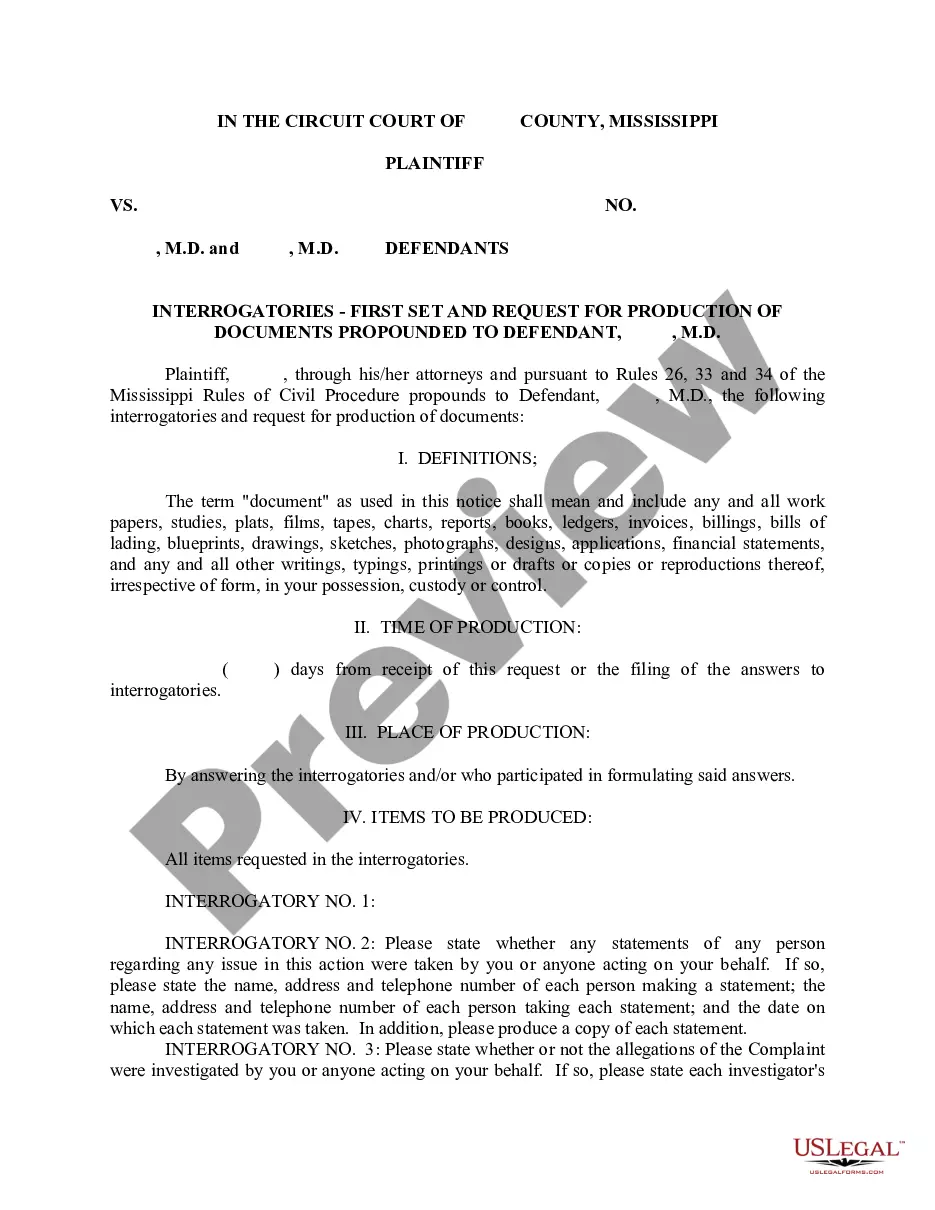

Idaho Sample Letter for Judicial Foreclosure

Description

How to fill out Sample Letter For Judicial Foreclosure?

US Legal Forms - one of the biggest libraries of authorized varieties in America - delivers an array of authorized papers web templates you are able to down load or produce. Using the web site, you can find thousands of varieties for business and personal reasons, sorted by types, suggests, or keywords and phrases.You will find the newest versions of varieties just like the Idaho Sample Letter for Judicial Foreclosure in seconds.

If you currently have a membership, log in and down load Idaho Sample Letter for Judicial Foreclosure from your US Legal Forms local library. The Obtain key will appear on each type you perspective. You get access to all in the past delivered electronically varieties from the My Forms tab of your respective account.

If you wish to use US Legal Forms initially, here are simple recommendations to obtain started:

- Be sure you have chosen the proper type to your town/region. Select the Review key to review the form`s content material. Look at the type explanation to actually have chosen the correct type.

- If the type doesn`t suit your needs, use the Search area at the top of the monitor to get the one that does.

- When you are pleased with the shape, affirm your choice by visiting the Get now key. Then, choose the costs strategy you want and give your references to register for an account.

- Procedure the purchase. Make use of your Visa or Mastercard or PayPal account to finish the purchase.

- Pick the format and down load the shape on your system.

- Make modifications. Fill out, change and produce and signal the delivered electronically Idaho Sample Letter for Judicial Foreclosure.

Each web template you included in your account lacks an expiry day and is yours permanently. So, if you wish to down load or produce yet another duplicate, just go to the My Forms section and click on the type you want.

Obtain access to the Idaho Sample Letter for Judicial Foreclosure with US Legal Forms, one of the most extensive local library of authorized papers web templates. Use thousands of specialist and state-certain web templates that fulfill your company or personal requires and needs.

Form popularity

FAQ

Idaho has judicial foreclosure, but has non-judicial foreclosure is the most common. A non-judicial foreclosure means that a ?Power of Sale? clause is in the deed of trust or the mortgage paperwork. This gives the lender the authority to sell the property if the borrower defaults on the loan.

Idaho has judicial foreclosure, but has non-judicial foreclosure is the most common. A non-judicial foreclosure means that a ?Power of Sale? clause is in the deed of trust or the mortgage paperwork. This gives the lender the authority to sell the property if the borrower defaults on the loan.

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

How Can I Stop a Foreclosure in Idaho? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

How Do I Avoid Foreclosure? You may be able to avoid foreclosure by making arrangements with your lender, such as getting forbearance or agreeing to a loan modification. Other options may include refinancing with a hard money loan or reverse mortgage.

Typically, the nonjudicial foreclosure sale process takes anywhere from 125 to 140 days. Notice of the date of sale must be given no less than 120 days after a notice of default has been recorded in the county record where the property is situated. Idaho Code § 45-1506.