Idaho Agreement Replacing Joint Interest with Annuity

Description

How to fill out Agreement Replacing Joint Interest With Annuity?

If you want to finalize, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and convenient search to find the documents you need.

Numerous templates for commercial and personal purposes are categorized by groups and sections, or keywords.

Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the Idaho Agreement Replacing Joint Interest with Annuity in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click on the Acquire button to locate the Idaho Agreement Replacing Joint Interest with Annuity.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

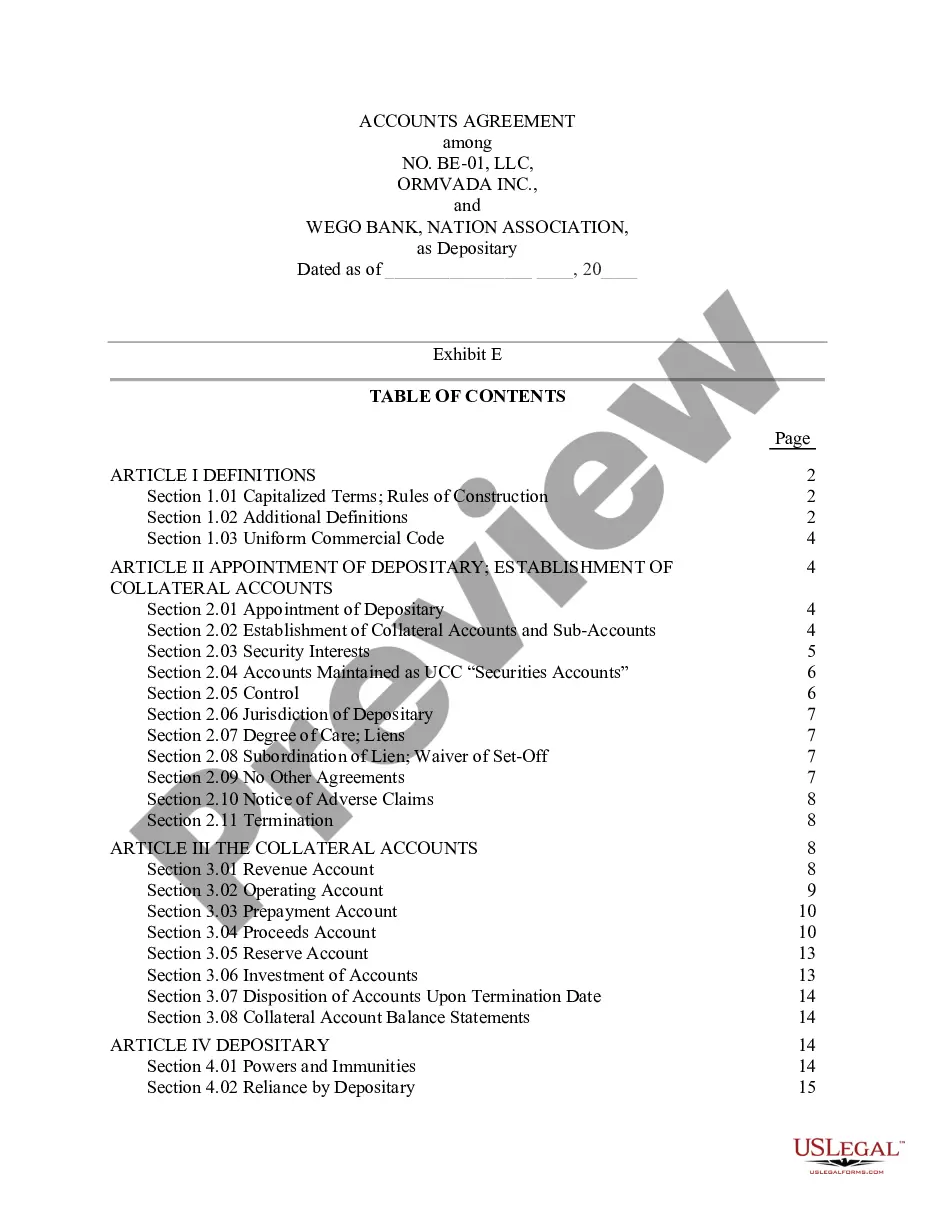

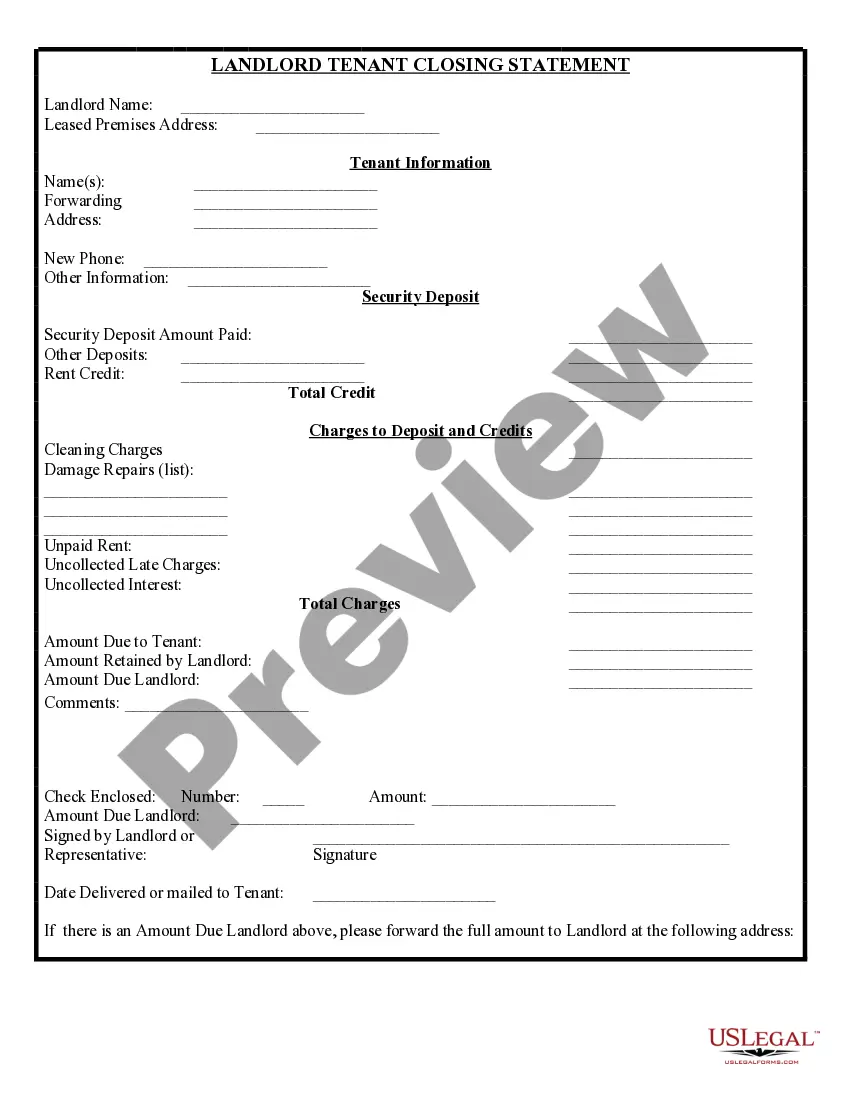

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative types of the legal document template.

Form popularity

FAQ

Requesting Annuitization You can elect to have the annuity payments start at any time from 30 days to one year in the future. Follow up the paperwork with a call to the insurance company or your agent to make sure the annuity payment will start as requested.

Definition: Replacement is any transaction where, in connection with the purchase of New Insurance or a New Annuity, you lapse, surrender, convert to Paid-up Insurance, Place on Extended Term, or borrow all or part of the policy loan values on an existing insurance policy or an annuity.

A typical variable annuity offers three basic features not commonly found in mutual funds: tax-deferred treatment of earnings; a death benefit; and. annuity payout options that can provide guaranteed income for life.

A single payment is allowed to earn interest for a specified duration. There are no annuity payments during this period of time, which is commonly referred to as the period of deferral.

An index annuity, also known as a fixed index annuity or an indexed annuity, pays a fixed rate of return based on a specific financial market's performance. Where a fixed annuity offers one guaranteed rate, an indexed annuity offers investors the potential to participate in some of the upsides of the stock market.

If a deferred annuity is surrendered prior to annuitization, the surrender value of the annuity is guaranteed according to the nonforfeiture provision. it is a period during which the payments into the annuity grow tax deferred.

Why is an equity indexed annuity considered to be a fixed annuity? It has a guaranteed minimum interest rate.

Equity indexed annuities (also referred to as fixed indexed annuities) are considered to be a type of fixed annuity because they have a guaranteed rate of return that cannot change or decrease during the lifetime of your plan.

If money is withdrawn from an annuity prior to the term of the contract, the insurance company usually assesses a surrender charge for early withdrawal. The Internal Revenue Service (IRS) may also assess a premature penalty of 10% and income tax on the withdrawn funds.

A surrender charge is a fee charged by insurance companies that you must pay if you sell or withdraw money from an annuity early. Surrendering your annuity will trigger the income tax that has been deferred up until that point.