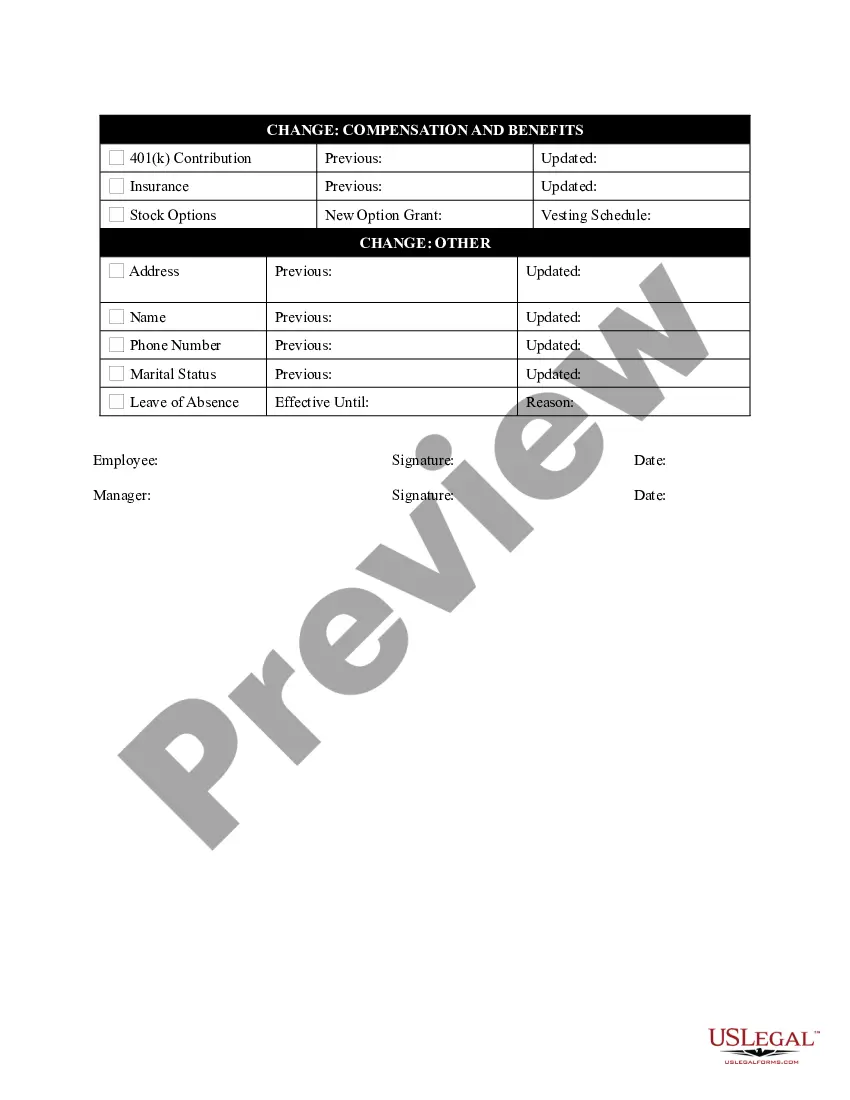

Idaho Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

If you desire to access, obtain, or print legal document templates, utilize US Legal Forms, the most significant collection of legal documents available online.

Employ the site's straightforward and user-friendly search feature to find the documents you require.

Numerous templates for both business and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Idaho Personnel Status Change Worksheet with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Idaho Personnel Status Change Worksheet.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to verify the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal document format.

Form popularity

FAQ

As an employer, you're responsible for paying SUI (remember, if you pay your state SUI in full and on time, you get a 90% tax credit on FUTA). Idaho's SUI rates range from 0.24% to 5.4%. The taxable wage base in 2022 is $46,500 for each employee. New employers pay 0.97% for at least the first six quarters.

You don't have to withhold Idaho income tax in any of the following situations: The employee isn't a resident of Idaho and earns less than $1,000 in Idaho in a calendar year. You employ an agricultural laborer who earns less than $1,000 in a calendar year.

All retail sales in Idaho are taxable unless specifically exempted by Idaho or federal law. A sale is exempt from sales and use tax only if Idaho law specifically allows an exemption.

Form 967. Send Form 967 to us once a year. On it, you report the taxable wages and reconcile the total amount of Idaho taxes you withheld during the calendar year to the amount you paid us during the same year.

Claim allowances for you or your spouse.If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances. If you work for more than one employer at the same time, you should claim zero allowances on your W-4 with any employer other than your principal employer.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

Form 910. Monthly filers: You must file Form 910 monthly if you're in one of these situations: You withhold less than $25,000 a month and more than $750 a quarter. You have only one monthly pay period.

Claim allowances for you or your spouse.If you're married, claim your allowances on the W-4 for the highest-paying job for the most accurate withholding. If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances.

Form 967. Send Form 967 to us once a year. On it, you report the taxable wages and reconcile the total amount of Idaho taxes you withheld during the calendar year to the amount you paid us during the same year.