Idaho Plan of Conversion from state stock savings bank to federal stock savings bank

Description

How to fill out Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

Discovering the right authorized record format could be a struggle. Of course, there are plenty of layouts available online, but how do you discover the authorized develop you will need? Take advantage of the US Legal Forms website. The assistance offers a large number of layouts, such as the Idaho Plan of Conversion from state stock savings bank to federal stock savings bank, which you can use for business and private requirements. Every one of the varieties are checked out by pros and satisfy state and federal specifications.

Should you be currently registered, log in to your account and click the Down load button to get the Idaho Plan of Conversion from state stock savings bank to federal stock savings bank. Use your account to look from the authorized varieties you may have purchased previously. Go to the My Forms tab of the account and acquire yet another backup in the record you will need.

Should you be a new end user of US Legal Forms, listed here are easy instructions that you should follow:

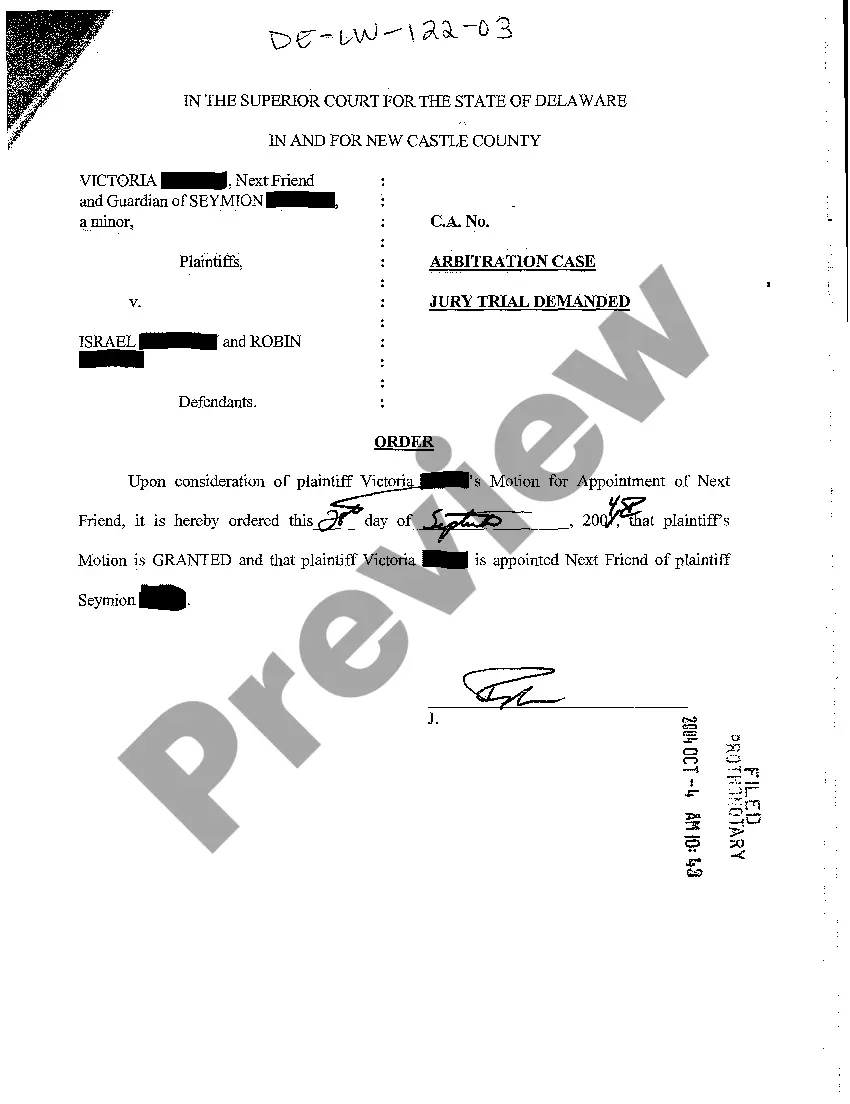

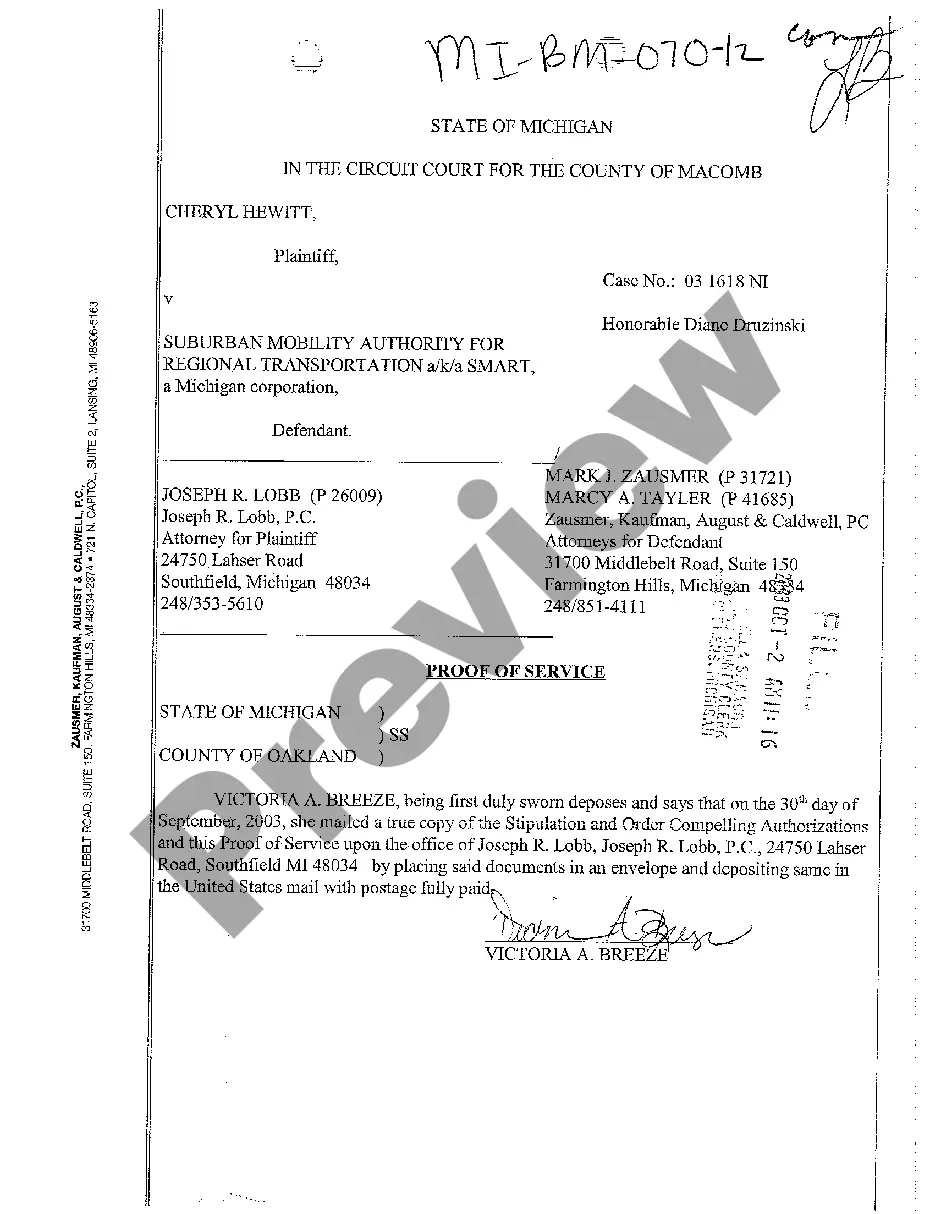

- Initially, make certain you have chosen the proper develop for your area/region. You may look through the shape utilizing the Review button and look at the shape outline to make certain this is the right one for you.

- In the event the develop is not going to satisfy your needs, take advantage of the Seach field to obtain the appropriate develop.

- When you are certain that the shape would work, select the Buy now button to get the develop.

- Pick the pricing program you need and type in the needed info. Create your account and pay for your order with your PayPal account or bank card.

- Pick the submit formatting and obtain the authorized record format to your device.

- Comprehensive, modify and printing and indication the acquired Idaho Plan of Conversion from state stock savings bank to federal stock savings bank.

US Legal Forms is definitely the greatest local library of authorized varieties for which you can discover various record layouts. Take advantage of the company to obtain professionally-manufactured papers that follow status specifications.

Form popularity

FAQ

The MHC converts to stock form by selling shares to the public in a new stock savings and loan holding company. The MHC members receive priority subscription rights to purchase shares in the new stock savings and loan holding company.

Mutual savings banks also have several disadvantages including being too conservative at times, having no member control, and having the possibility of being acquired or going public.

The Demutualization Process In a demutualization, a mutual company elects to change its corporate structure to a public company, where prior members may receive a structured compensation or ownership conversion rights in the transition, in the form of shares in the company.

Mutual banks are owned by their borrowers and depositors. Ownership and profit sharing are what differentiate mutual banks from stock banks, which are owned and controlled by individual and institutional shareholders that profit from them.

Merger/conversions (the purchase of a mutual savings bank by a stock bank, with the depositors of the mutual bank offered the opportunity to purchase stock of the acquiring bank or holding company) are closely reviewed by the FDIC to ensure that (i) the value of the converting institution is fairly determined, and (ii) ...

Federal savings associations (also called "federal thrifts" or "federal Savings Banks"), in the United States, are institutions chartered by the Office of Thrift Supervision which is now administered by Office of the Comptroller of the Currency after the agencies merged.