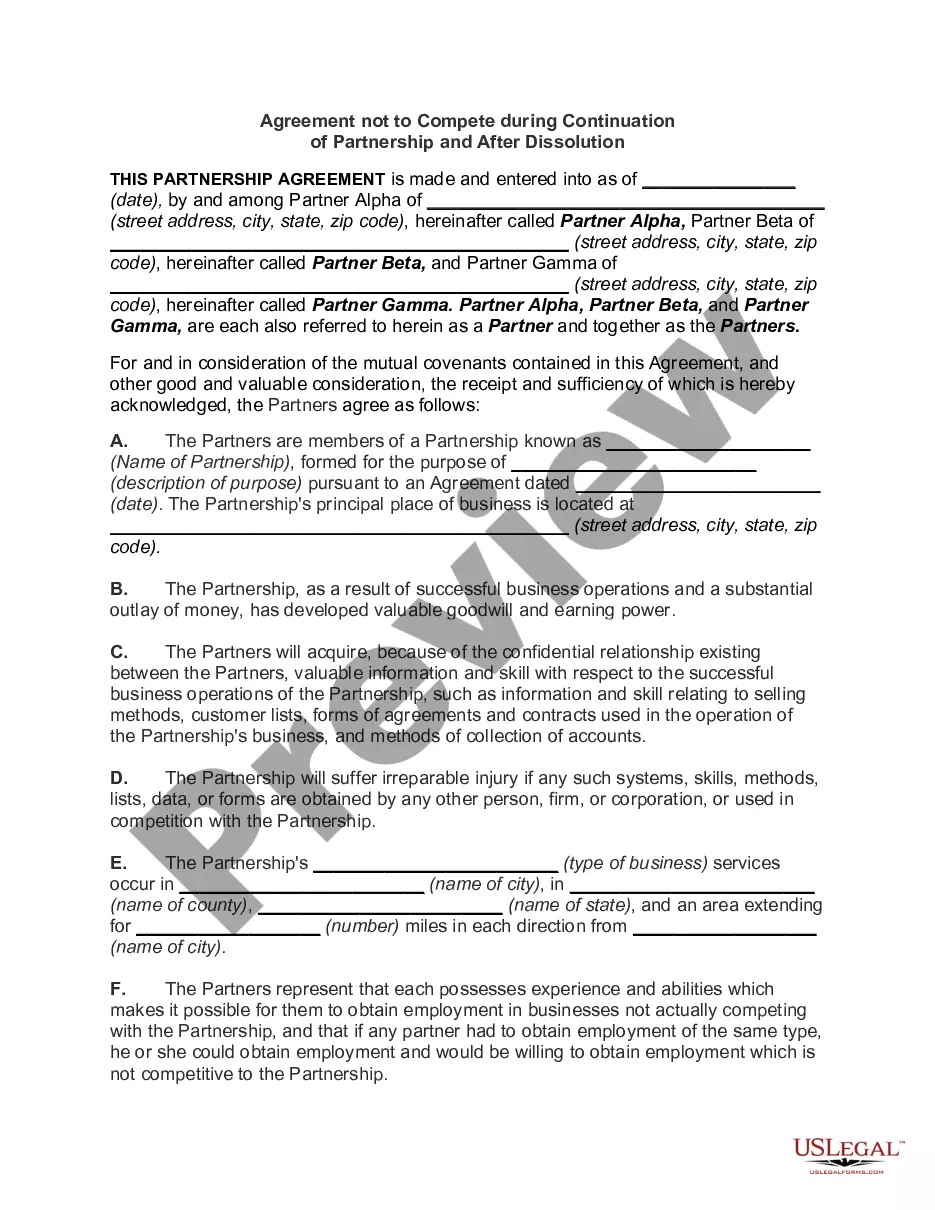

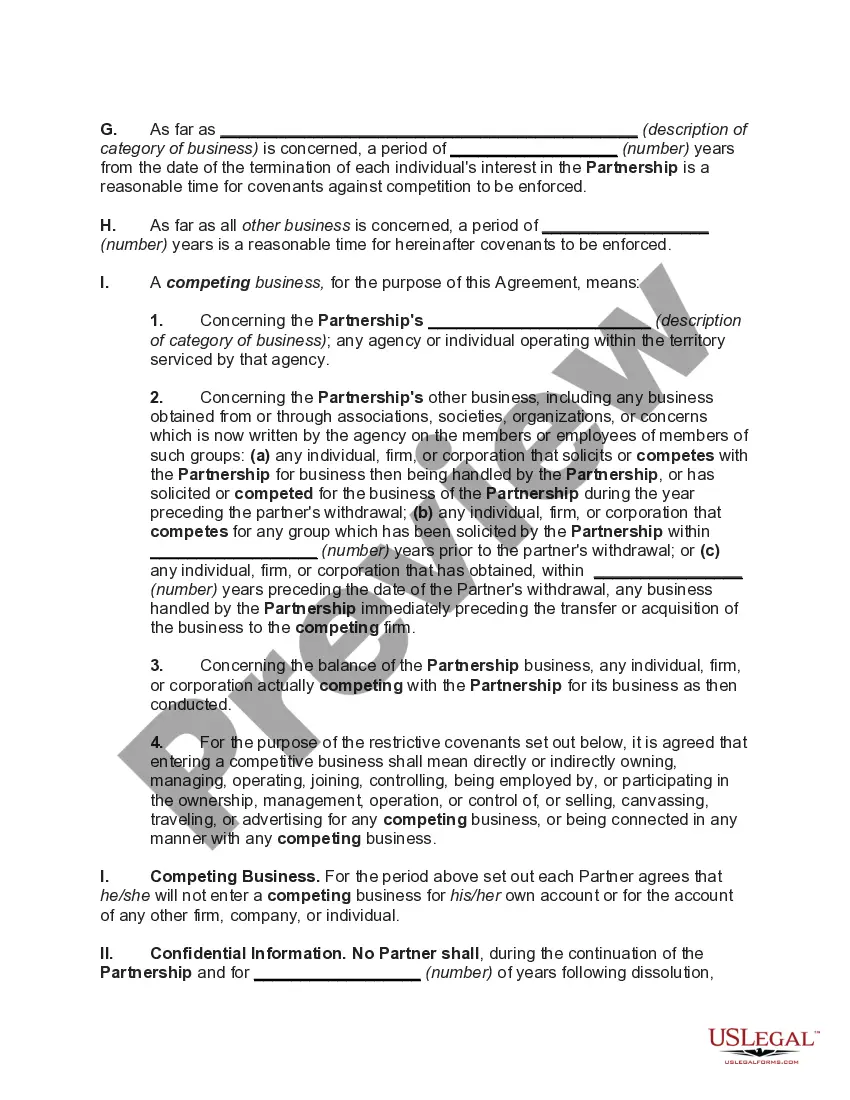

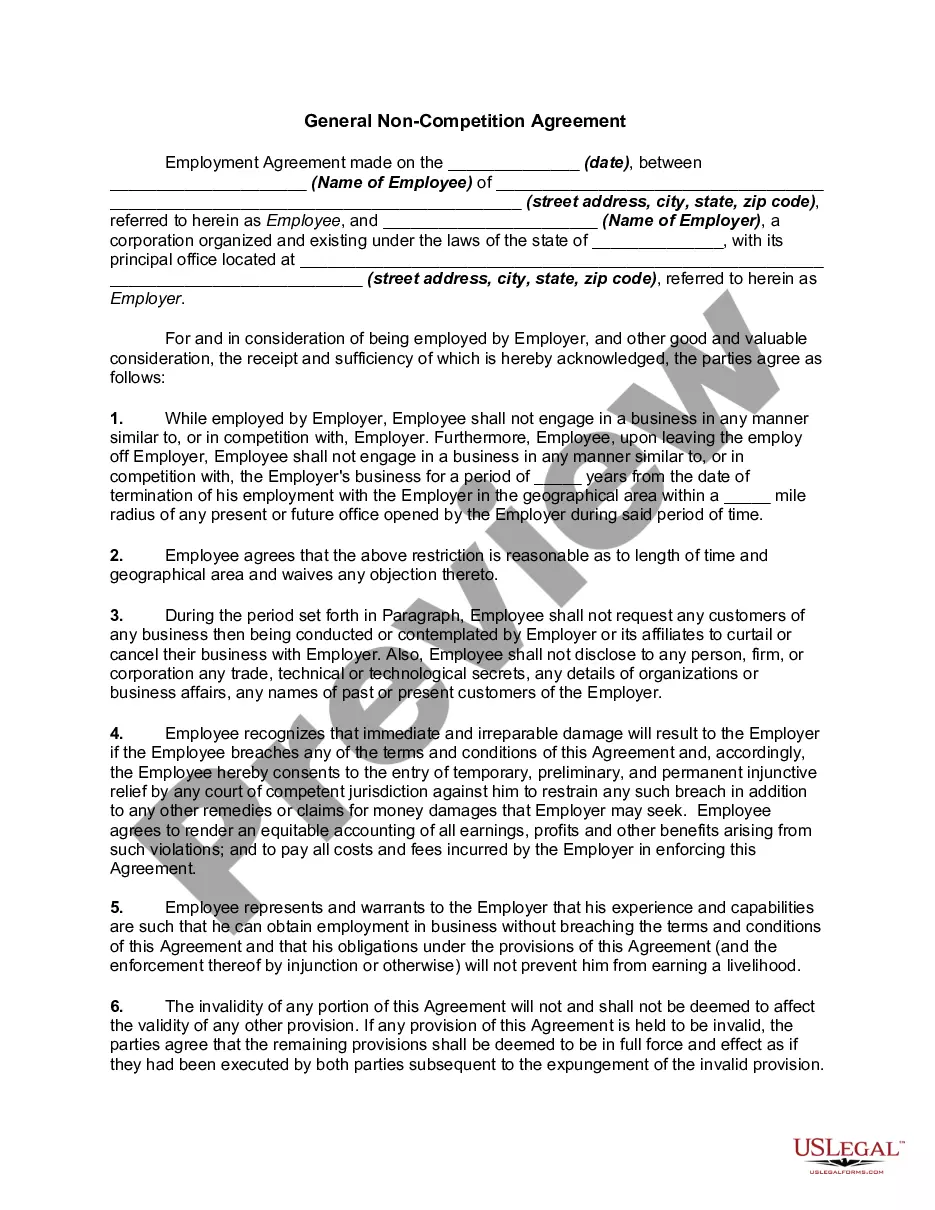

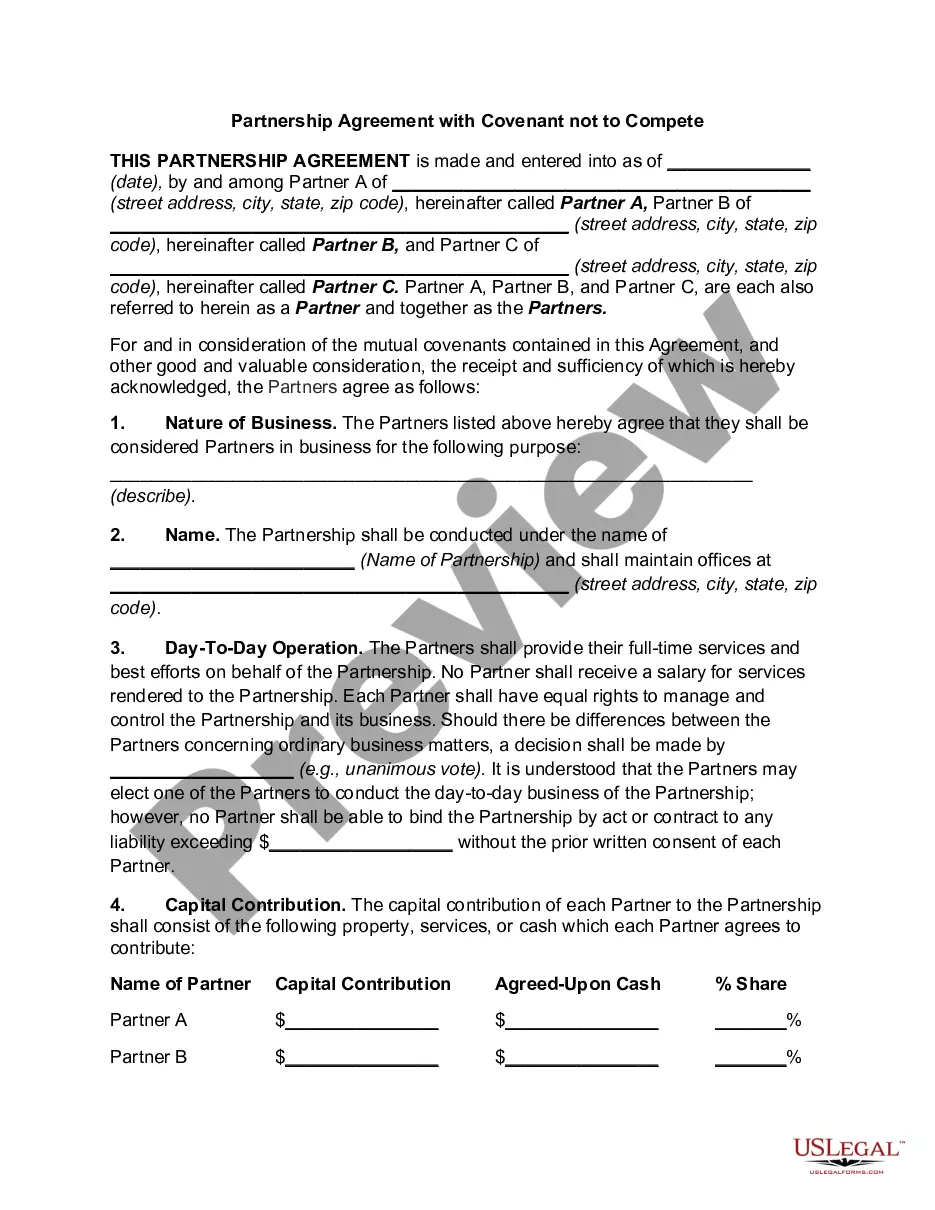

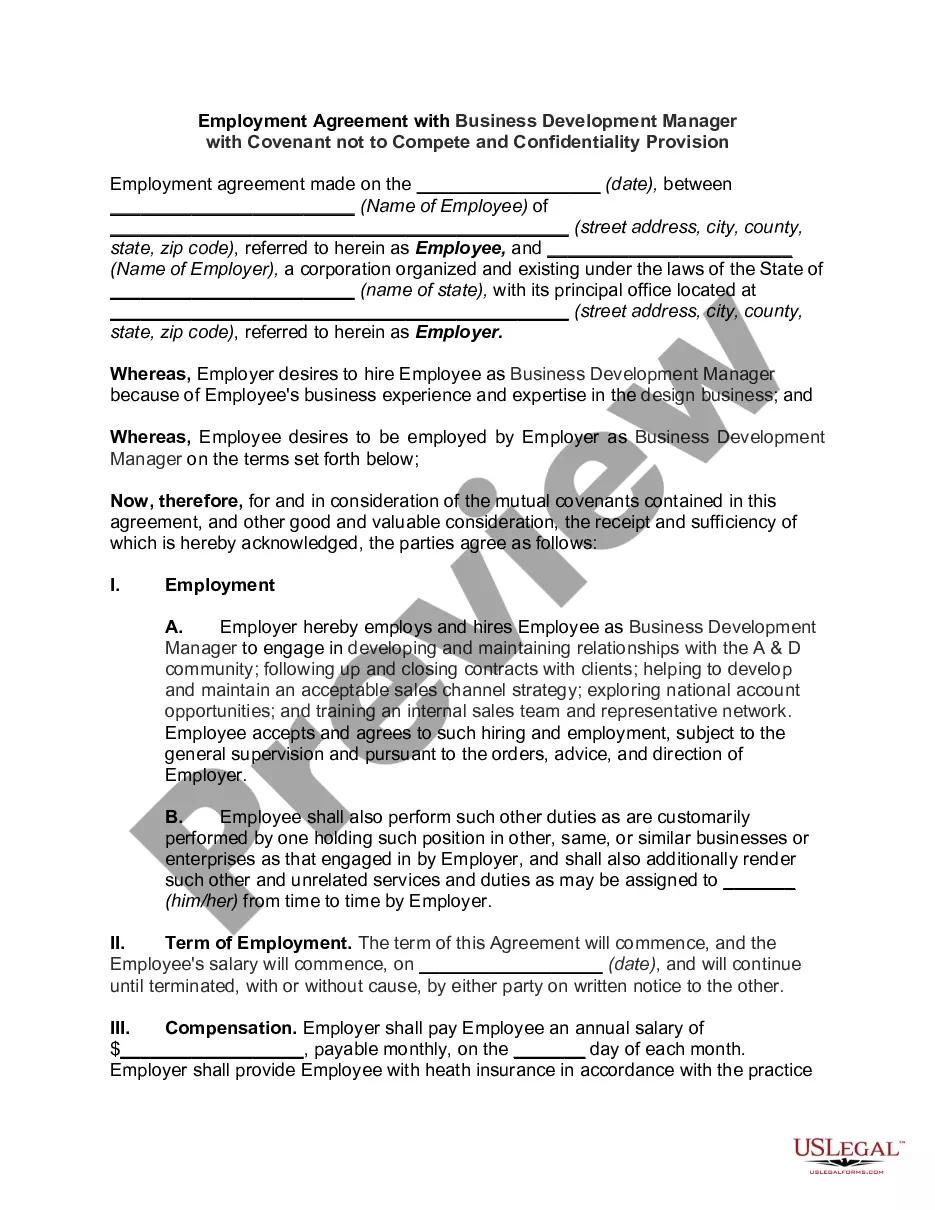

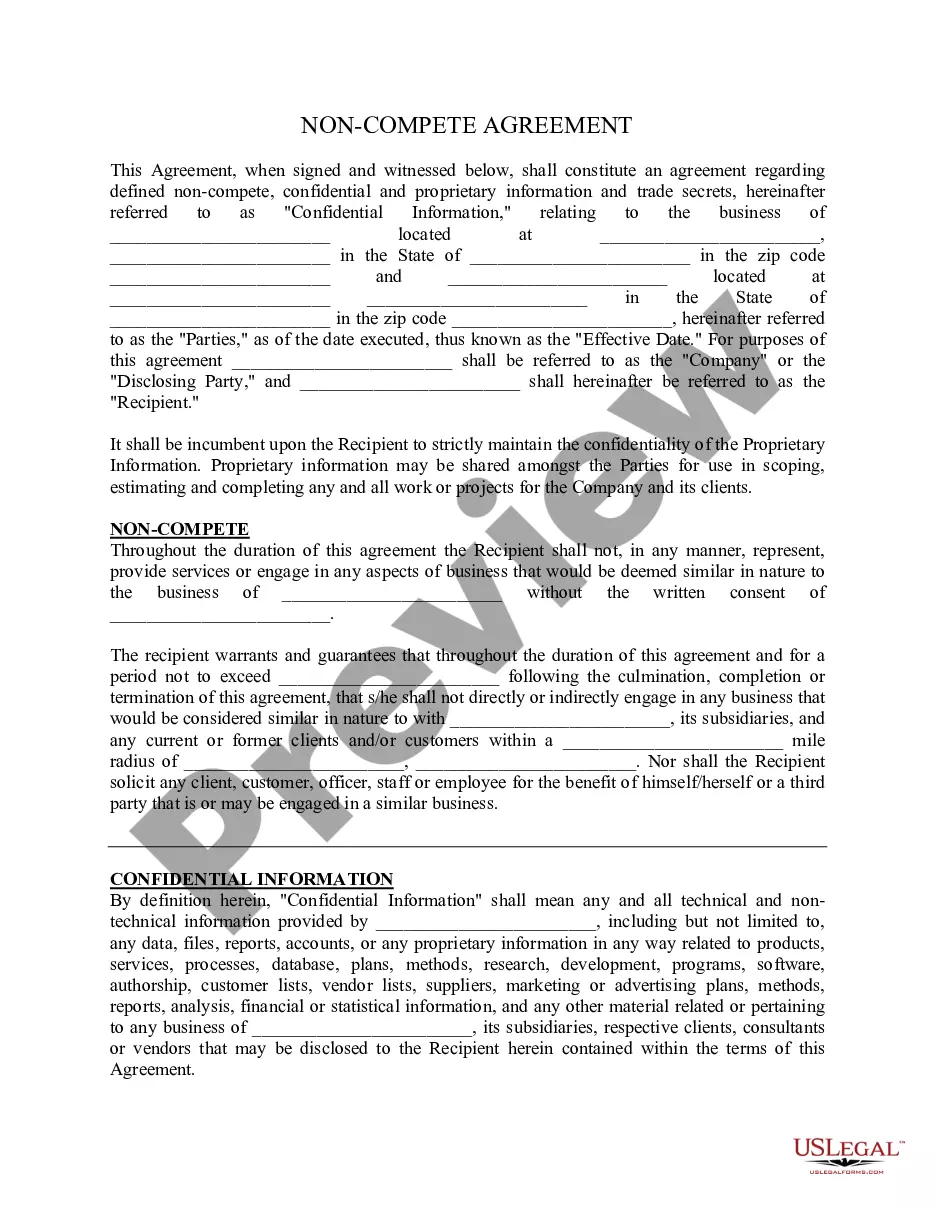

Idaho Agreement not to Compete during Continuation of Partnership and After Dissolution

Description

How to fill out Agreement Not To Compete During Continuation Of Partnership And After Dissolution?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad variety of legal form templates that you can download or print.

By using the platform, you will access numerous forms for commercial and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Idaho Agreement not to Compete during Continuation of Partnership and After Dissolution in just a few seconds.

If you already have a subscription, Log In and download the Idaho Agreement not to Compete during Continuation of Partnership and After Dissolution from the US Legal Forms library. The Download button will appear on every form you review. You can view all previously downloaded forms in the My documents section of your account.

Make edits. Fill out, modify, print, and sign the downloaded Idaho Agreement not to Compete during Continuation of Partnership and After Dissolution.

Every template you save in your account has no expiration date and is yours forever. So, if you wish to download or print another copy, just visit the My documents section and click on the form you need. Access the Idaho Agreement not to Compete during Continuation of Partnership and After Dissolution with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

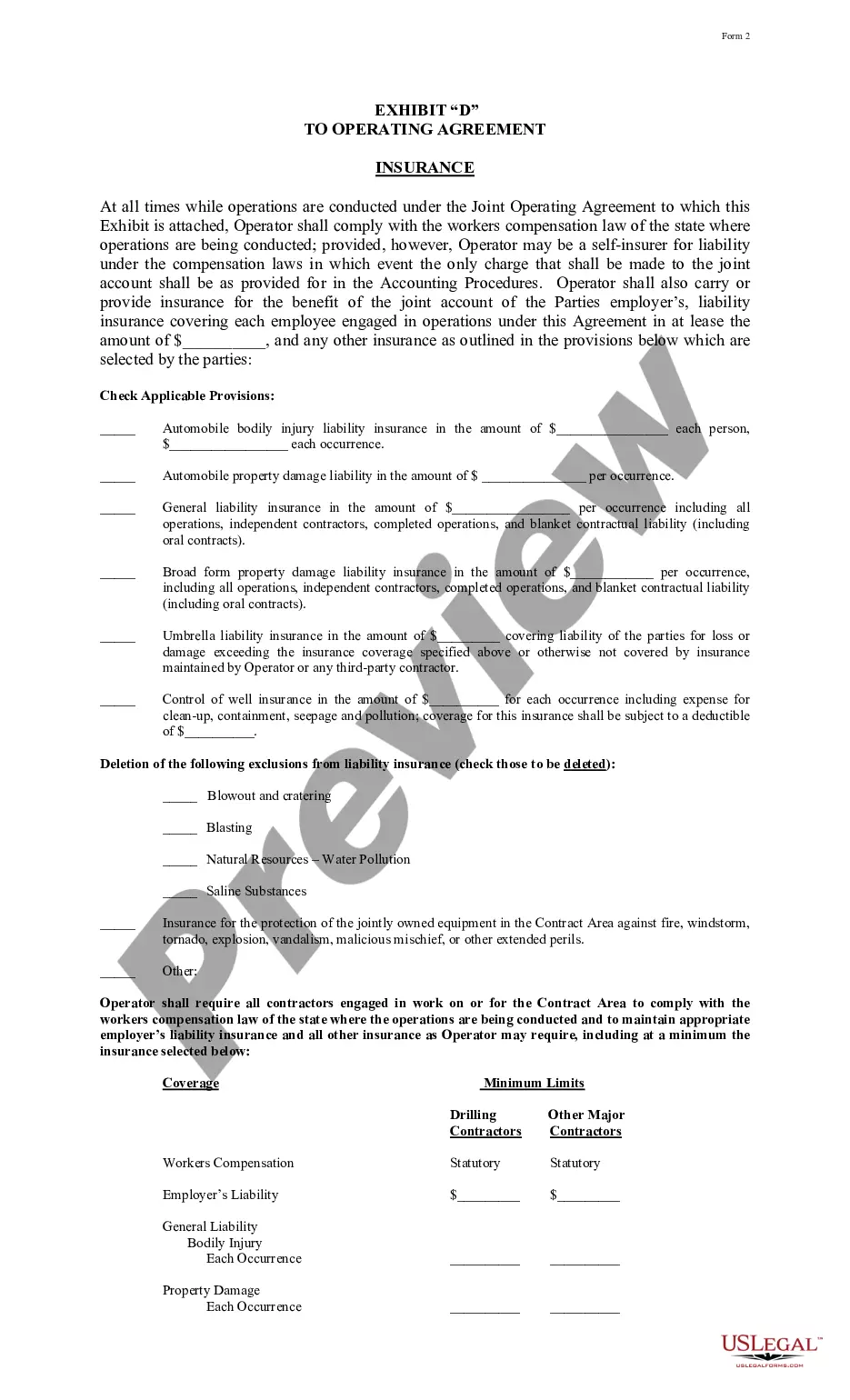

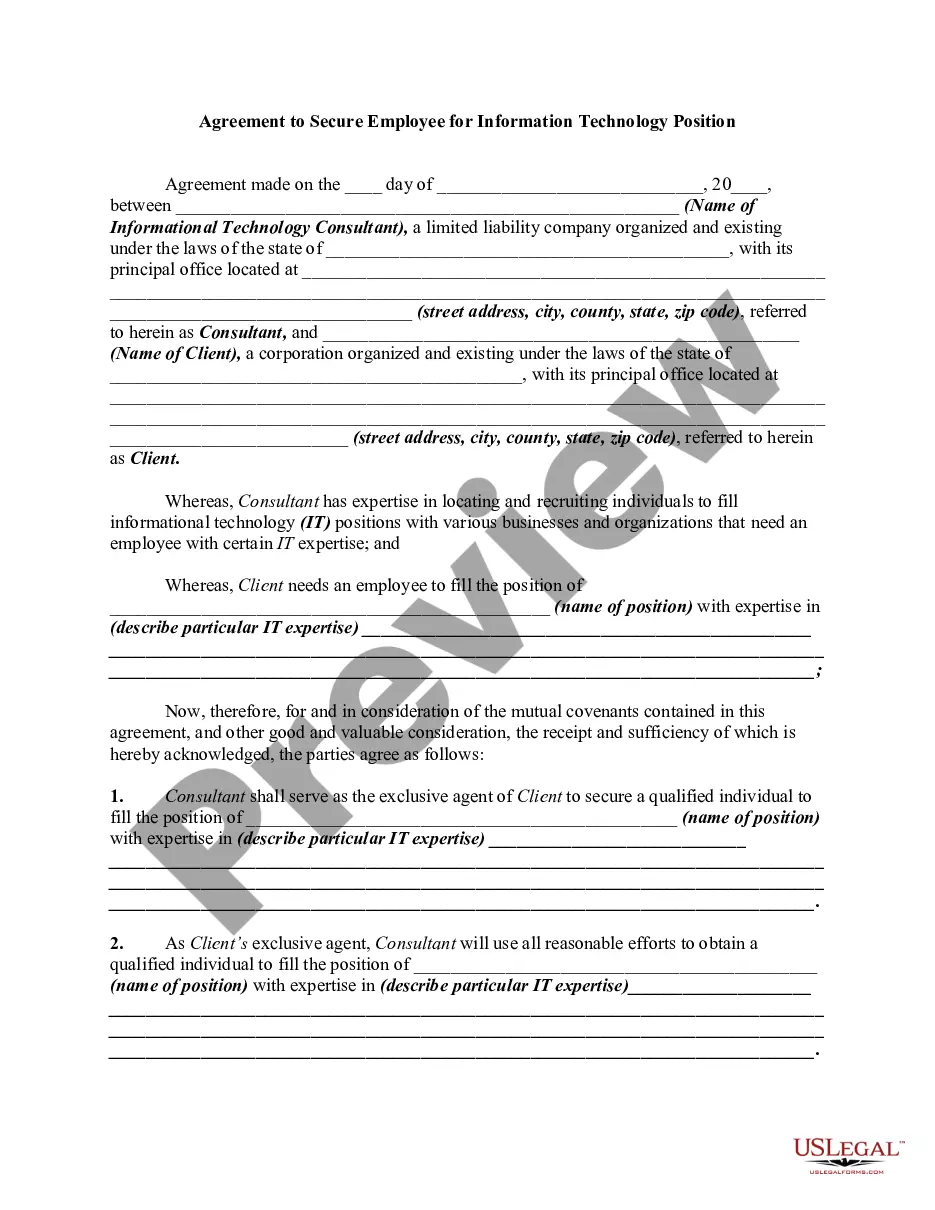

- Ensure that you have selected the correct form for your city/state. Review the Preview option to confirm the form’s content.

- Check the form summary to make sure you have chosen the right document.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

The partnership can be dissolved if the partner has breached the agreements that are related to the management of business affairs. The dissolution of partnership also can be done when a partner indulges in any other illegal or unethical business activities.

Effect of DissolutionA partnership continues after dissolution only for the purpose of winding up its business. The partnership is terminated when the winding up of its business is completed.

Start now and decide later.Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

53.79 Dissolution - general The dissolution of a partnership is the process during which the affairs of the partnership are wound up (where the ongoing nature of the partnership relation terminates).

After the dissolution of the partnership, the partner is liable to pay his debt and to wind up the affairs regarding the partnership. After the dissolution, partners are liable to share the profit which they have decided in agreement or accordingly.

The Partnership Act also means that a partnership can be automatically dissolved in the event of numerous other occurrences, such as: One of the partners going bankrupt. The death of a partner. The partnership reaching the end of a previously agreed fixed term.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Partnership Agreements and the Exit of One Partner A partnership does not necessarily end when a partner exits. The remaining partners may continue with the partnership. Therefore, your partnership agreement covers what happens when a partner wants to leave, becomes incapacitated, or dies.

The dissolution of a partnership firm is said to be dissolved when the relationship between the partners is terminated. In case of dissolution, the firm ceases to exist. The process of dissolution includes disposing of the assets and the liabilities are paid off.