Idaho Adjustments in the event of reorganization or changes in the capital structure

Description

How to fill out Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

Are you presently inside a placement that you need to have files for both company or individual purposes almost every time? There are tons of legitimate file web templates available on the Internet, but getting ones you can trust isn`t easy. US Legal Forms gives a huge number of form web templates, much like the Idaho Adjustments in the event of reorganization or changes in the capital structure, which are written to fulfill state and federal requirements.

In case you are currently informed about US Legal Forms internet site and also have a free account, merely log in. After that, you can download the Idaho Adjustments in the event of reorganization or changes in the capital structure format.

Should you not provide an account and would like to begin using US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for the proper town/state.

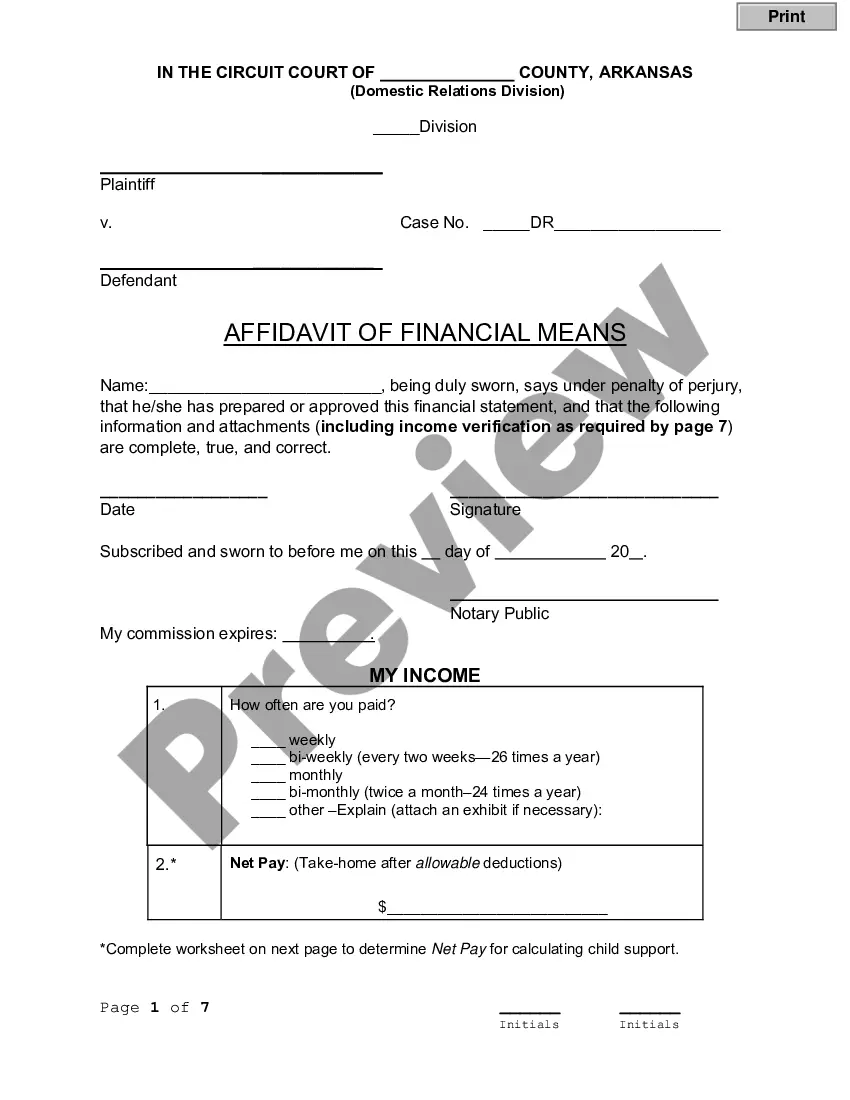

- Utilize the Preview key to analyze the form.

- Look at the description to actually have selected the correct form.

- In case the form isn`t what you`re searching for, take advantage of the Lookup field to obtain the form that meets your requirements and requirements.

- Whenever you obtain the proper form, simply click Purchase now.

- Pick the pricing program you want, submit the necessary info to generate your account, and pay money for an order making use of your PayPal or credit card.

- Select a convenient data file formatting and download your version.

Get all the file web templates you have purchased in the My Forms food selection. You can obtain a more version of Idaho Adjustments in the event of reorganization or changes in the capital structure any time, if required. Just click the essential form to download or produce the file format.

Use US Legal Forms, probably the most extensive assortment of legitimate varieties, to save efforts and steer clear of mistakes. The support gives appropriately manufactured legitimate file web templates that you can use for a variety of purposes. Create a free account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

Form 42 is used to show the total for the unitary group. A schedule must be attached detailing the Idaho apportionment factor computation for each corporation in the group.

Use Form 41S to amend your Idaho income tax return. Make sure you check the Amended Return box and enter the reason for amending. If you amend your federal return, you also must file an amended Idaho income tax return.

You can deduct costs of buying, selling or improving your property from your gain. These include: estate agents' and solicitors' fees. costs of improvement works, for example for an extension - normal maintenance costs like decorating do not count.

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

Long-term capital gains tax rates for the 2023 tax year For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300.

The deduction is 60% of the capital gain net income included in federal taxable income from the sale of Idaho property. ?Capital gain net income? is the amount left over when you reduce your gains by your losses from selling or exchanging capital assets.

Form PTE-12 is the reconciliation schedule you include with the entity's Idaho income tax return (Form 41S, Form 65, or Form 66) as required by Idaho Code section 63-3036B. Include each owner's complete information whether the owner has Idaho distributable income or a loss.

Avoiding capital gains tax on your primary residence You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years.