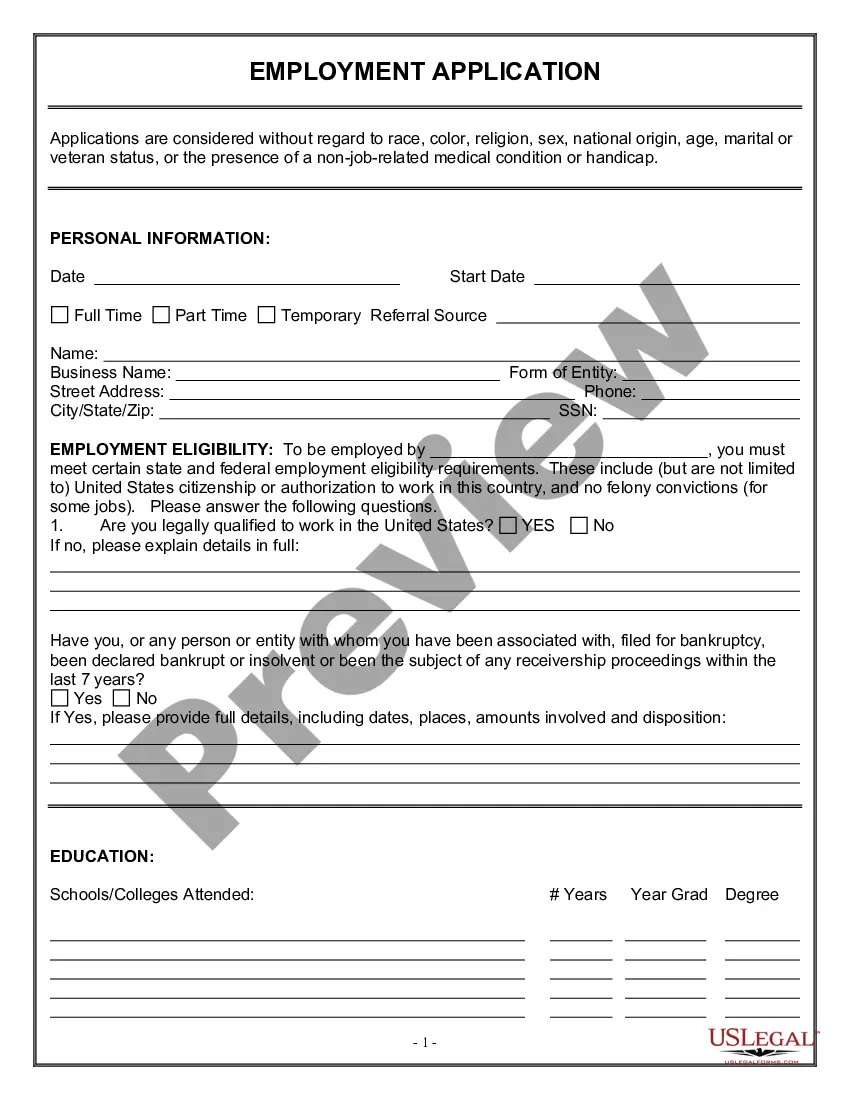

Idaho Application for Military Leave Bank

Description

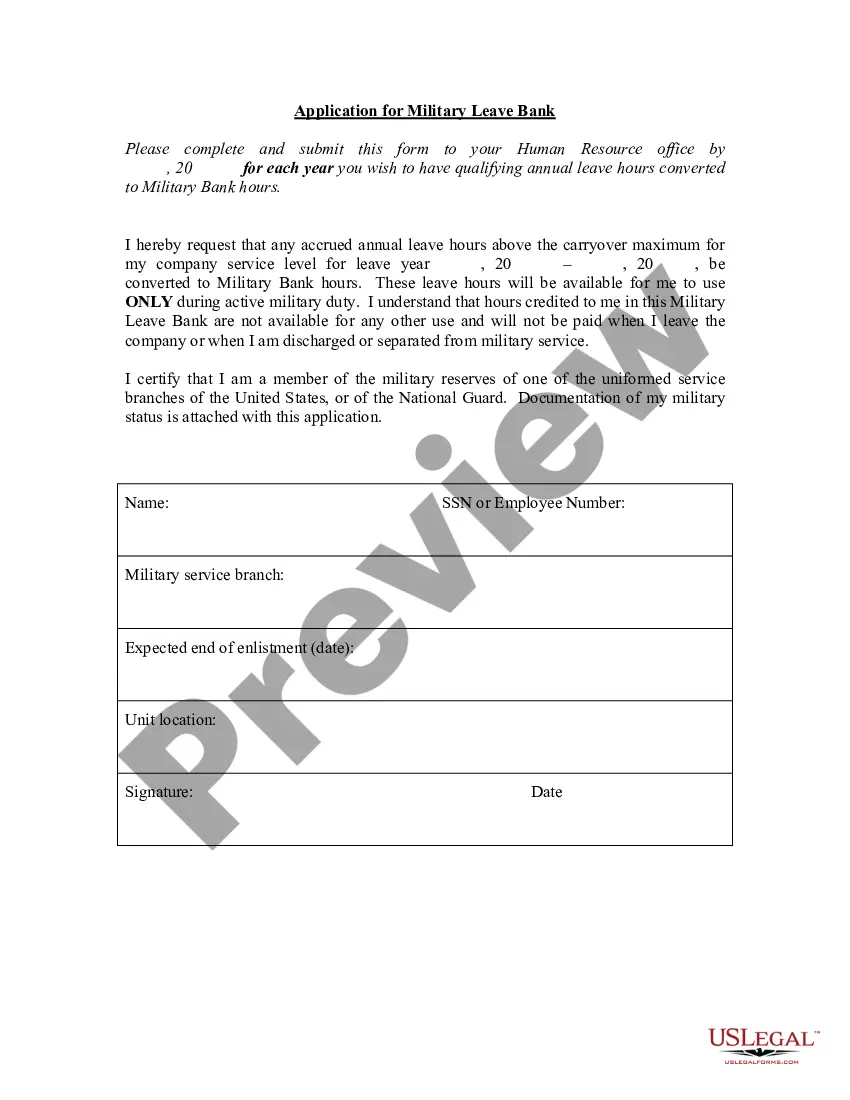

How to fill out Application For Military Leave Bank?

Locating the correct legal document format can be challenging. Undoubtedly, there are numerous templates available online, but how can you pinpoint the specific legal form you need? Visit the US Legal Forms website. This platform provides a vast selection of templates, including the Idaho Application for Military Leave Bank, which can be utilized for both business and personal needs. All the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to locate the Idaho Application for Military Leave Bank. Use your account to browse through the legal documents you have previously acquired. Navigate to the My documents section of your account to retrieve another copy of the document you need.

If you are a first-time user of US Legal Forms, here are simple steps for you to follow: First, ensure that you have selected the appropriate form for your locality. You can review the form using the Review button and read the form description to confirm it is suitable for your needs. If the form does not satisfy your requirements, utilize the Search box to find the correct document. Once you are confident the form is suitable, click the Buy Now button to access the form. Choose the payment plan you prefer and input the required details. Create your account and pay for your order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document to your device. Complete, modify, and print and sign the obtained Idaho Application for Military Leave Bank.

US Legal Forms is the premier repository of legal documents where you can find a multitude of document templates. Leverage the service to download professionally crafted paperwork that meets state regulations.

- Identify the right legal file format.

- Browse various themes available online.

- Use US Legal Forms website for collection.

- Access previous templates throughMy documents.

- Follow simple guidelines for new users.

- Choose payment and download the file.

Form popularity

FAQ

If you are a resident of Idaho, stationed in Idaho on active duty: Then all of your income is taxable to Idaho including the active duty military pay and all additional income regardless of where it was earned. You are required to file an Idaho income tax return if Idaho is your home of record.

The following states have no state income tax and, therefore, do not tax military retirement pay: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

If you are a resident of Idaho, stationed in Idaho on active duty: Then all of your income is taxable to Idaho including the active duty military pay and all additional income regardless of where it was earned. You are required to file an Idaho income tax return if Idaho is your home of record.

Idaho Veterans Employment BenefitsIdaho state employment gives preference points for active duty veterans. Honorably discharged veterans get 5 preference points, disabled veterans get 10 preference points. Surviving spouses who have not remarried can get the same points as the veteran.

To request a temporary or extended military leave of absence, the employee should generally obtain a request for leave of absence form from HR. Written notice is preferred, but not required under the law or this policy.

Idaho doesn't charge its state income tax on military retirement pay for those age 65 or older, but it does tax pension benefits for military retirees who are younger than 65.

Income tax rates range from 1% to 6.5% on Idaho taxable income. Individual income tax is graduated. This means that Idaho taxes higher earnings at a higher rate.

Active-duty service members file state income taxes in their state of legal residence. Military service members are not required to change their legal residence when they move to a new state solely because of military orders; they may maintain their legal residence in a state where they have previously established it.

Active-duty service members file state income taxes in their state of legal residence. Military service members are not required to change their legal residence when they move to a new state solely because of military orders; they may maintain their legal residence in a state where they have previously established it.

If your military home of record is a state other than Idaho, but you are stationed in Idaho, you are considered a "military nonresident." Your active duty military income is not subject to Idaho income tax. However, all other types of Idaho source income (for example, a part-time job) are subject to Idaho income tax.