Idaho Software Maintenance Agreement

Description

How to fill out Software Maintenance Agreement?

You can spend several hours online trying to locate the proper document template that fulfills the federal and state requirements you seek.

US Legal Forms offers an extensive collection of legal forms that are reviewed by experts.

You can easily obtain or print the Idaho Software Maintenance Agreement from their service.

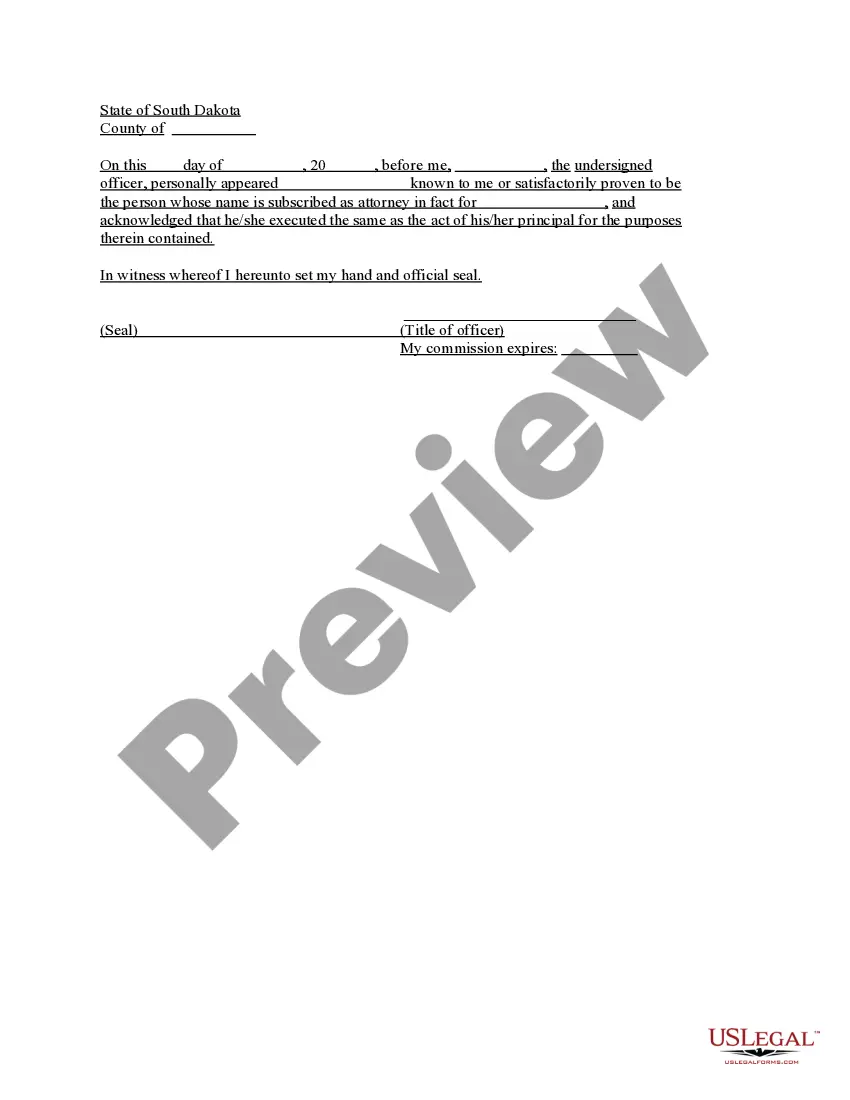

If available, use the Preview button to review the document template as well. If you wish to find another version of the form, use the Lookup field to locate the template that meets your needs and preferences.

- If you already have a US Legal Forms account, you may sign in and click the Download button.

- After that, you can complete, edit, print, or sign the Idaho Software Maintenance Agreement.

- Every legal document template you acquire belongs to you indefinitely.

- To obtain an additional copy of the purchased document, go to the My documents section and click the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the right document template for the county/city you choose.

- Check the document description to confirm you've picked the correct form.

Form popularity

FAQ

Idaho generally does not require sales tax on Software-as-a-Service.

Several examples of exemptions are prescription drugs, some groceries, truck campers, office trailers, and transport trailers. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

A software maintenance agreement, or SMA, is a legal contract that obligates the software vendor to provide technical support and updates for an existing software product for their customers. It may also extend the expiration date of certain features, such as new releases or upgrades.

Idaho generally does not require sales tax on Software-as-a-Service.

Sales of parts purchased for use in performing service under optional maintenance contracts are subject to sales tax in Idaho.

Maintenance agreements provide routine maintenance, access to emergency repairs, and constant upgrades to software and your system's hardware. More importantly, the agreement make you a priority and allows you to build a relationship with your maintenance provider.

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.

A service maintenance contract is a legal agreement between a company and a maintenance service provider. It specifies the terms and conditions of the agreement between the two parties.

Services in Idaho are generally not taxable. However if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Idaho, with a few exceptions such as prescription drugs.

Software maintenance as a product does NOT include the creation, design, implementation, integration, etc. of a software package. These examples are considered software maintenance as a service.