Idaho Conversion Agreement

Description

How to fill out Conversion Agreement?

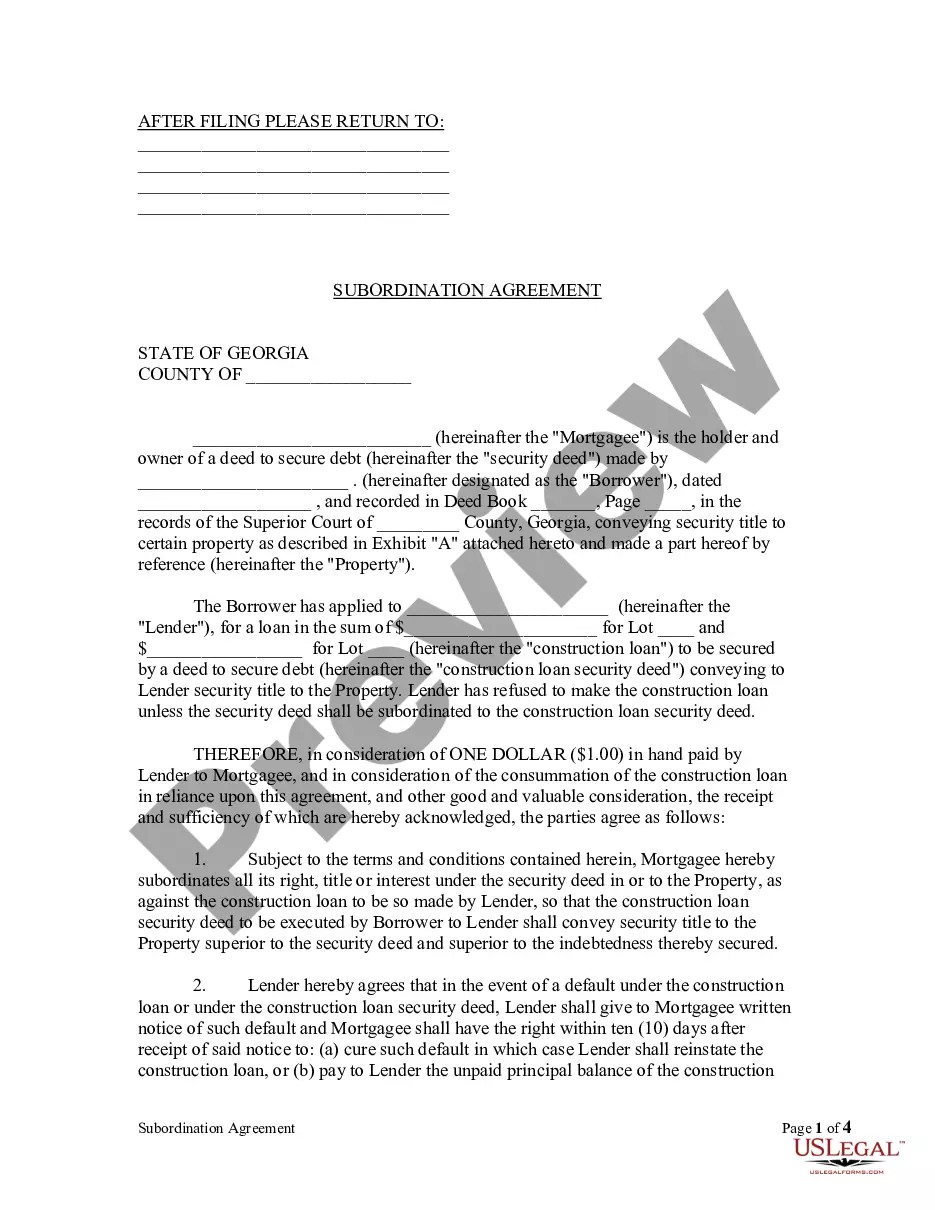

You may invest time online looking for the authorized file design that fits the state and federal needs you want. US Legal Forms provides a large number of authorized forms which can be reviewed by specialists. It is simple to down load or produce the Idaho Conversion Agreement from the support.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Download key. After that, it is possible to complete, modify, produce, or sign the Idaho Conversion Agreement. Every authorized file design you purchase is your own property forever. To have one more version of any purchased form, visit the My Forms tab and click the corresponding key.

If you use the US Legal Forms site the first time, keep to the simple recommendations below:

- Initial, make sure that you have selected the best file design for that region/city of your liking. Browse the form description to make sure you have picked out the proper form. If offered, make use of the Preview key to look through the file design as well.

- If you want to find one more version in the form, make use of the Search discipline to obtain the design that meets your needs and needs.

- Once you have discovered the design you want, just click Get now to carry on.

- Choose the prices strategy you want, type your references, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can use your bank card or PayPal bank account to pay for the authorized form.

- Choose the structure in the file and down load it to your gadget.

- Make alterations to your file if required. You may complete, modify and sign and produce Idaho Conversion Agreement.

Download and produce a large number of file layouts while using US Legal Forms Internet site, which provides the largest selection of authorized forms. Use skilled and condition-specific layouts to tackle your organization or personal demands.

Form popularity

FAQ

While a written operating agreement isn't required (per Idaho Statute § 30-25-102), your operating agreement is an essential document for many important aspects of your business, from opening a bank account to handling major events (like fighting lawsuits).

File the Statement of Domestication with the Idaho Secretary of State's Business Services Office. The Statement of Domestication may be e-filed. File the Certificate of Organization. File the Certificate of Organization with the Business Services of the Secretary of State.

Filing for Conversion with the Idaho Secretary of State Choose the company you wish to convert, and then select the option ?File Amendment.? Follow the steps, upload the required documentation and pay a $30 fee?your conversion is now filed. Within seven to ten business days, your corporation will legally be an LLC.

NOTE: You can, as an individual, act as your own registered agent if you have an Idaho physical address. Or, you may use another legal business entity who is filed with our office with an Idaho physical address, but not your own entity.

An LLC is a domestic company in one state ? its state of organization. It is considered a foreign company in every other jurisdiction. If an LLC wants to transact business in a state other than its state of organization, it will have to register as a foreign LLC with that other state's business entity filing office.

The process to register a foreign LLC in Idaho involves filing a Foreign Registration Statement with Idaho's Secretary of State and paying a $100 online state filing fee (add $4 if paying by credit card or $20 if filing by mail).

Idaho LLC Formation Filing Fee: $100 The cost to start an Idaho LLC is $100 for online filings, and $120 for paper filings. Forming your LLC involves filing an Idaho Certificate of Organization with the Secretary of State. Filing your certificate officially creates your Idaho LLC.

How to start an Idaho LLC Name your Idaho LLC. Create a business plan. Get a federal employer identification number (EIN) File an Idaho Certificate of Organization. Choose a registered agent in Idaho. Obtain business licenses and permits. Understand Idaho state tax requirements. Prepare an operating agreement.