Idaho Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

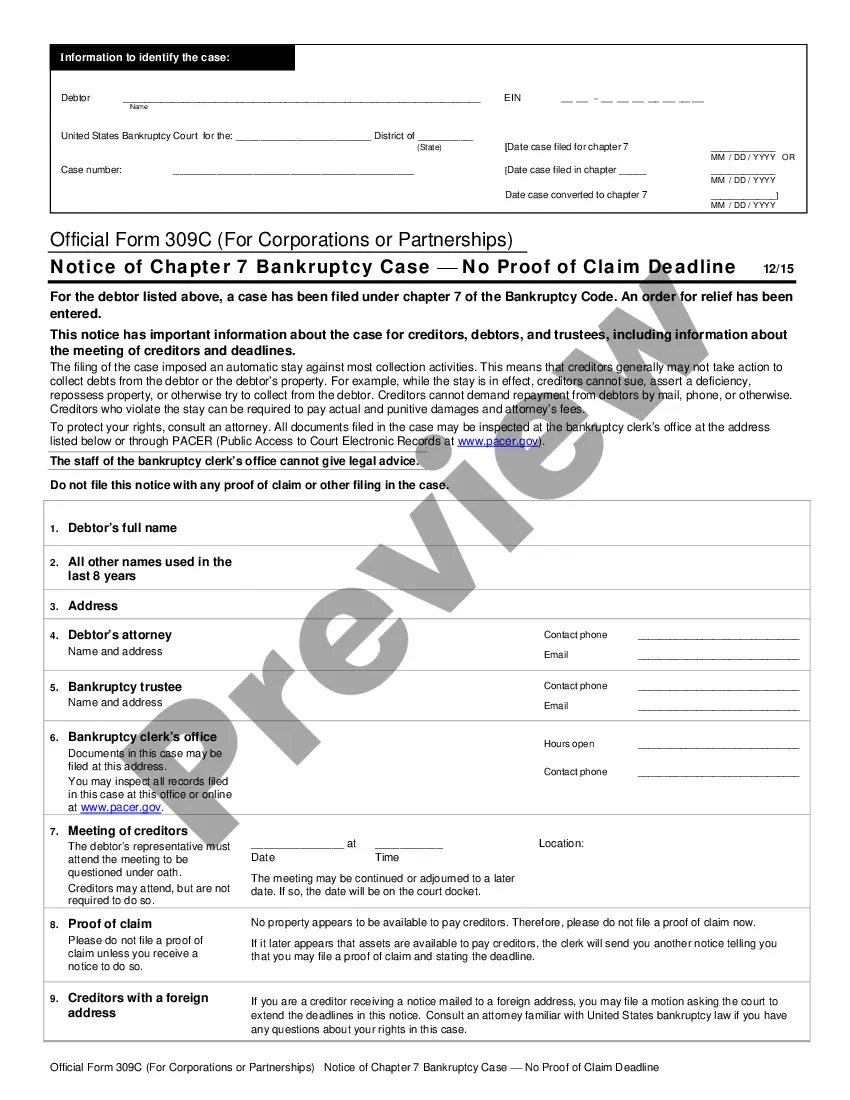

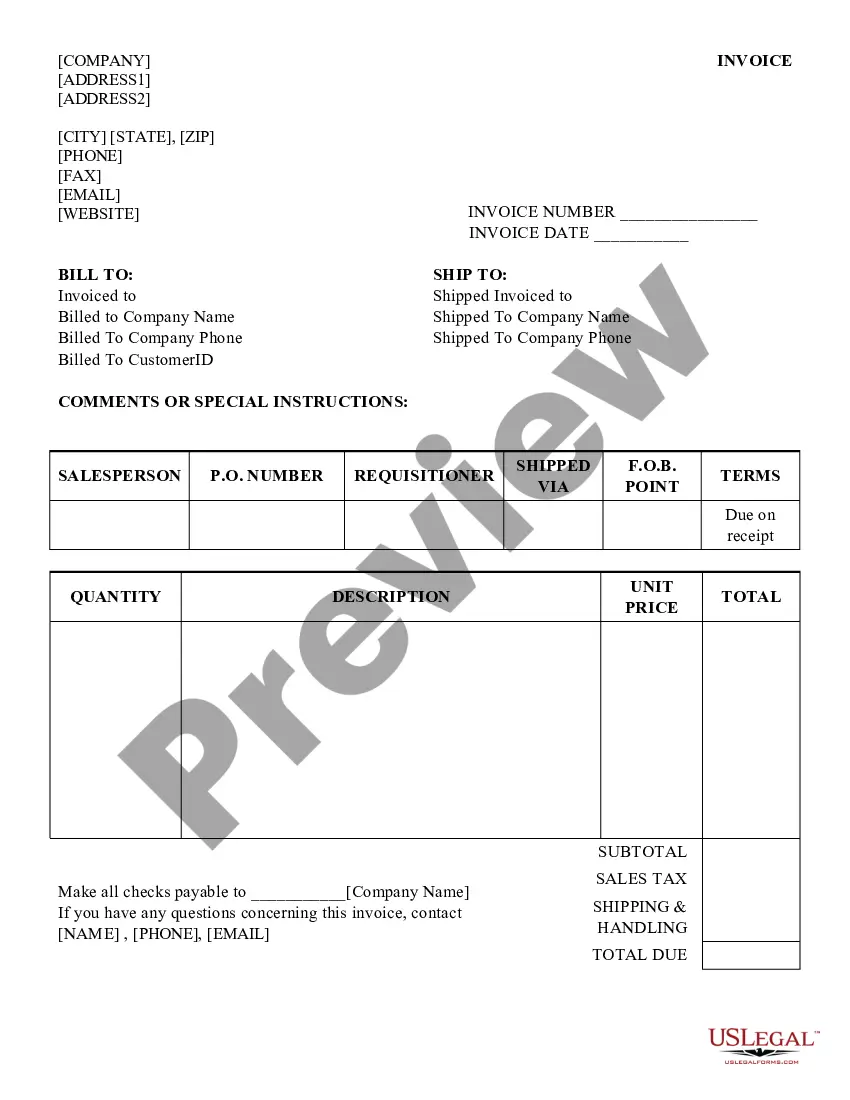

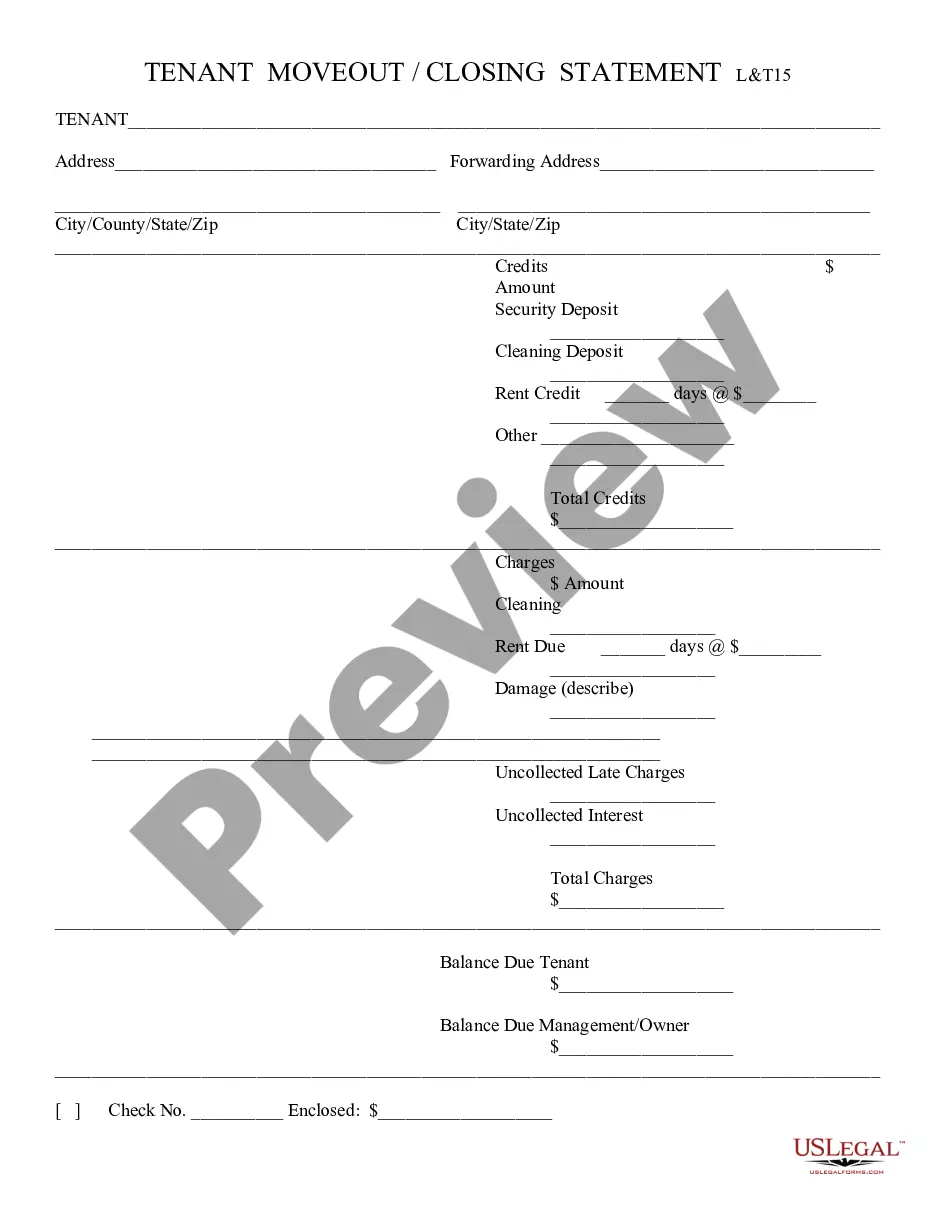

How to fill out Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

If you need to total, download, or print authorized file templates, use US Legal Forms, the biggest collection of authorized forms, that can be found on the web. Use the site`s simple and easy convenient research to obtain the documents you need. A variety of templates for company and person functions are categorized by groups and says, or keywords and phrases. Use US Legal Forms to obtain the Idaho Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 with a few click throughs.

If you are previously a US Legal Forms buyer, log in to the bank account and click on the Acquire button to get the Idaho Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005. You can even accessibility forms you previously delivered electronically within the My Forms tab of your bank account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for your appropriate area/region.

- Step 2. Use the Preview method to look through the form`s content material. Don`t overlook to learn the description.

- Step 3. If you are not happy with all the form, utilize the Search industry on top of the monitor to locate other variations in the authorized form web template.

- Step 4. Once you have found the form you need, go through the Acquire now button. Opt for the prices program you prefer and add your references to sign up to have an bank account.

- Step 5. Process the transaction. You should use your credit card or PayPal bank account to accomplish the transaction.

- Step 6. Find the formatting in the authorized form and download it on your own device.

- Step 7. Total, change and print or sign the Idaho Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005.

Each authorized file web template you buy is your own property eternally. You might have acces to every form you delivered electronically in your acccount. Select the My Forms section and choose a form to print or download again.

Be competitive and download, and print the Idaho Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 with US Legal Forms. There are many expert and condition-certain forms you can use for the company or person demands.

Form popularity

FAQ

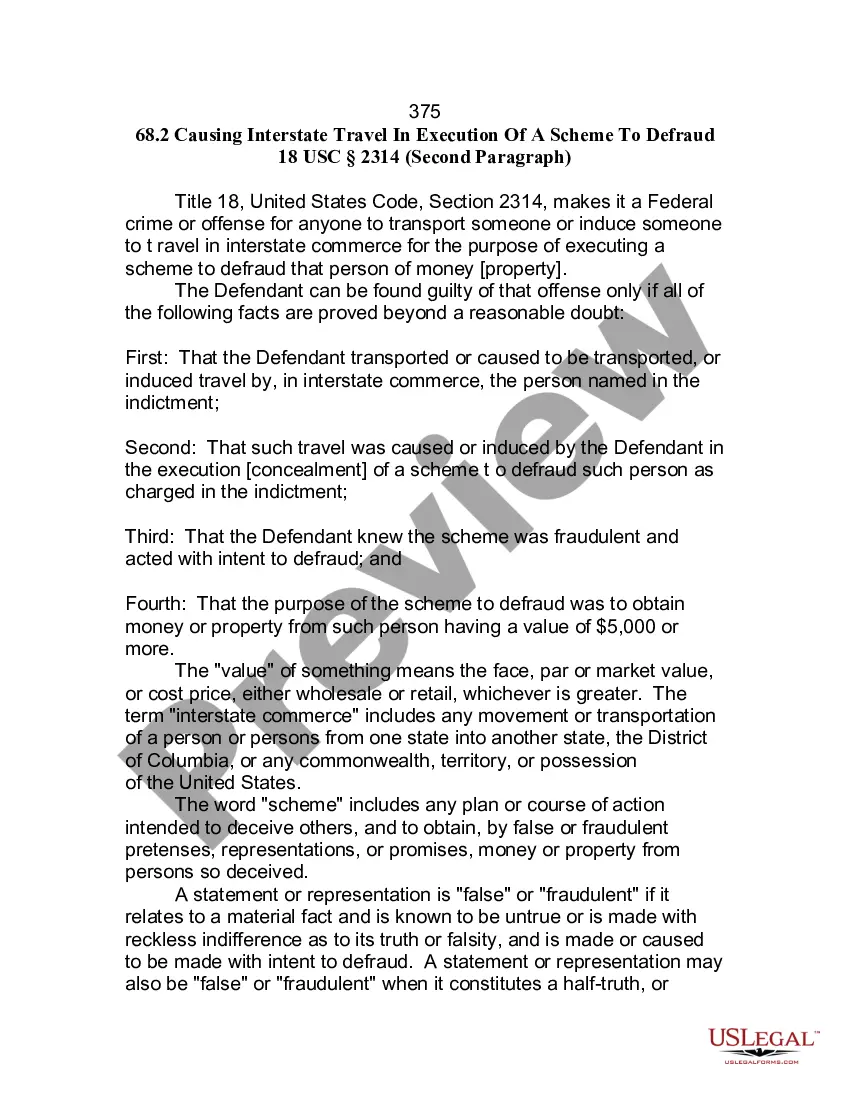

Priority Unsecured Debts Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. In a Chapter 7 asset case, priority claims receive payment in full before any payments to general unsecured creditors. Priority debts are nondischargeable.

In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders.

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.

Creditors are ranked as follows: Secured creditors with a fixed charge. Administrator/Liquidator fees. Preferential creditors. Secondary preferential creditors (expanded to include HMRC for certain taxes) Secured creditors with a floating charge. Unsecured creditors (including all other HMRC debt) Shareholders.

What is an Unsecured Claim? Unsecured claims are the opposite of secured claims: There is no property to seize, repossess, or foreclose upon. Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans.

Priority debt is a phrase referring to the most urgent or important debts that must be paid off in bankruptcy. Listed in the order of priority, these include alimony, child support, trustee fees, bankruptcy attorney fees, court fines, employee wage debt.

Under the priority system, certain unsecured creditors are entitled to full payment before other unsecured creditors receive anything at all. Whether a creditor filed a proof of claim form within the deadline also influences the order of payment.

An unsecured creditor with a nonpriority claim must be paid at least as much as the creditor would have received had the debtor filed under Chapter 7, and the payments need not be in cash. Nonpriority claims may be paid in cash, property, or securities of the debtor or the successor to the debtor under the plan.