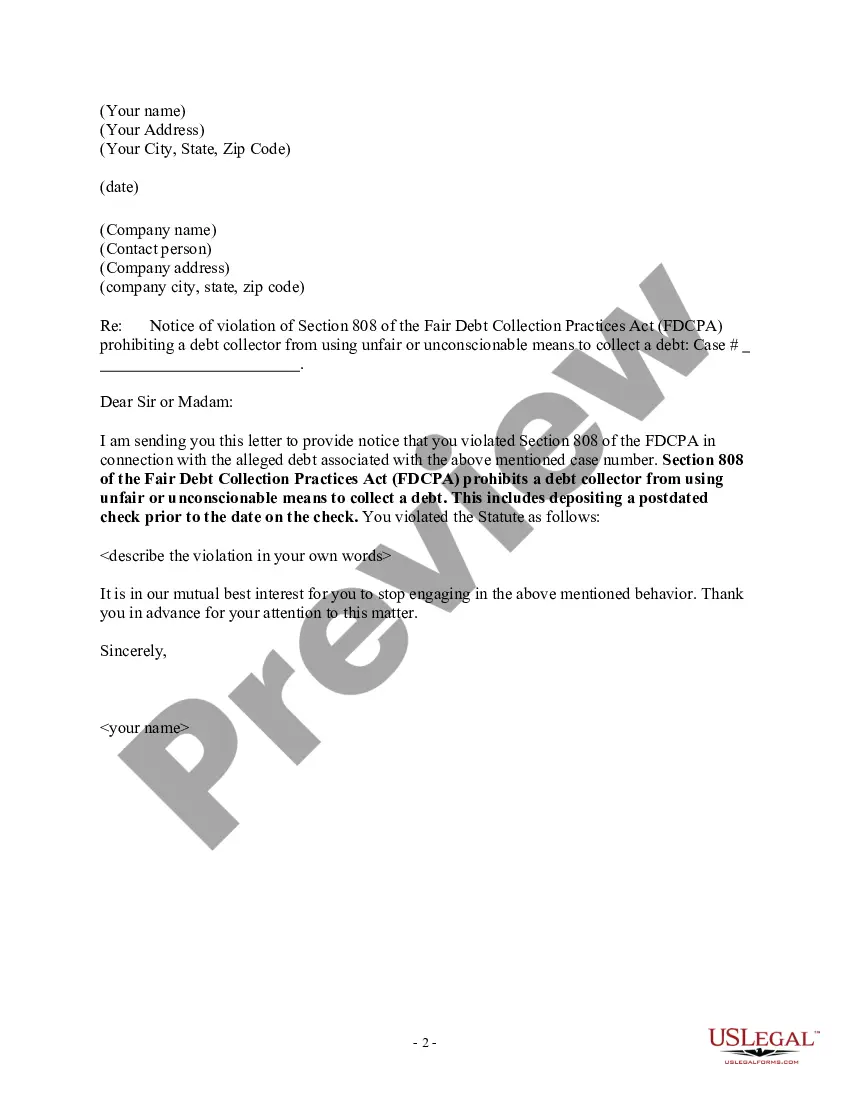

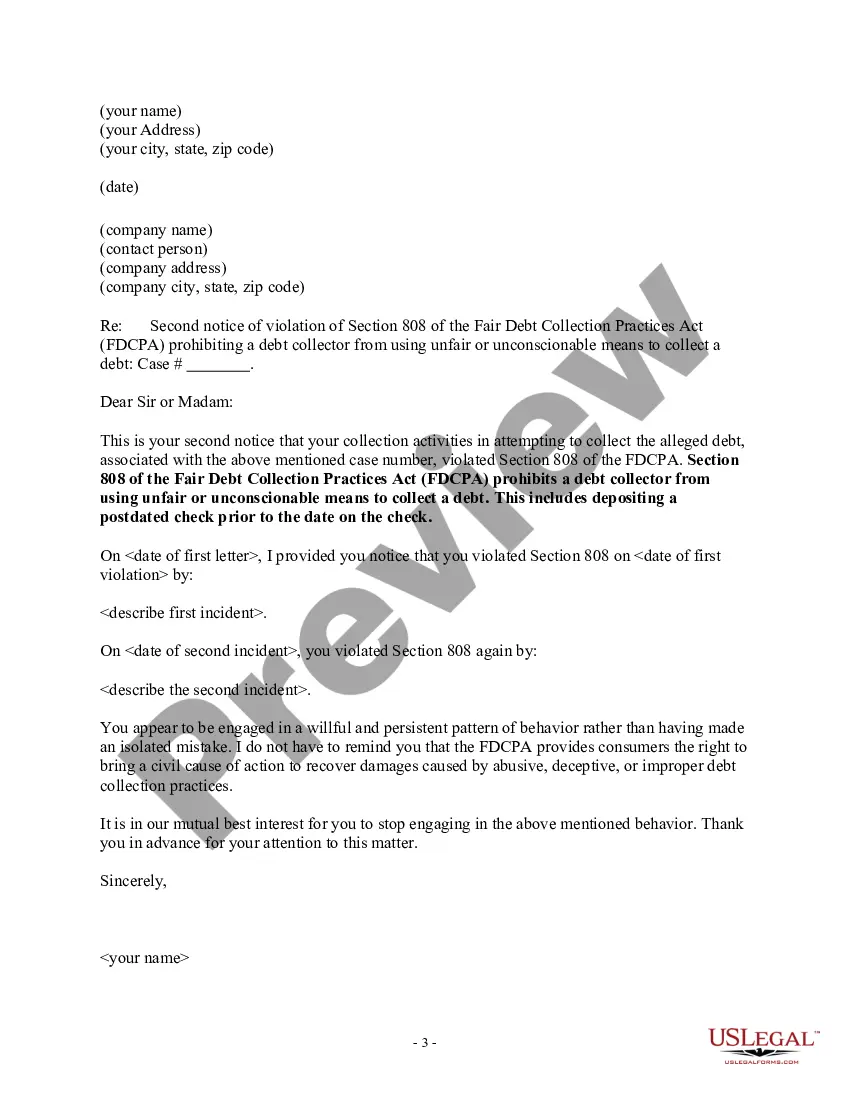

A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Idaho Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

How to fill out Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

It is possible to invest hours on the web attempting to find the legal papers format that suits the state and federal requirements you want. US Legal Forms provides thousands of legal kinds which are analyzed by professionals. It is possible to download or produce the Idaho Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check from my assistance.

If you currently have a US Legal Forms account, you can log in and then click the Down load switch. Afterward, you can comprehensive, change, produce, or indication the Idaho Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check. Every single legal papers format you buy is your own property permanently. To have an additional version for any obtained type, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms site for the first time, stick to the easy guidelines under:

- Initially, ensure that you have selected the best papers format for the region/town of your liking. Look at the type description to ensure you have picked out the correct type. If accessible, take advantage of the Review switch to look throughout the papers format too.

- If you want to locate an additional variation of the type, take advantage of the Lookup discipline to obtain the format that meets your needs and requirements.

- When you have identified the format you want, click Buy now to carry on.

- Pick the prices program you want, type in your references, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You can utilize your Visa or Mastercard or PayPal account to fund the legal type.

- Pick the file format of the papers and download it to the device.

- Make modifications to the papers if needed. It is possible to comprehensive, change and indication and produce Idaho Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

Down load and produce thousands of papers templates using the US Legal Forms site, which provides the most important selection of legal kinds. Use professional and state-particular templates to take on your small business or specific needs.

Form popularity

FAQ

The 11-word credit phrase loophole refers to a specific phrase that can effectively challenge a debt collector's claim. This phrase indicates a request for verification of the debt, putting the onus on the collector to prove their case. Utilizing such phrases can empower you in debt disputes, especially when considering the Idaho Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check. Platforms like USLegalForms can provide resources to help you understand and apply these concepts.

The 11-word phrase in the book 'Credit Secrets' is a powerful tool aimed at helping individuals gain insights into managing and improving their credit. This phrase often serves as a reminder of the importance of strategic communication with creditors. By using this knowledge wisely, you can tackle challenges, including those involving the Idaho Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

Some frequent FDCPA violations include misleading statements, threats of action that cannot legally be taken, and using abusive language during communication. Collectors may also fail to provide you with written validation of your debt within five days of their initial contact. Recognizing these violations empowers you to take the necessary steps towards your rights, especially if you receive an Idaho Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check. By using resources like uslegalforms, you can easily navigate these situations.

You can use the phrase: 'Please cease all communication with me immediately.' This phrase works as a request to halt debt collectors from contacting you further. While it may not eliminate the underlying debt, it serves as a formal notice of your preference. Familiarize yourself with the Idaho Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check to enhance your understanding of the legalities.

According to UCC § 3-113, if a financial instrument, such as a check, is undated, its official date is the date on which it first came into the possession of the person or business listed on it. Since banks follow the UCC, your undated check will be deposited.

Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice. Contact your bank or credit union to learn what its policies are.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

In most cases, when you receive a postdated check, you can deposit or cash a postdated check at any time. Debt collectors may be prohibited from processing a check before the date on the check, but most individuals are free to take postdated checks to the bank immediately.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.