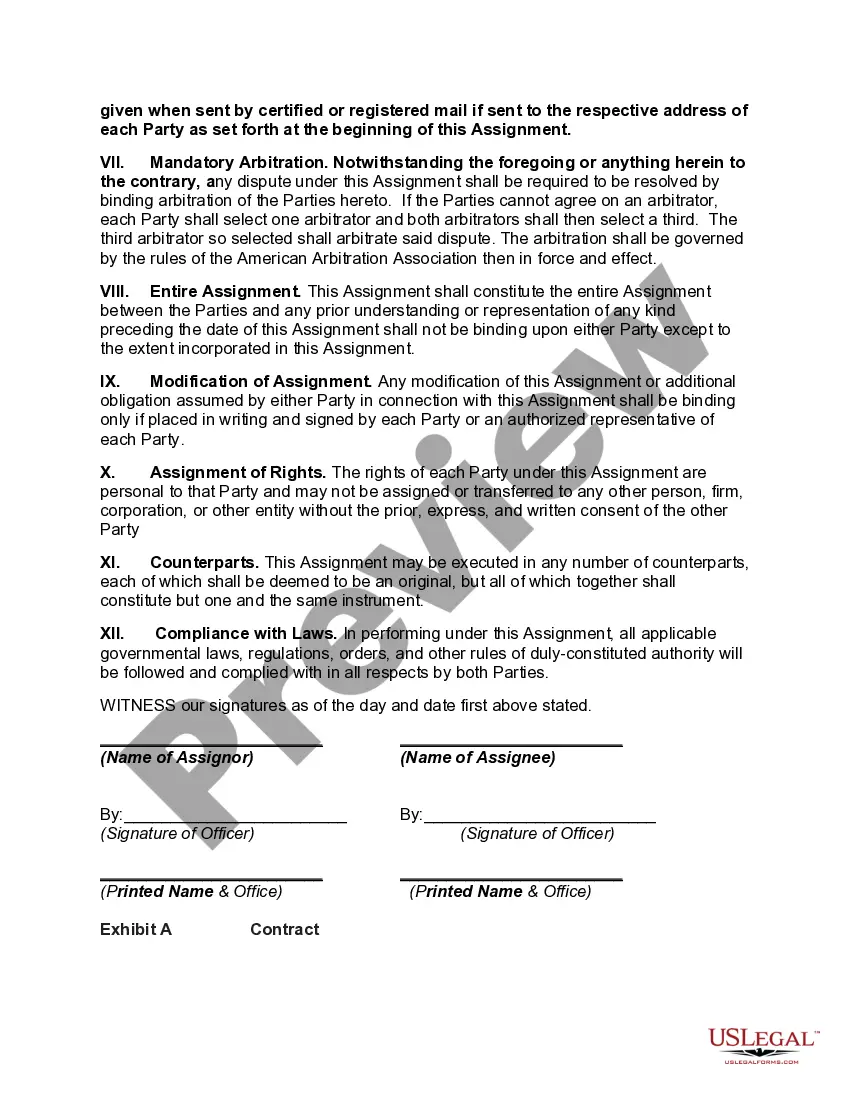

Idaho Assignment of Money Due or to Become Due under Contract

Description

How to fill out Assignment Of Money Due Or To Become Due Under Contract?

You are able to invest time on-line looking for the authorized document design that suits the state and federal demands you will need. US Legal Forms provides a large number of authorized types which are evaluated by specialists. You can actually down load or print out the Idaho Assignment of Money Due or to Become Due under Contract from the service.

If you already possess a US Legal Forms bank account, you are able to log in and then click the Obtain switch. Following that, you are able to total, revise, print out, or indication the Idaho Assignment of Money Due or to Become Due under Contract. Each authorized document design you purchase is your own property permanently. To obtain yet another copy of the acquired type, proceed to the My Forms tab and then click the related switch.

Should you use the US Legal Forms site the very first time, follow the basic directions listed below:

- First, ensure that you have selected the proper document design for that region/metropolis of your choosing. Browse the type description to make sure you have chosen the correct type. If available, utilize the Preview switch to appear from the document design as well.

- If you would like discover yet another model of the type, utilize the Search discipline to find the design that meets your needs and demands.

- When you have located the design you need, click on Acquire now to proceed.

- Select the pricing strategy you need, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your credit card or PayPal bank account to fund the authorized type.

- Select the formatting of the document and down load it in your system.

- Make alterations in your document if necessary. You are able to total, revise and indication and print out Idaho Assignment of Money Due or to Become Due under Contract.

Obtain and print out a large number of document templates making use of the US Legal Forms website, which offers the largest assortment of authorized types. Use specialist and express-certain templates to tackle your business or person demands.

Form popularity

FAQ

Search Idaho Statutes 67-2602. ADMINISTRATOR OF THE DIVISION OF OCCUPATIONAL AND PROFESSIONAL LICENSES. The division of occupational and professional licenses shall be headed by an administrator appointed by the governor and who shall serve at the pleasure of the governor.

(1) A creditor may not take an assignment of earnings of the debtor for payment or as security for payment of a debt arising out of a regulated consumer credit transaction. An assignment of earnings in violation of this section is unenforceable by the assignee of the earnings and revocable by the debtor.

28-2-725. Statute of limitations in contracts for sale. (1) An action for breach of any contract for sale must be commenced within four (4) years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one (1) year but may not extend it.

(1) It is the policy of this state that all bills owed by the state of Idaho or any taxing district within the state shall be paid promptly. No state agency or taxing district supported in whole or in part by tax revenues shall be exempt from the provisions of this section, except as provided in subsection (20).

Idaho's prompt payment laws only regulate payments from the public entity to the prime contractor. Once the prime has submitted a proper payment request, the public entity must accept, certify, and pay within 60 calendar days of receipt. However, this deadline may be modified by the contract between the parties.

It is the purpose of this act to permit the state and public agencies to make the most efficient use of their powers by enabling them to cooperate to their mutual advantage and thereby provide services and facilities and perform functions in a manner that will best with geographic, economic, population, and ...

(1) Notwithstanding any other provision of law to the contrary, it shall be the policy of this state that all public agencies and political subdivisions of the state of Idaho and their agents shall make selections for professional engineering, architectural, landscape architecture, construction management, and ...