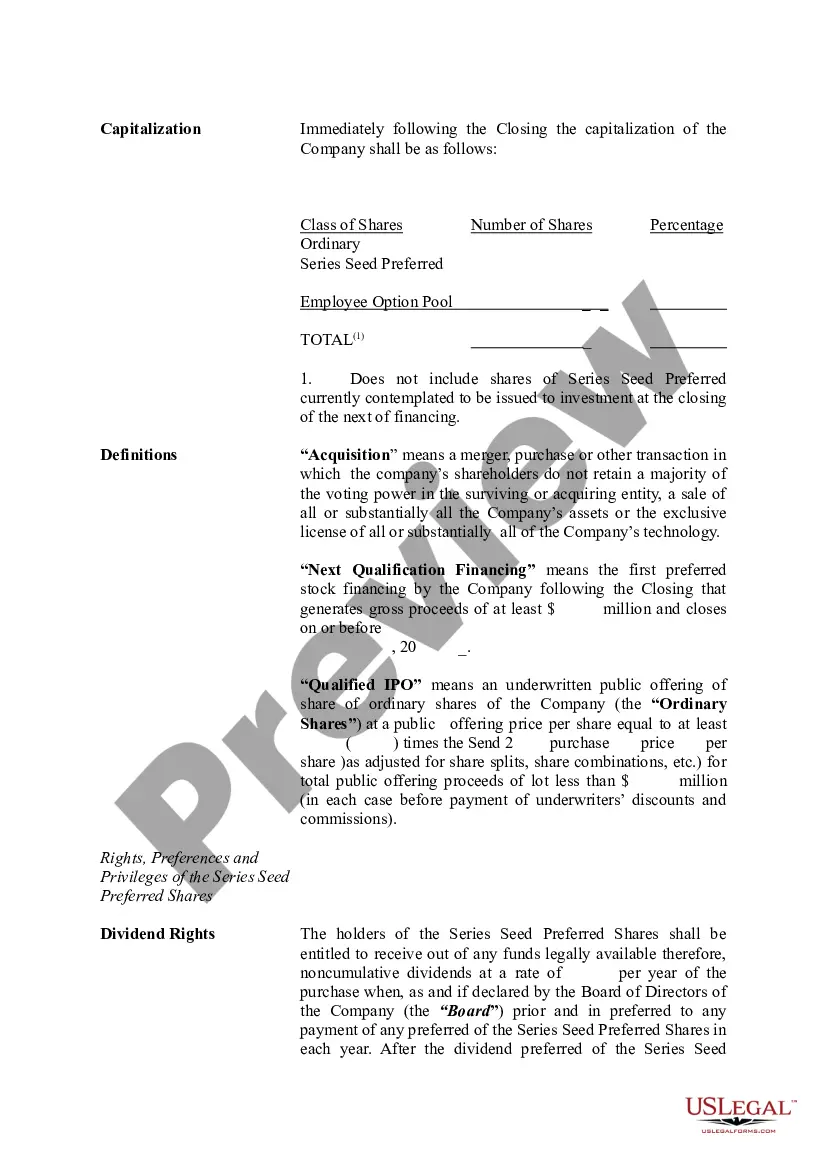

Idaho Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Term Sheet - Series Seed Preferred Share For Company?

Are you within a place in which you will need files for sometimes business or specific purposes virtually every time? There are a variety of lawful record themes available on the net, but locating ones you can rely on isn`t effortless. US Legal Forms offers a large number of develop themes, such as the Idaho Term Sheet - Series Seed Preferred Share for Company, which can be published in order to meet state and federal requirements.

Should you be presently knowledgeable about US Legal Forms web site and possess your account, basically log in. Next, it is possible to obtain the Idaho Term Sheet - Series Seed Preferred Share for Company design.

Unless you offer an account and wish to start using US Legal Forms, adopt these measures:

- Discover the develop you require and make sure it is for the correct metropolis/region.

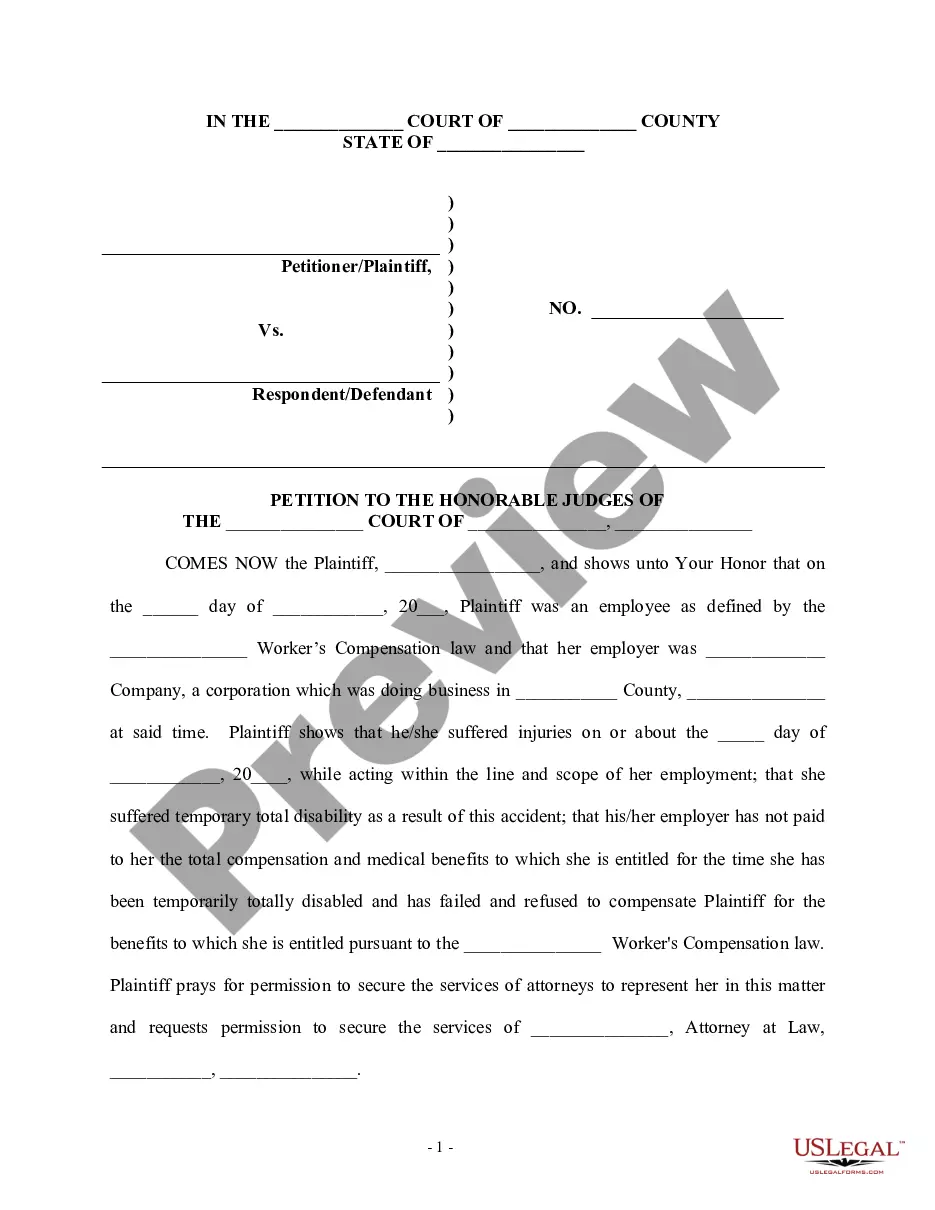

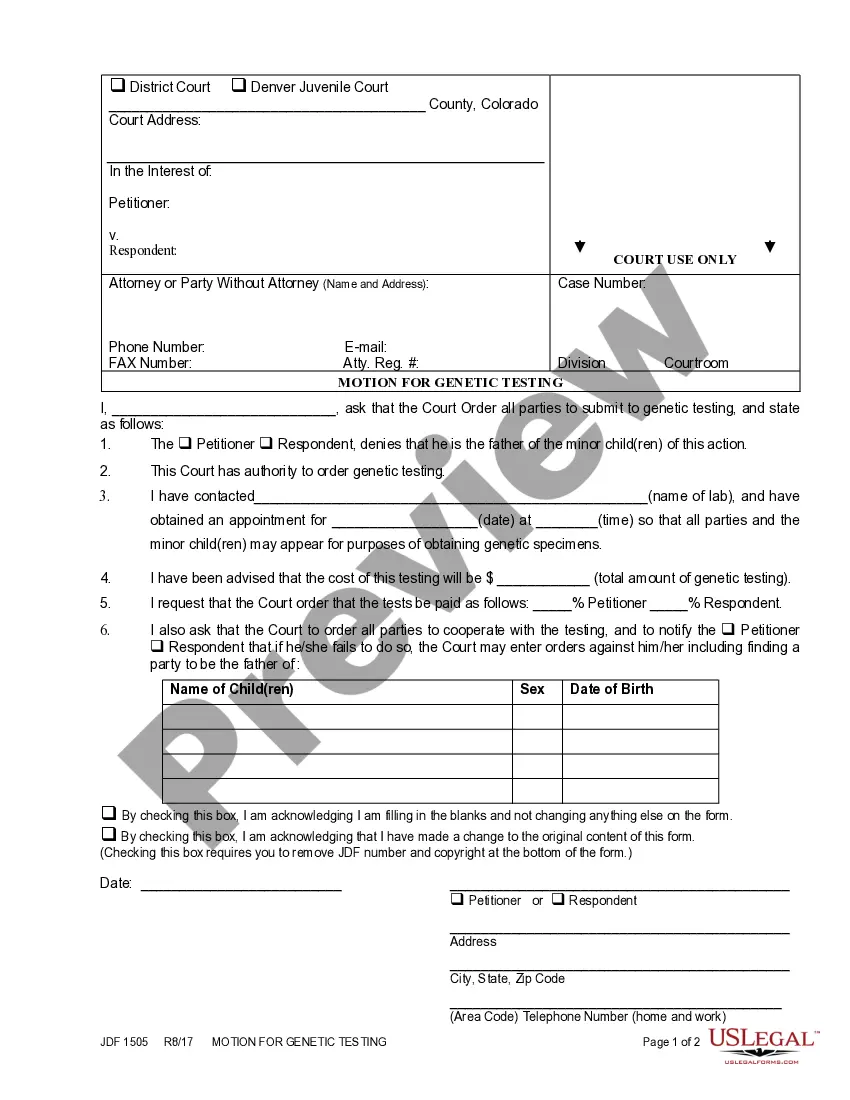

- Use the Preview switch to review the shape.

- Read the explanation to actually have chosen the appropriate develop.

- If the develop isn`t what you`re trying to find, take advantage of the Research discipline to find the develop that fits your needs and requirements.

- When you find the correct develop, just click Get now.

- Opt for the rates program you need, fill in the desired details to make your bank account, and purchase your order making use of your PayPal or credit card.

- Decide on a practical file structure and obtain your version.

Discover all the record themes you may have purchased in the My Forms menus. You can aquire a further version of Idaho Term Sheet - Series Seed Preferred Share for Company whenever, if necessary. Just go through the necessary develop to obtain or produce the record design.

Use US Legal Forms, the most comprehensive collection of lawful forms, to conserve efforts and steer clear of blunders. The services offers skillfully manufactured lawful record themes which you can use for a selection of purposes. Produce your account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

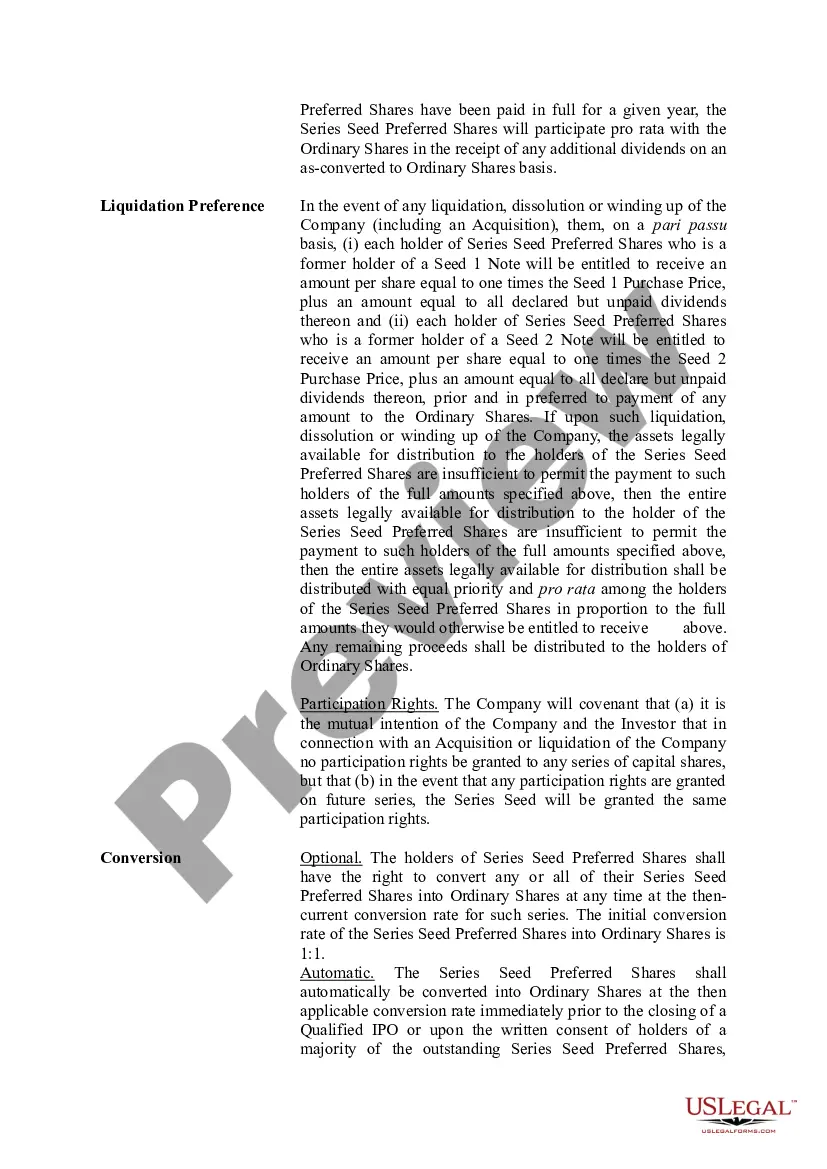

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

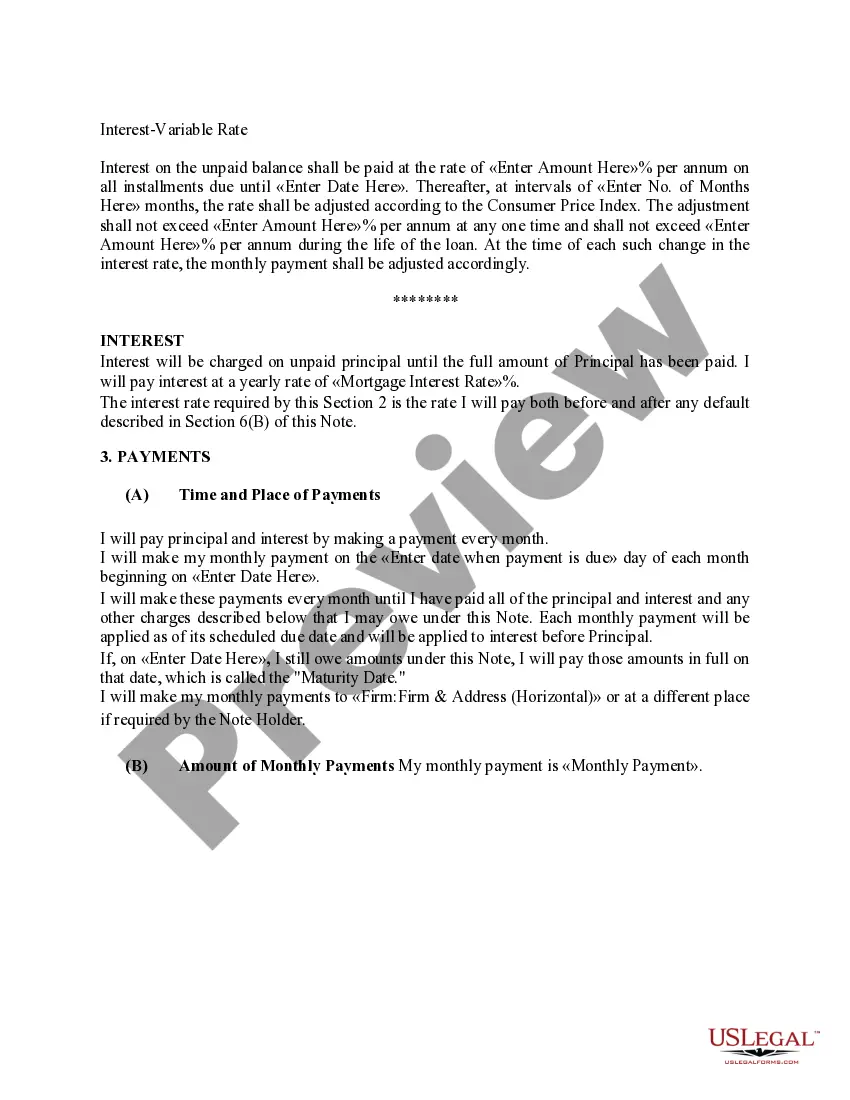

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

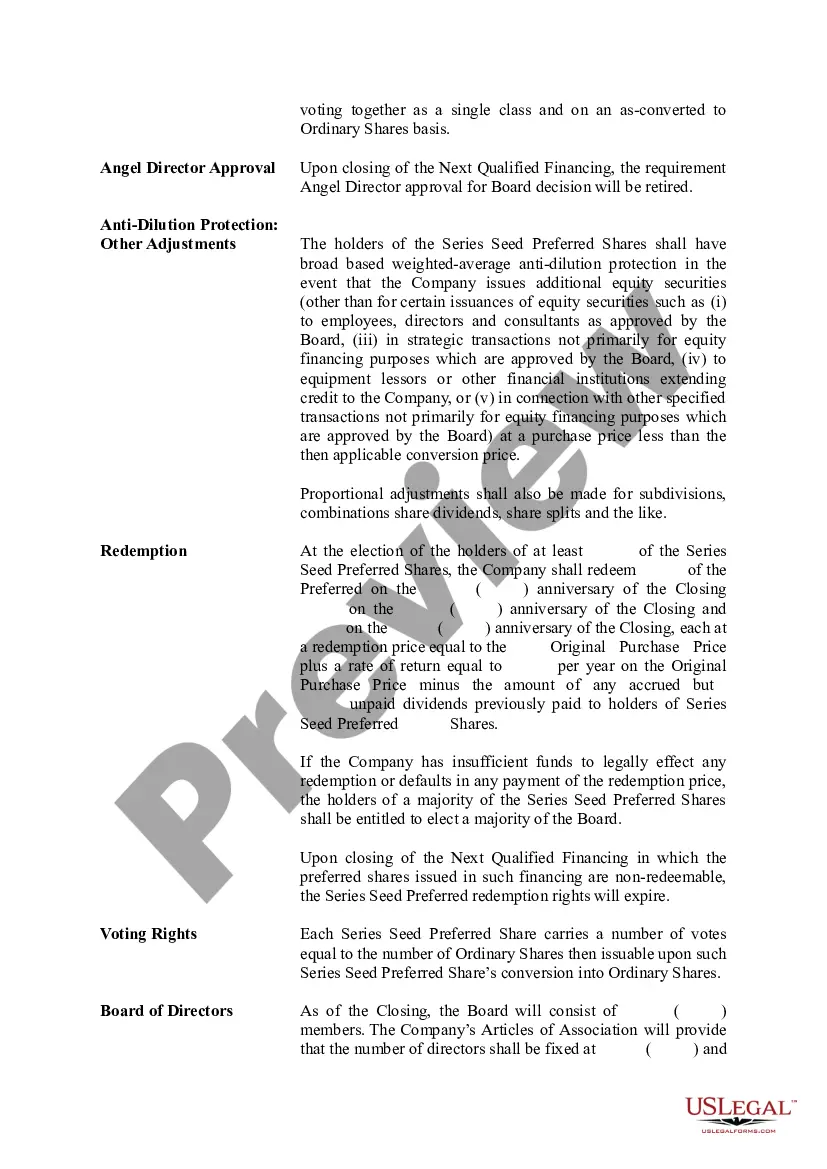

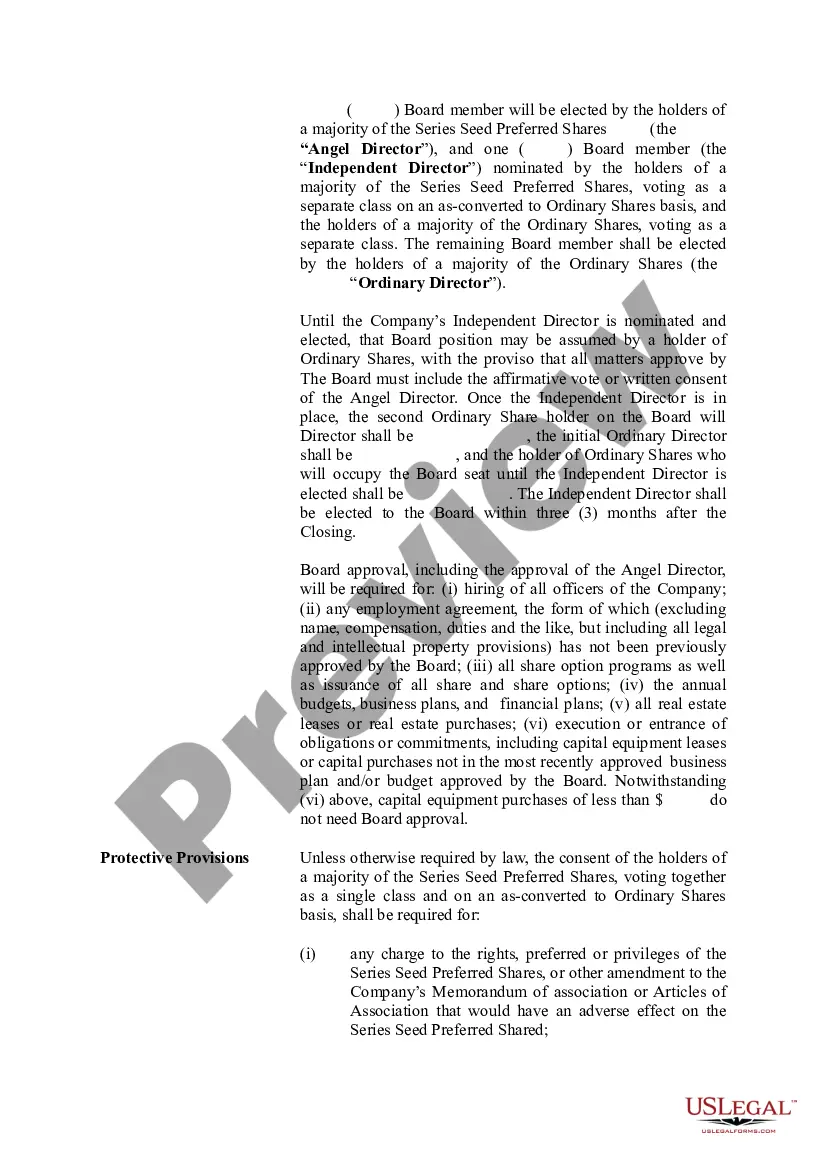

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

Key Takeaways. Preferred stock is a different type of equity that represents ownership of a company and the right to claim income from the company's operations. Preferred stockholders have a higher claim on distributions (e.g. dividends) than common stockholders.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements ? like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.