and click the Download switch. After that, you are able to full, change, print out, or signal the Idaho Mismatched Social Security Number and Name Form. Each and every authorized papers format you purchase is your own permanently. To get an additional duplicate for any obtained kind, check out the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms site initially, adhere to the straightforward recommendations below:

- Initially, make sure that you have selected the right papers format for the region/area that you pick. Look at the kind description to make sure you have selected the correct kind. If available, utilize the Preview switch to appear from the papers format as well.

- In order to locate an additional version from the kind, utilize the Lookup discipline to find the format that meets your requirements and demands.

- Once you have found the format you desire, just click Acquire now to continue.

- Select the rates strategy you desire, type in your references, and register for a free account on US Legal Forms.

- Total the deal. You should use your charge card or PayPal accounts to cover the authorized kind.

- Select the structure from the papers and download it to the gadget.

- Make adjustments to the papers if necessary. You can full, change and signal and print out Idaho Mismatched Social Security Number and Name Form.

Download and print out 1000s of papers templates using the US Legal Forms website, which provides the largest assortment of authorized types. Use skilled and condition-distinct templates to handle your company or individual demands.

Form popularity

FAQ

Report any change to the Social Security Administration by visiting their website or calling them at 800-772-1213 (TTY 800-325-0778).

If your SSA match status is ?Not Matched,? the information didn't match with the SSA. Verify that your Social Security number, date of birth, and name are as they appear on your Social Security card. If the information is correct, and you are still having issues, contact SSA at 1-800-772-1213. Was this page helpful?

An invalid SSN is one that the SSA never assigned. In case you're wondering, a valid SSN will never look like this: The first three digits as ?000,? ?666,? or in the 900 series. The second group that consists of two digits as ?00.?

An SSA mismatch may occur if: Your citizenship or immigration status was not updated with SSA. You did not report your name change to SSA. Your name, Social Security number, or date of birth is incorrect in SSA records.

If you want to correct or update your name or date of birth on your Social Security record, you must apply for a corrected Social Security card. Go to Get Or Replace A Social Security Card and follow the instructions.

If your name and Social Security number don't match because of a mistake (for example, if the name on your W-4 form is "Jon Smith", but the name on record for your Social Security number is "Jonathan Smith") your employer must give you 90 days to fix the problem with the Social Security Administration.

If you accidentally typed in the wrong SSN for your return, the error code you'll get is 0500, meaning your tax information doesn't match the data the IRS has on file from the Social Security Administration (SSA). To contact the SSA call 1 (800) 772-1213.

File a report with your local police or the police in the community where the identity theft took place. Report identity theft at the Federal Trade Commission's Identity Theft webpage.