Idaho Sixty Day New Hire Survey

Description

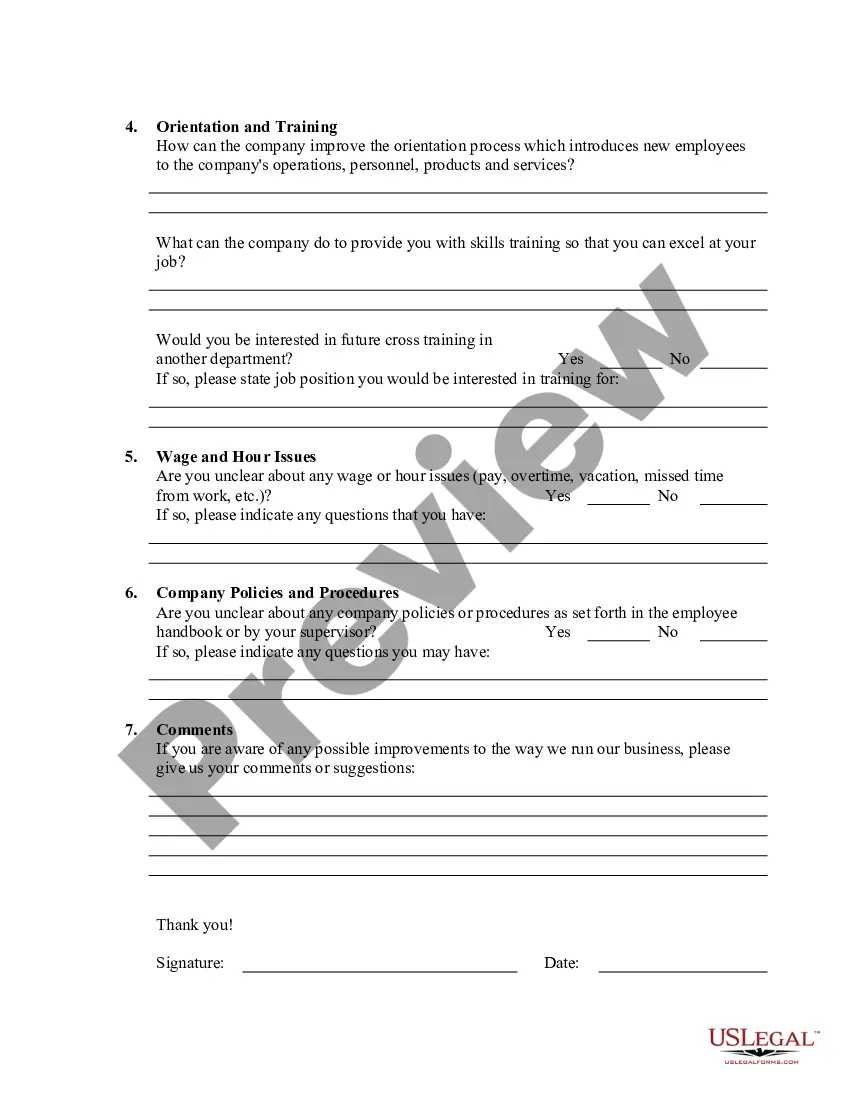

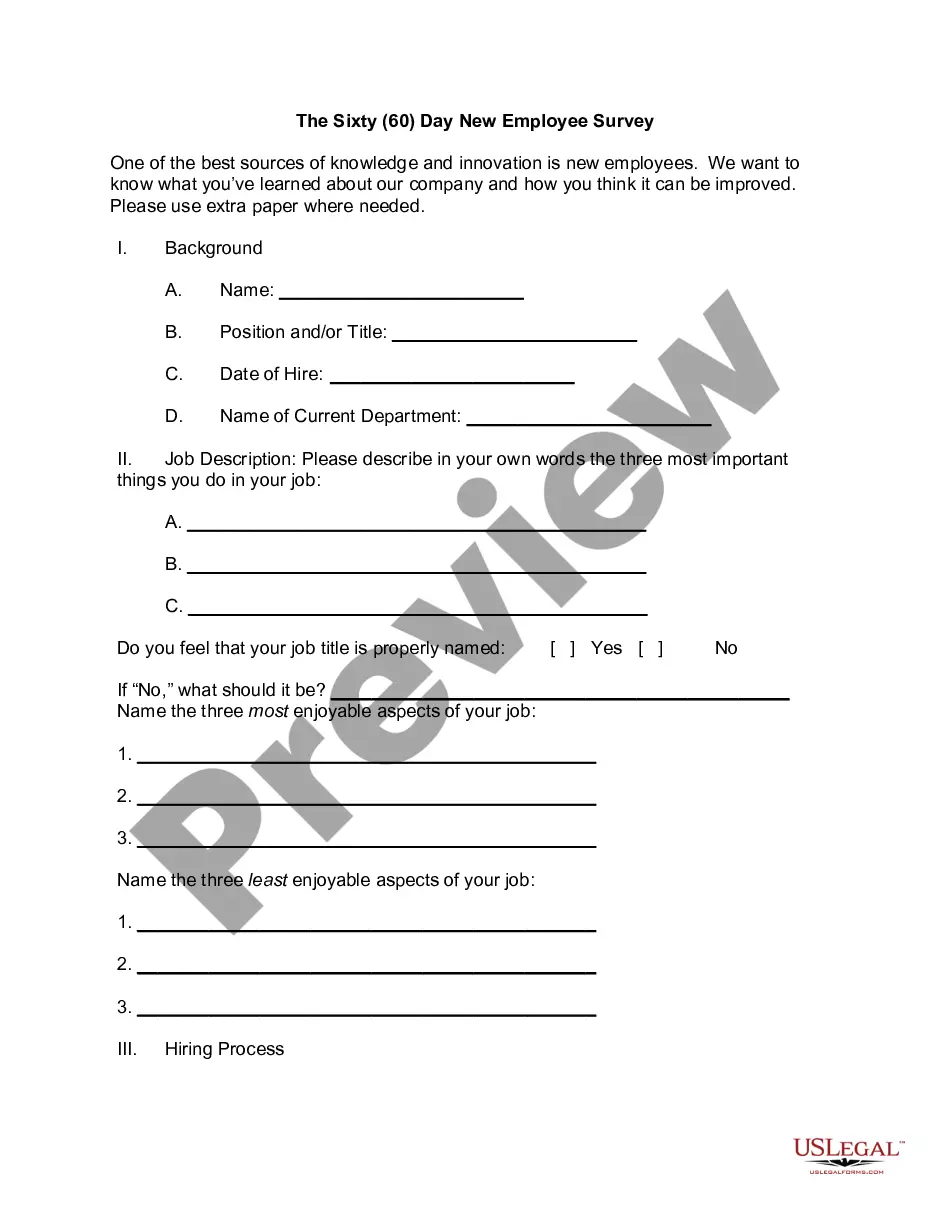

How to fill out Sixty Day New Hire Survey?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you will gain access to thousands of forms for business and personal needs, organized by categories, states, or keywords. You can obtain the most recent versions of forms like the Idaho Sixty Day New Hire Survey within moments.

If you possess a membership, Log In and download the Idaho Sixty Day New Hire Survey from the US Legal Forms library. The Download button will be available on every form you review. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use a Visa, Mastercard, or PayPal account to finalize the payment.

Select the file format and download the document onto your device. Edit it as needed. Fill out, modify, and print, and sign the saved Idaho Sixty Day New Hire Survey. Each template you added to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you require. Gain access to the Idaho Sixty Day New Hire Survey with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your personal or business needs and requirements.

- Ensure you have selected the appropriate form for your locality/region.

- Click on the Preview button to review the form's details.

- Check the form description to confirm that you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

Idaho's new hire reporting law requires all Idaho employers to report their new employees to the Idaho Department of Labor within 20 days of the date of hire, as well as rehired employees if their previous employment was terminated at least 60 days prior to their first day of employment.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

Setting Up Your New Employee: Fill out the required Form I-9. This is a two-part form to be filled out by employee and employer. For more information, read our help article, Form I-9 In a Nutshell.

Your employer can change or reduce your rate of pay at any time. The employer must notify you of any reduction in your pay rate prior to the work being performed. Absent an agreed upon rate of pay, employers are only required to pay the minimum wage.

Steps to Hiring your First Employee in IdahoStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Idaho is a "work at will" state. This means there is no set length for an employment relationship and either the employer or the employee may end it at any time, with or without notice; with or without cause.

If you are already receiving benefits, already have your card and you file your weekly claim on a Sunday before 7 p.m., your funds should be available by the following Wednesday at 8 a.m. local time.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.