Idaho Real Property - Schedule A - Form 6A - Post 2005

Description

How to fill out Real Property - Schedule A - Form 6A - Post 2005?

Have you been in a place the place you need papers for possibly company or specific uses nearly every day time? There are a variety of legal papers themes available on the net, but getting kinds you can trust isn`t easy. US Legal Forms offers thousands of type themes, such as the Idaho Real Property - Schedule A - Form 6A - Post 2005, that are composed to fulfill state and federal needs.

When you are currently knowledgeable about US Legal Forms website and possess your account, just log in. Afterward, it is possible to down load the Idaho Real Property - Schedule A - Form 6A - Post 2005 template.

Should you not have an bank account and need to begin using US Legal Forms, follow these steps:

- Obtain the type you need and ensure it is for that correct area/state.

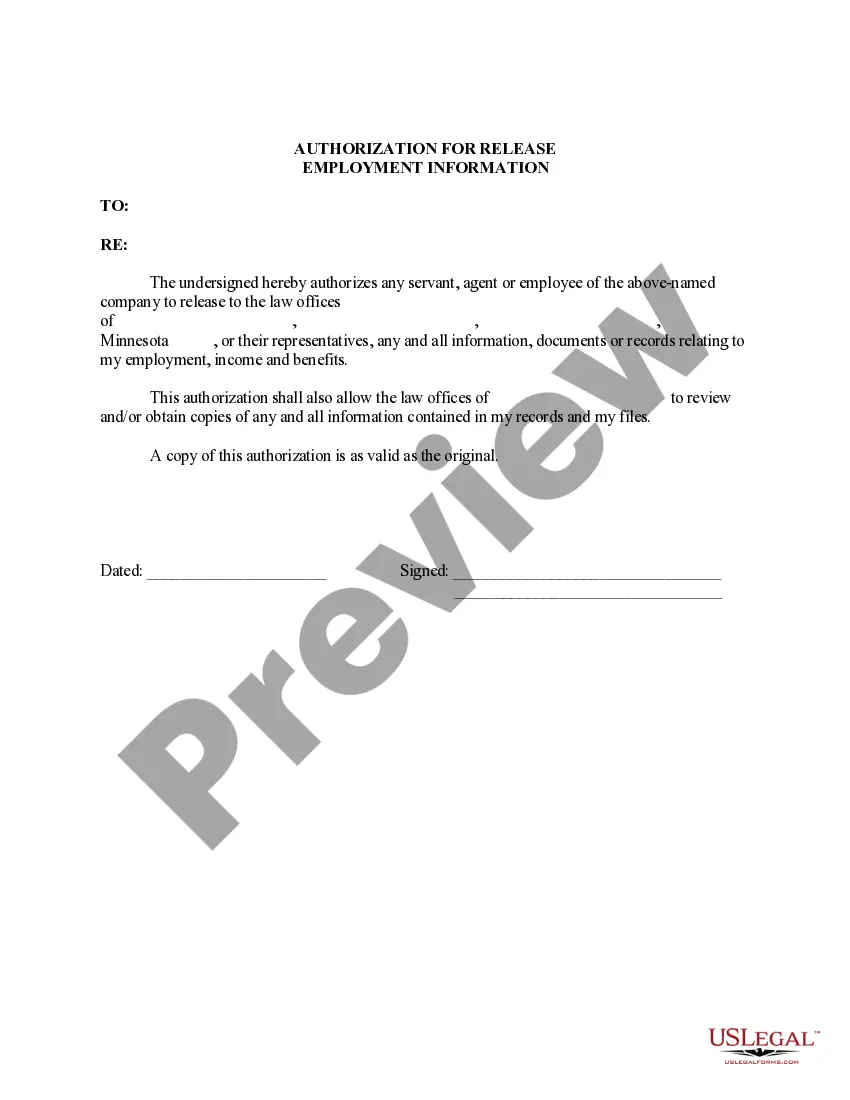

- Use the Review switch to analyze the form.

- Look at the explanation to actually have selected the correct type.

- When the type isn`t what you are searching for, use the Look for discipline to discover the type that fits your needs and needs.

- When you obtain the correct type, click Purchase now.

- Pick the pricing strategy you would like, fill in the required information and facts to create your account, and pay for the order utilizing your PayPal or bank card.

- Select a handy document formatting and down load your version.

Get each of the papers themes you might have purchased in the My Forms food list. You can aquire a further version of Idaho Real Property - Schedule A - Form 6A - Post 2005 whenever, if possible. Just click on the required type to down load or print the papers template.

Use US Legal Forms, the most comprehensive collection of legal types, to conserve some time and prevent errors. The services offers skillfully manufactured legal papers themes that you can use for a variety of uses. Make your account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

When selling a primary residence property, capital gains from the sale can be deducted from the seller's owed taxes if the seller has lived in the property themselves for at least 2 of the previous 5 years leading up to the sale. That is the 2-out-of-5-years rule, in short.

The Basics of Section 121 Exclusions Likewise, people who sell secondary residences such as vacation homes can't use the exclusion. It's also generally not available to people who frequently buy and sell primary homes. Further, property used in a trade or business can't benefit from the exclusion either.

Exceptions to the Two-in-Five-Year Rule You were separated or divorced during the time you owned your home. Your spouse died during the time you owned your home. The sale of your home involved vacant land. You sold your right to a remainder interest (the right to own a home in the future)

In order to qualify for the principal residency exclusion, an owner must pass both ownership and usage tests. The two-out-of-five-year rule states that an owner must have owned the property that is being sold for at least two years (24 months) in the five years prior to the sale.

For example, a death in the family, losing your job and qualifying for unemployment, not being able to afford the house anymore because of a change in employment or marital status, a natural disaster that destroys your house, or you or your spouse have twins or another multiple birth.

Taxpayers who don't qualify to exclude all of the taxable gain from their income must report the gain from the sale of their home when they file their tax return. Anyone who chooses not to claim the exclusion must report the taxable gain on their tax return.

Capital gains taxes will be paid at the standard rate if you sell before the two-year mark because you won't receive any exemption. To avoid the taxes on a sale of a home, you must use the property as your primary residence for a minimum of two years. Doing so will ensure you avoid any capital gains penalties.

Proving it should be a straightforward matter, however. A voter registration card or driver's license, a series of tax returns mailed to you at that address, or utility bills directed to you all indicate your principal residence. Internal Revenue Service. ?Publication 523: Selling Your Home,? Page 3.