Idaho Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc.

Description

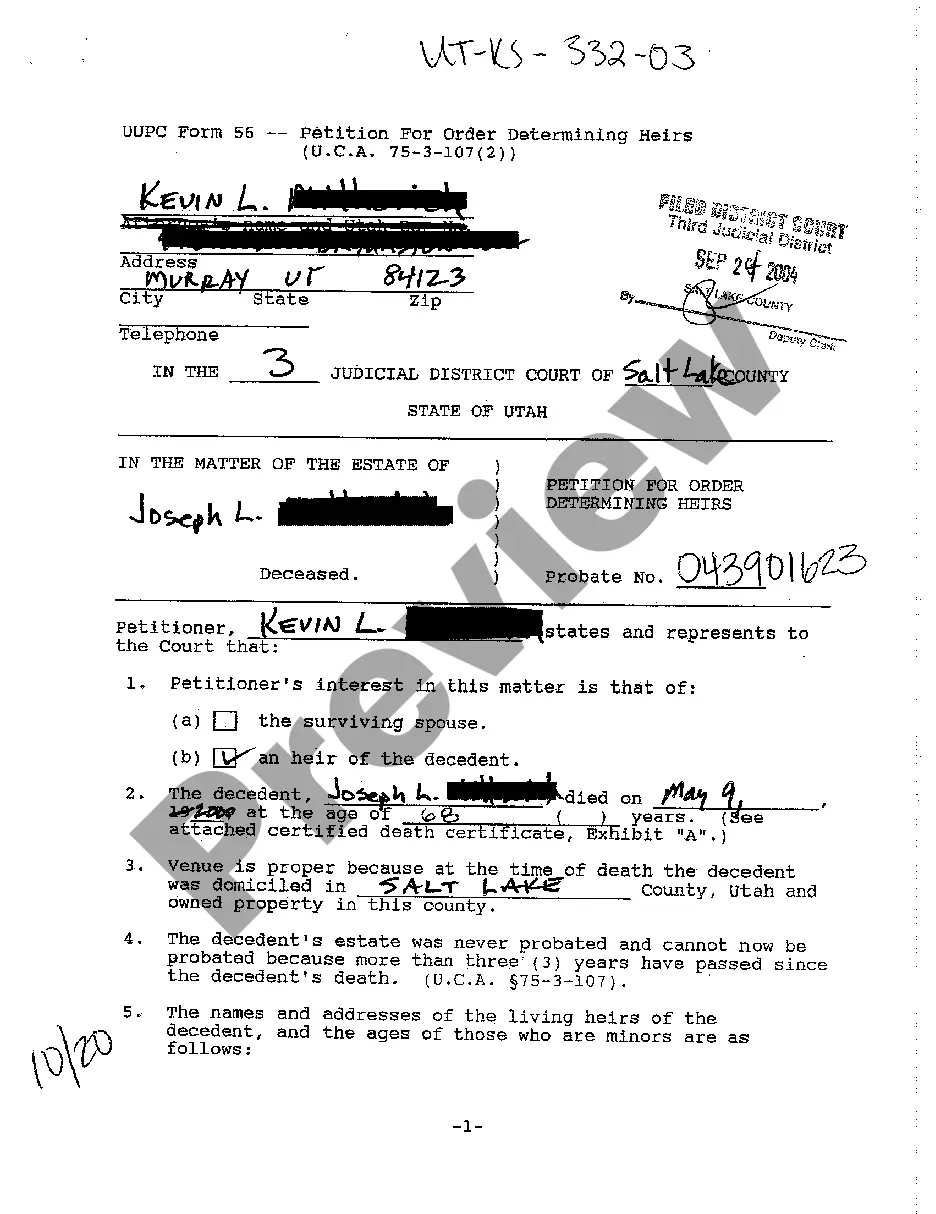

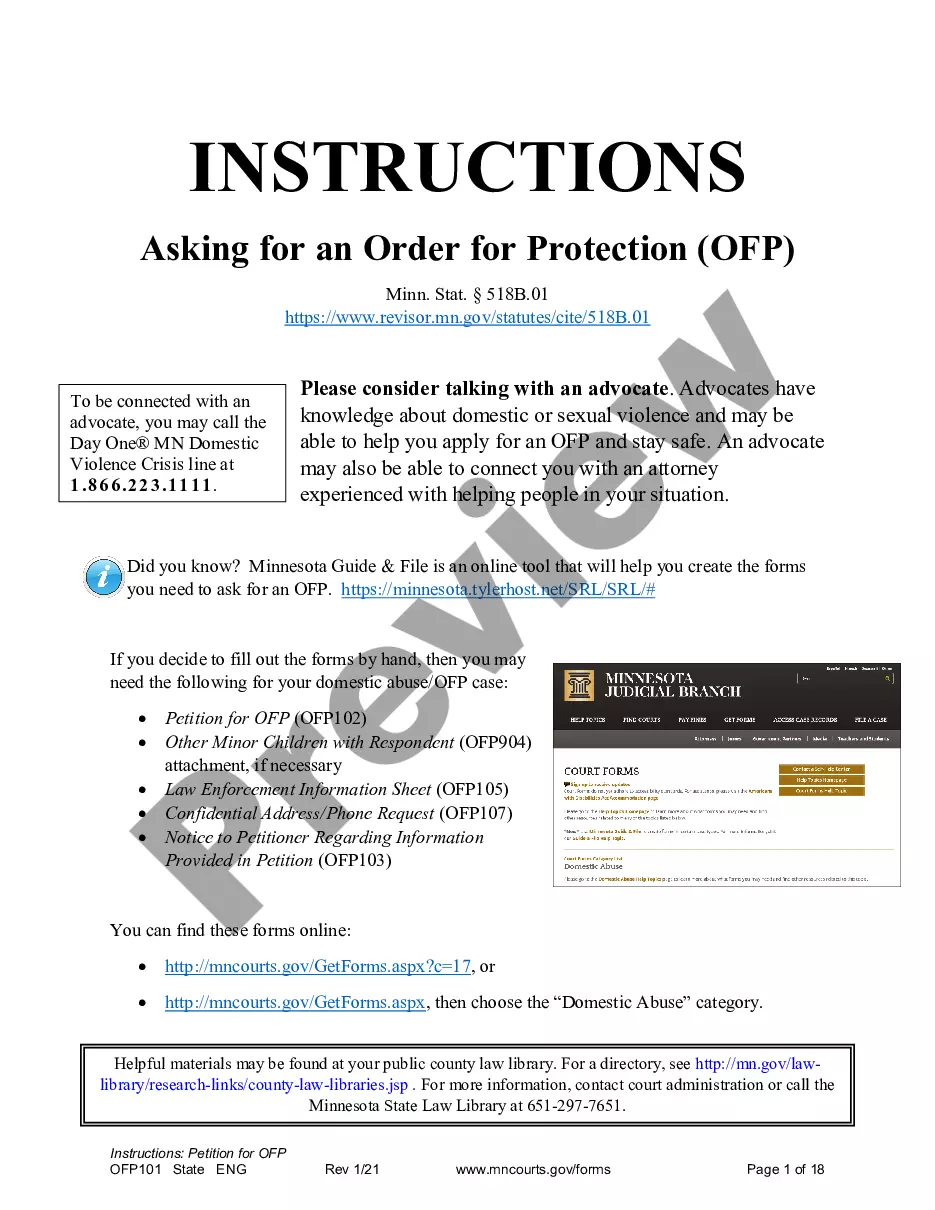

How to fill out Agreement And Plan Of Merger By Filtertek, Inc., Filtertek De Puerto Rico, And Filtertek USA, Inc.?

If you want to complete, obtain, or print authorized file themes, use US Legal Forms, the most important collection of authorized kinds, that can be found on the Internet. Utilize the site`s easy and handy search to discover the documents you need. Various themes for company and person uses are categorized by classes and says, or keywords. Use US Legal Forms to discover the Idaho Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. within a number of clicks.

In case you are already a US Legal Forms customer, log in for your accounts and then click the Download key to find the Idaho Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc.. You may also gain access to kinds you earlier delivered electronically in the My Forms tab of your accounts.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for the correct metropolis/region.

- Step 2. Use the Review choice to look through the form`s articles. Never forget about to read the description.

- Step 3. In case you are unsatisfied with all the develop, take advantage of the Search area at the top of the monitor to discover other variations in the authorized develop template.

- Step 4. When you have located the form you need, click on the Buy now key. Pick the rates program you prefer and include your references to register for the accounts.

- Step 5. Method the transaction. You can utilize your charge card or PayPal accounts to accomplish the transaction.

- Step 6. Choose the formatting in the authorized develop and obtain it on the system.

- Step 7. Full, change and print or indicator the Idaho Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc..

Each authorized file template you purchase is yours forever. You possess acces to each and every develop you delivered electronically in your acccount. Click the My Forms portion and select a develop to print or obtain once more.

Contend and obtain, and print the Idaho Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. with US Legal Forms. There are many professional and status-particular kinds you may use for the company or person needs.

Form popularity

FAQ

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

Mergers are most commonly done to gain market share, reduce costs of operations, expand to new territories, unite common products, grow revenues, and increase profits?all of which should benefit the firms' shareholders.

What is an Agreement Of Merger? An agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

Along with the press release, the public target will also file the definitive agreement (usually as an exhibit to the press release 8-K or sometimes as a separate 8-K). In a stock sale, the agreement is often called the merger agreement, while in an asset sale, it's often called an asset purchase agreement.

An integration clause?sometimes called a merger clause or an entire agreement clause?is a legal provision in Contract Law that states that the terms of a contract are the complete and final agreement between the parties.

When a transaction closes, the new company will simply take over performance as the successor-in-interest to the old company. The merger agreement will already assign the rights and obligations under existing contracts to the buyer without a new, specific process for each existing agreement.