Idaho Monthly Retirement Planning

Description

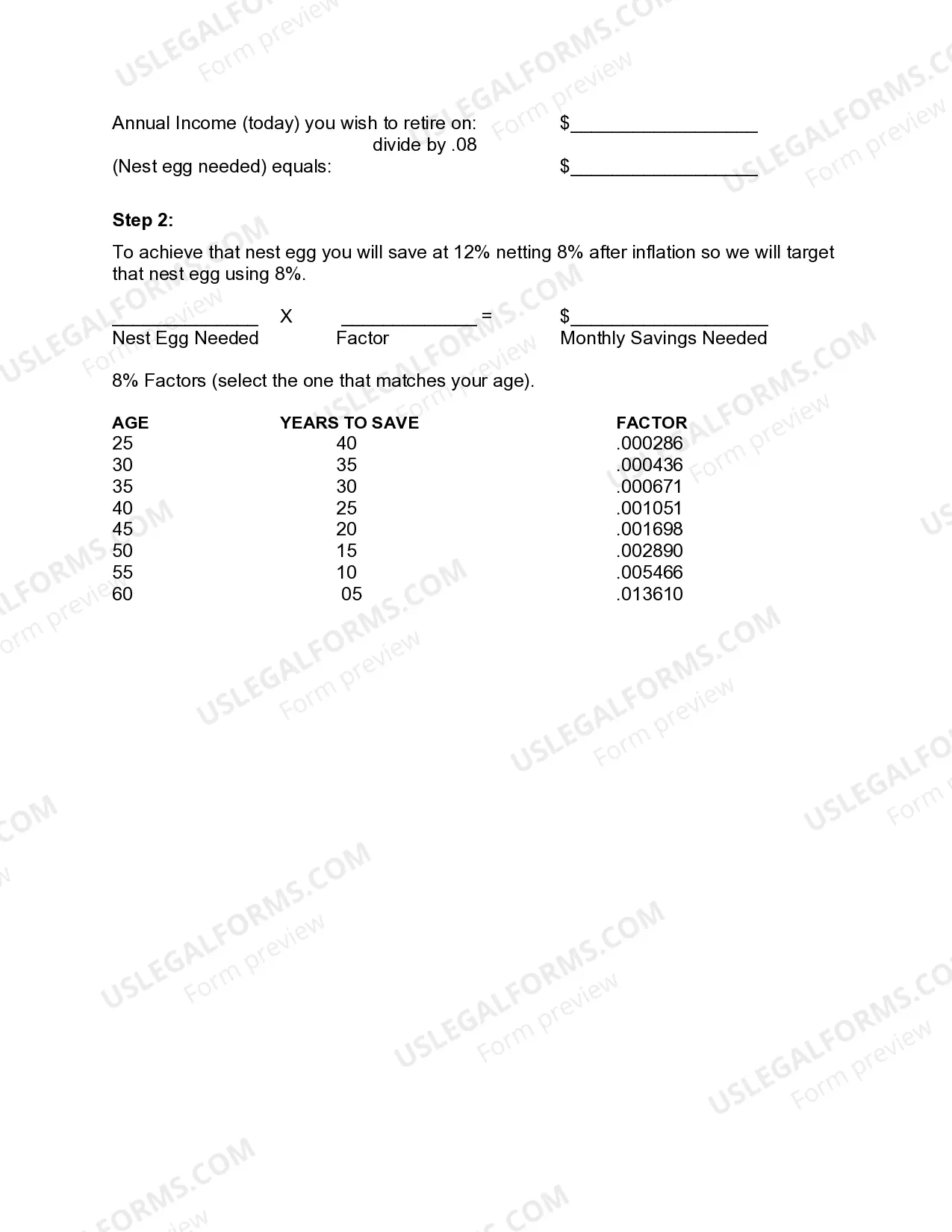

How to fill out Monthly Retirement Planning?

Are you situated in a location where you require documentation for either business or personal purposes nearly every day.

There are numerous valid form templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of document templates, such as the Idaho Monthly Retirement Planning, that are drafted to comply with federal and state regulations.

Once you find the appropriate form, click Get now.

Choose the payment plan you want, fill in the necessary information to create your account, and purchase an order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Idaho Monthly Retirement Planning template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/county.

- Utilize the Review feature to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form isn’t what you seek, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

With a $600,000 retirement portfolio, the income you can generate depends on your withdrawal strategy and investment returns. Generally, following the 4% rule, you could expect to withdraw about $24,000 per year. This estimate is crucial for Idaho Monthly Retirement Planning as it impacts your overall budgeting. USLegalForms offers insights to help calculate realistic retirement income expectations.

Yes, you can set up your own retirement plan by choosing from various options available to you, such as IRAs or solo 401(k) plans. This gives you control over your investment choices and contribution levels. However, it’s crucial to understand the rules and limits associated with your selected plan. US Legal Forms can provide the necessary resources and templates to facilitate your personal Idaho Monthly Retirement Planning efforts.

When you retire as a vested member, PERSI will pay you a benefit every month for as long as you live and, if you select a retirement option with a survivor benefit, your Contingent Annuitant will receive a lifetime bene- fit after your death.

Teachers may retire when they qualify for the "Rule of 90," meaning their age plus years of service equal 90, while other vested teachers may not retire until age 65.

Full formula - a method of calculating retirement benefits which multiplies three factors to compute a retirement benefit: Final average salary (generally, the member's highest three years) Years and months of creditable service, and.

Calculation Example Danny has 28 years of service as a police officer and he is age 50 years and 4 months. PERSI will determine his service credit in months: 28 years x 12 months = 336 months. PERSI will determine his age in months: 50 years x 12 months + 4 additional months for a total. of 604 months.

You become fully vested if you belong to PERSI as little as five years (60 months) which means you will receive a lifetime benefit at retirement.

PERSI is required by law to withhold federal taxes of 20% on withdrawal payments of tax-deferred contributions and interest unless you roll over your funds directly to another eligible retirement plan or IRA.

Although you would have exhausted everything you contributed, PERSI would continue to pay you $1,500 a month for the rest of your life, plus annual cost-of-living adjustments (COLAs) if ap- proved by the State Legislature.

When you leave PERSI-covered employment, you may withdraw your Base Plan money and any interest earned or you may choose to leave your contributions and interest in PERSI until a future date or until you retire. If you withdraw your funds, tax penalties and withholdings may apply.