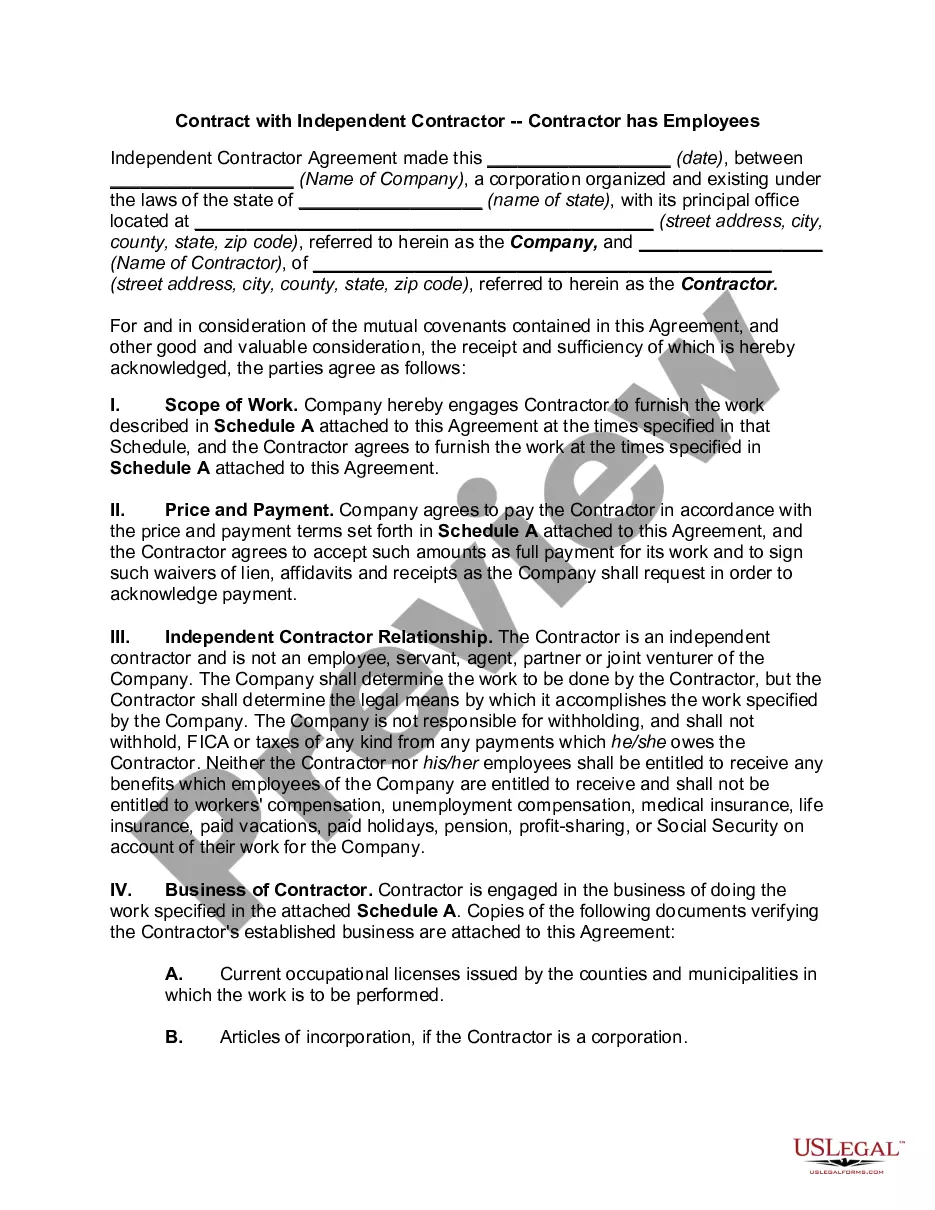

Idaho Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Contract With Independent Contractor - Contractor Has Employees?

Finding the appropriate valid document template can be quite challenging.

Certainly, there are numerous templates accessible online, but how can you locate the valid one you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct template for your specific city/county. You can preview the form using the Review button and check the form outline to confirm it is suitable for you.

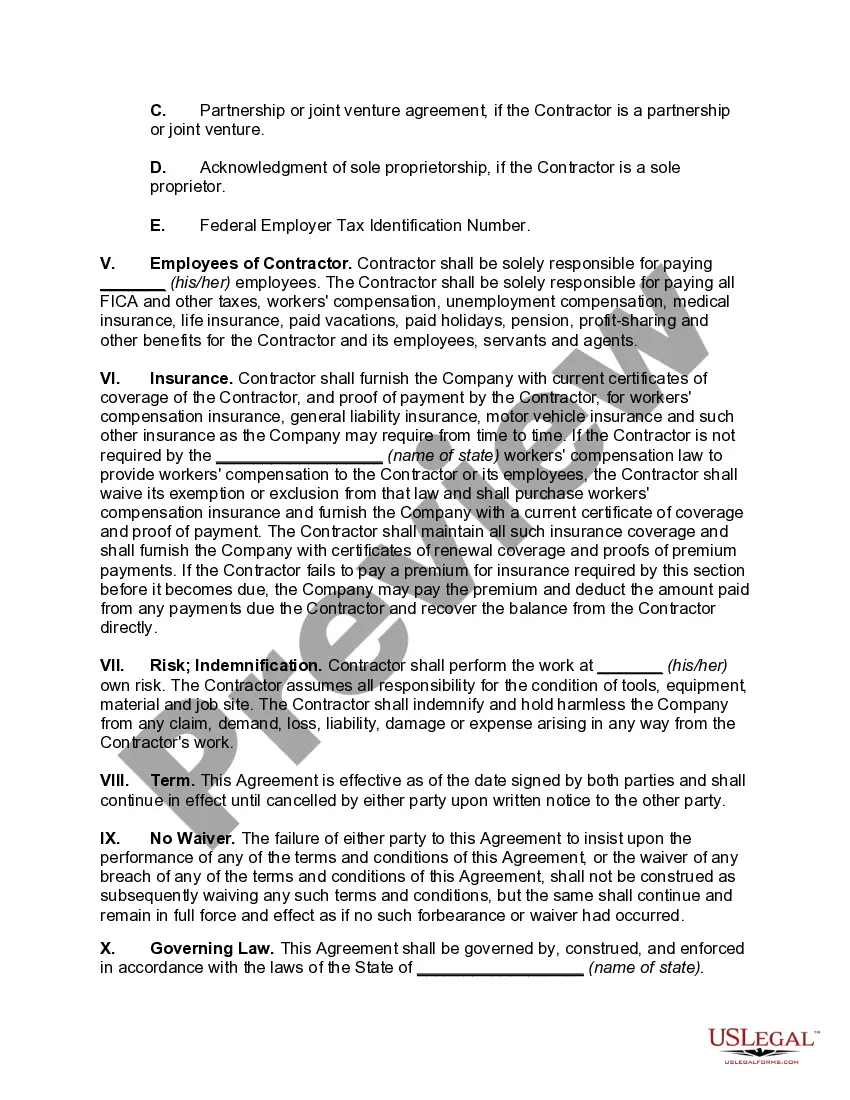

- The service offers thousands of templates, including the Idaho Contract with Independent Contractor - Contractor has Employees, which you can use for business and personal purposes.

- All forms are vetted by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to download the Idaho Contract with Independent Contractor - Contractor has Employees.

- Use your account to browse the valid forms you may have previously ordered.

- Navigate to the My documents section of your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

Wage & Hour LawIndependent contractors are not considered employees under the Fair Labor Standards Act and therefore are not covered by its wage and hour provisions. Generally, an independent contractor's wages are set pursuant to his or her contract with the employer.

A: Typically a worker cannot be both an employee and an independent contractor for the same company. An employer can certainly have some employees and some independent contractors for different roles, and an employee for one company can perform contract work for another company.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

All contractors are required by Idaho law to be registered with the Idaho Contractors Board, which is a division of the State of Idaho, Bureau of Occupational Licenses. You may not obtain building permits without a contractor registration number.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

The most common business organizations for Independent Contractors include C-corporation, S-Corporation, Partnership, Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Sole Proprietorship.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

There are several types of business bank accounts to consider for your independent contracting business. You can consider an account with a local bank as well as an online business bank account. You may prefer mobile banking if you don't need to go into a physical branch and don't need to deposit cash.