Idaho Debt Adjustment Agreement with Creditor

Description

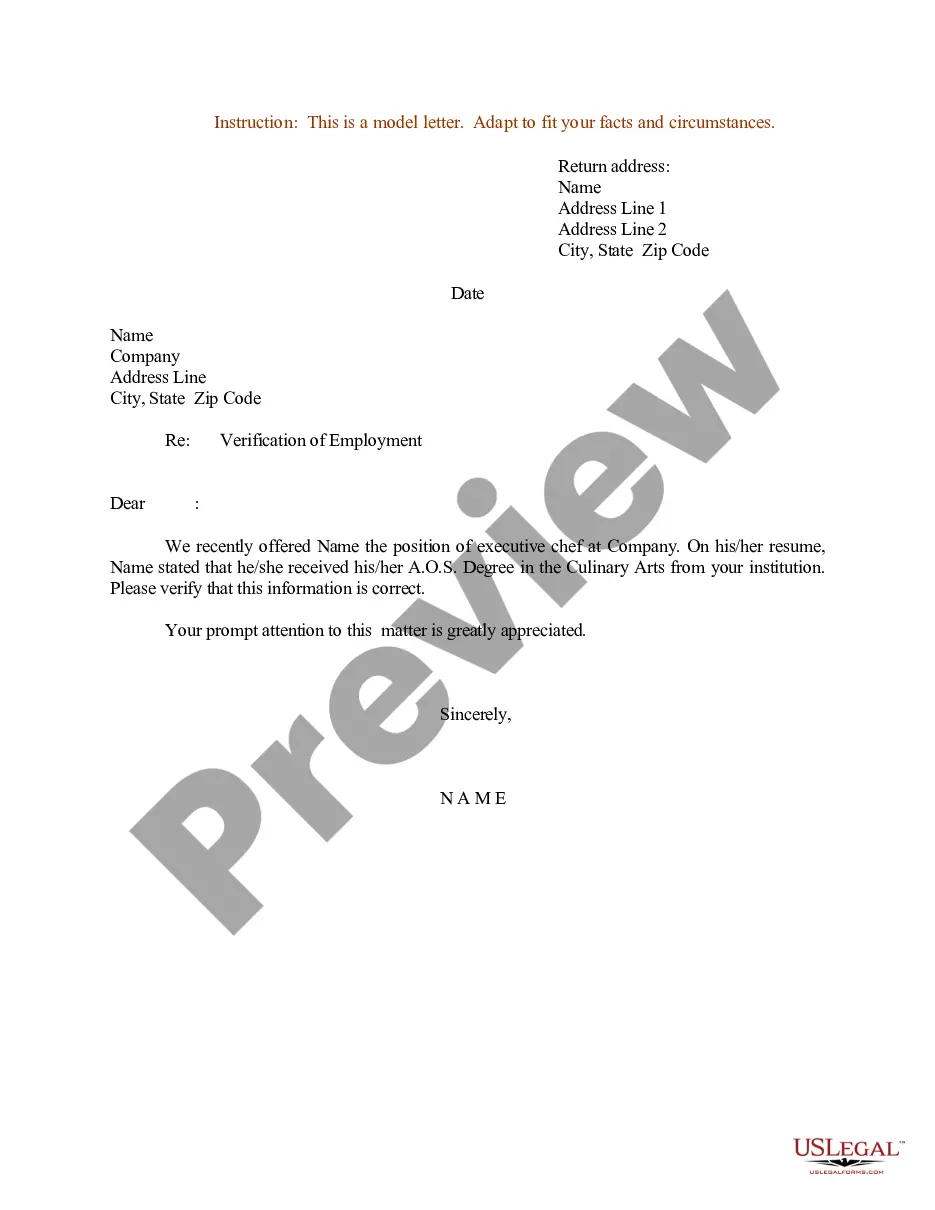

How to fill out Debt Adjustment Agreement With Creditor?

You may invest time online trying to locate the valid document template that meets your federal and state requirements.

US Legal Forms offers thousands of valid templates that are evaluated by professionals.

You can conveniently acquire or create the Idaho Debt Adjustment Agreement with Creditor through their services.

To find another version of the form, utilize the Search field to locate the template that suits your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, create, or sign the Idaho Debt Adjustment Agreement with Creditor.

- Every valid document template you receive is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city.

- Read the form information to confirm you have chosen the right template.

Form popularity

FAQ

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent.

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Occasionally, when a debt goes to collections you may be able to negotiate with the collector to accept a smaller amount than what you originally owed. An agent may decide it's worthwhile to accept partial payment now rather than go through a prolonged collection process.

Typically, the original creditor is most willing to negotiate when your balance has recently been sent to a collector. At that point, which is generally within six months, the creditor does not have many expenses in the file and can pull it back easily.