Idaho Changing state of incorporation

Description

How to fill out Changing State Of Incorporation?

Discovering the right legal file template could be a battle. Naturally, there are a lot of themes accessible on the Internet, but how would you find the legal type you want? Utilize the US Legal Forms website. The support offers thousands of themes, such as the Idaho Changing state of incorporation, which you can use for business and personal requirements. All the forms are checked by pros and meet up with federal and state specifications.

Should you be already authorized, log in for your bank account and then click the Obtain switch to obtain the Idaho Changing state of incorporation. Utilize your bank account to search with the legal forms you may have bought previously. Check out the My Forms tab of the bank account and have another backup in the file you want.

Should you be a brand new consumer of US Legal Forms, here are basic directions for you to comply with:

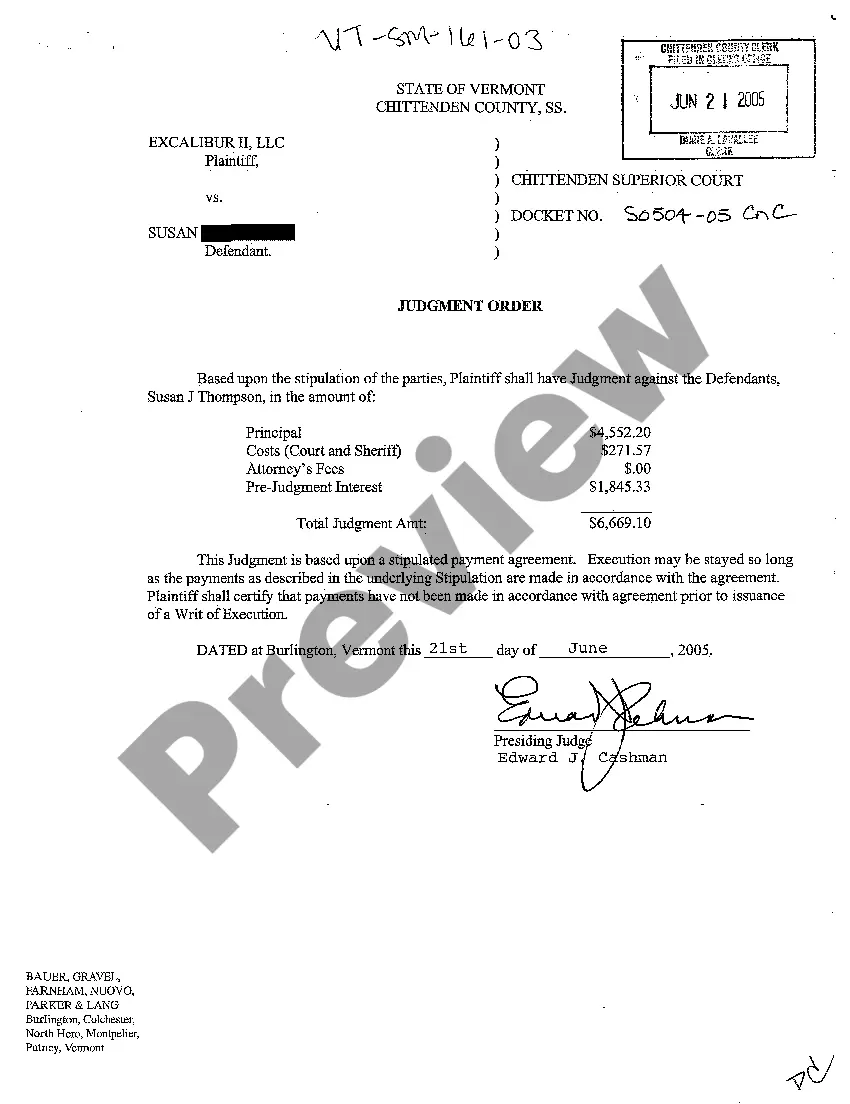

- Very first, make certain you have chosen the appropriate type for the metropolis/county. You are able to look through the form while using Preview switch and read the form information to make certain this is the right one for you.

- In the event the type is not going to meet up with your preferences, utilize the Seach industry to discover the right type.

- Once you are certain that the form is suitable, go through the Get now switch to obtain the type.

- Pick the rates strategy you desire and type in the essential information. Build your bank account and purchase your order making use of your PayPal bank account or bank card.

- Opt for the file format and obtain the legal file template for your device.

- Comprehensive, change and produce and indication the obtained Idaho Changing state of incorporation.

US Legal Forms will be the greatest library of legal forms where you will find different file themes. Utilize the service to obtain appropriately-created files that comply with express specifications.

Form popularity

FAQ

To make amendments to your Idaho Corporation, you submit the completed Articles of Amendment form, or you may draft your own Articles of Amendment and provide them to the Secretary of State by mail or in person. Submit them in duplicate with the filing fee.

You will be required to obtain a new EIN if any of the following statements are true. A new LLC with more than one owner (Multi-member LLC) is formed under state law. A new LLC with one owner (Single Member LLC) is formed under state law and chooses to be taxed as a corporation or an S corporation.

The process to register a foreign LLC in Idaho involves filing a Foreign Registration Statement with Idaho's Secretary of State and paying a $100 online state filing fee (add $4 if paying by credit card or $20 if filing by mail).

To form an Idaho S corp, you'll need to ensure your company has an Idaho formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

File Articles of Organization ? Conversion (Form LLC-1A (PDF)) online at bizfileOnline.sos.ca.gov, by mail, or in person. The filing fee is $150 if a California Corp is involved; and $70 for all others.

To start an Idaho corporation, you'll need to file Idaho Articles of Incorporation with the Secretary of State and pay a $100 filing fee.

How to change from LLC to S corp. To make an LLC to S corp. election with the IRS, you need to file form 2553 Election by a Small Business Corporation.

Any time you transfer an ownership interest in an LLC, there must be an official certificate of transfer. New members will need to be recorded on the company's annual report, which is filed with the Idaho Secretary of State.