Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

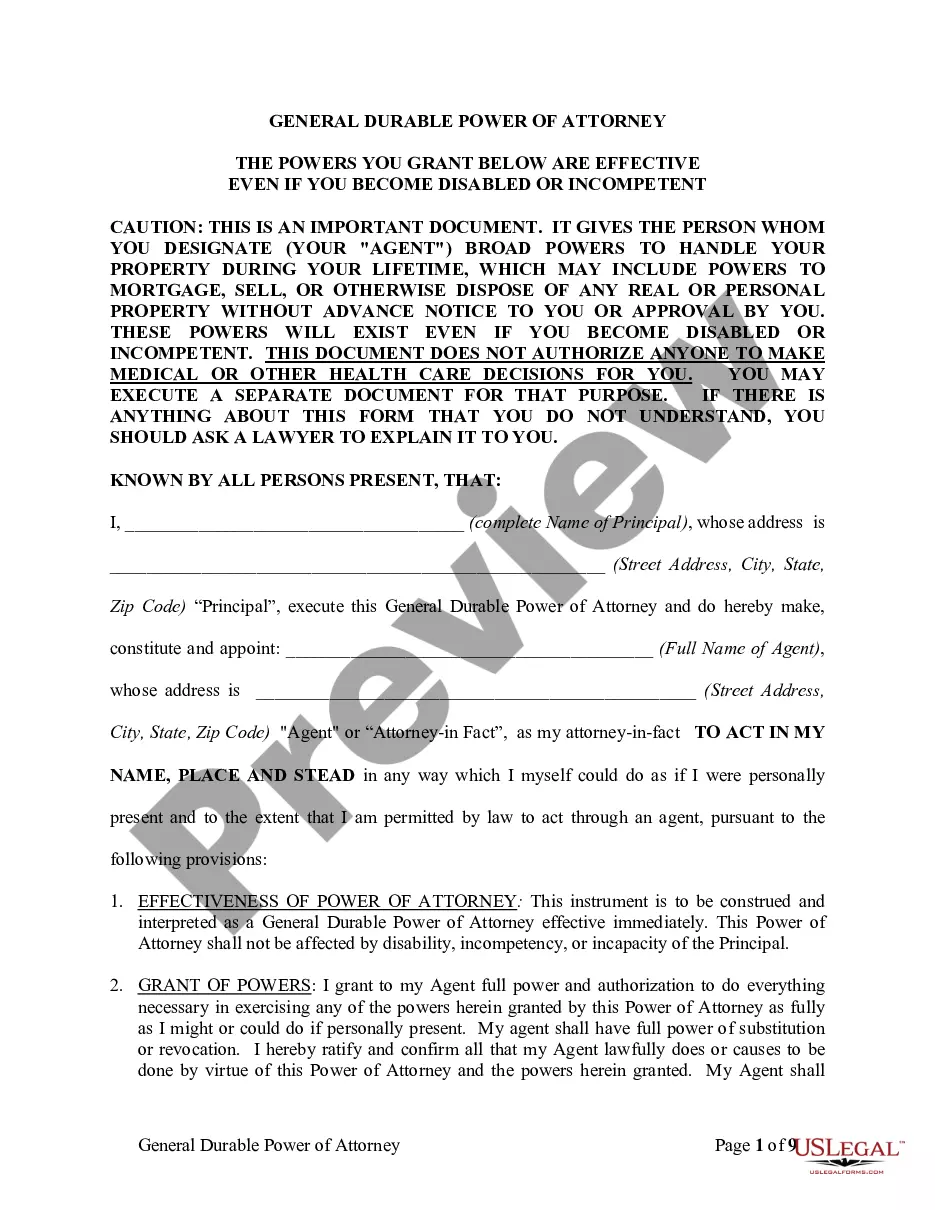

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

If you have to complete, obtain, or printing legitimate papers layouts, use US Legal Forms, the biggest selection of legitimate types, that can be found online. Make use of the site`s simple and practical search to discover the papers you will need. A variety of layouts for organization and personal uses are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to discover the Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with a number of mouse clicks.

In case you are already a US Legal Forms buyer, log in for your bank account and click on the Down load button to obtain the Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. You can even gain access to types you earlier acquired inside the My Forms tab of the bank account.

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for the correct metropolis/land.

- Step 2. Take advantage of the Preview option to look over the form`s information. Do not overlook to learn the outline.

- Step 3. In case you are unhappy using the develop, make use of the Search field near the top of the monitor to discover other versions of the legitimate develop format.

- Step 4. Once you have discovered the shape you will need, click the Acquire now button. Opt for the prices program you favor and add your accreditations to sign up to have an bank account.

- Step 5. Method the purchase. You can utilize your credit card or PayPal bank account to perform the purchase.

- Step 6. Pick the file format of the legitimate develop and obtain it on your device.

- Step 7. Total, edit and printing or signal the Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Each legitimate papers format you purchase is yours forever. You may have acces to every develop you acquired with your acccount. Select the My Forms segment and decide on a develop to printing or obtain once again.

Contend and obtain, and printing the Idaho Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms. There are thousands of professional and status-specific types you can use for your personal organization or personal requirements.

Form popularity

FAQ

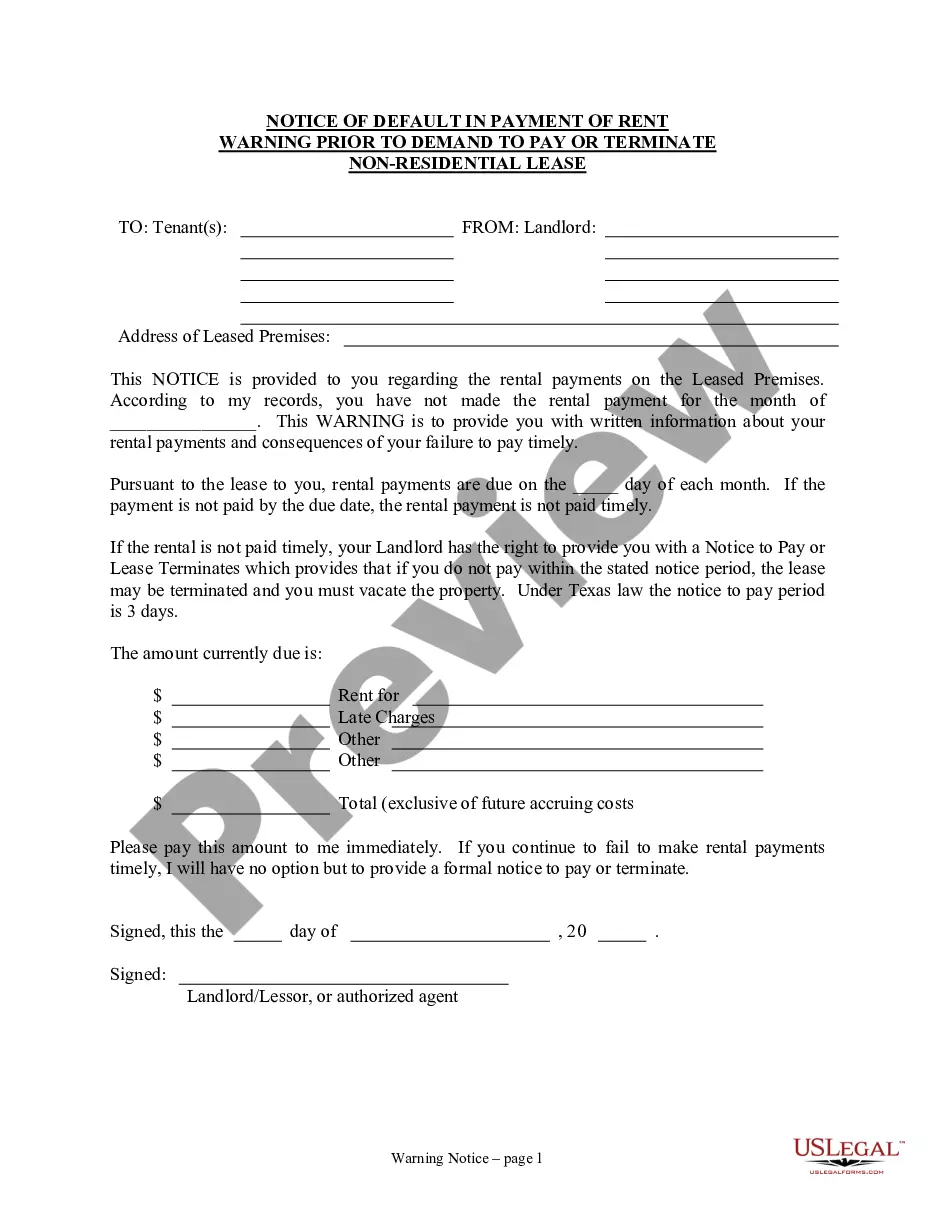

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments.

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure.

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.

A SLAT is an irrevocable trust used to transfer money and property out of the trustmaker spouse's estate into a trust for the other spouse's benefit. Using a SLAT, the trustmaker spouse can take advantage of their lifetime gift and estate tax exclusion amounts by making sizable, permanent gifts to the SLAT.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

TESTAMENTARY TRUST These trusts can have many names including: Bypass Trust, Family Trust, Children's Trust, Residuary Trust or QTIP (Second Marriage Trust). Testamentary Trusts are typically created to provide support for surviving spouses, children or family groups.