Corporations must be formed under the enabling legislation of a state or the federal government, since corporations may lawfully exist only by consent or grant of the sovereign. Therefore, in drafting pre-incorporation agreements and other instruments preliminary to incorporation, the drafter must become familiar with and follow the particular statutes under which the corporation is to be formed.

Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association

Description

How to fill out Resolution To Incorporate As Nonprofit Corporation By Members Of A Church Operating As An Unincorporated Association?

Are you currently in a circumstance where you require documents for either business or personal use almost every day.

There are numerous authentic document templates accessible online, but finding versions you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church functioning as an Unincorporated Association, which are designed to meet state and federal requirements.

Select the pricing plan you want, complete the required information to create your account, and purchase the order using your PayPal or credit card.

Choose a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church functioning as an Unincorporated Association template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the document.

- Read the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that fits your needs.

- If you find the right form, click Buy now.

Form popularity

FAQ

An unincorporated association is a group formed for a common purpose without legal incorporation, while a corporation is a legally recognized entity with its own rights and liabilities. When members of a church operating as an unincorporated association seek to formalize their operations, they often consider the Idaho Resolution to Incorporate as Nonprofit Corporation. This resolution provides legal protections and credibility that an unincorporated association lacks. Understanding these differences can help you make informed decisions about your organization's structure.

To become a non-profit organization in Idaho, you must complete the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association. This involves drafting your organization’s articles of incorporation and filing them with the Idaho Secretary of State. Additionally, you should obtain an Employer Identification Number from the IRS and apply for tax-exempt status if applicable. Utilizing platforms like USLegalForms can simplify this process by providing templates and guidance tailored for your non-profit formation.

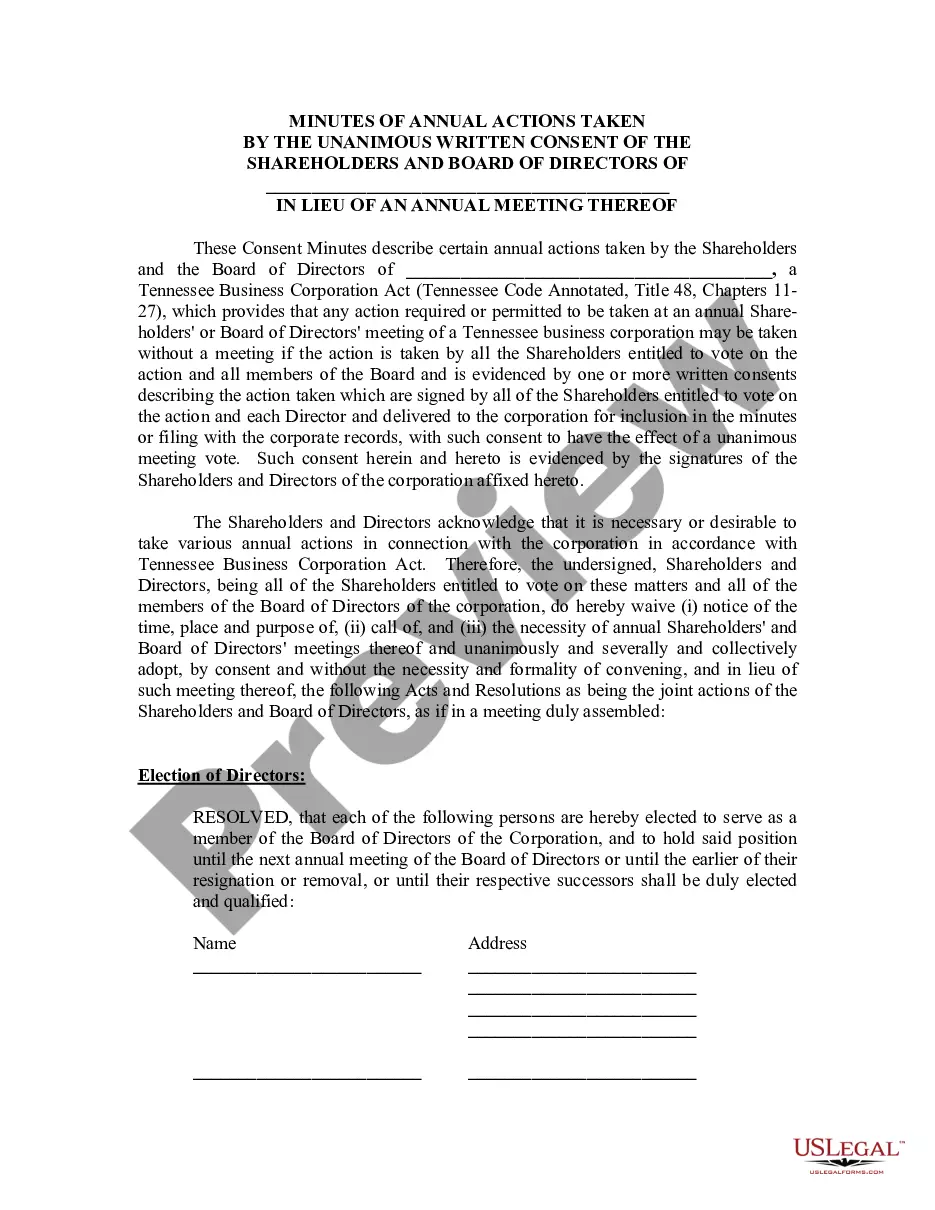

A board resolution letter sample includes a formal declaration of the decisions made during a board meeting. It typically covers the resolution number, content of the resolution, and any supporting documentation. Look for samples that relate to the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, which can often be found on platforms like uslegalforms for reliable resources.

Writing an article of association for a non-profit requires detailing the governance structure and operational guidelines. Include sections on purpose, membership, and management roles, while ensuring compliance with the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association. Utilize templates from uslegalforms for accuracy and efficiency.

A resolution statement should clearly express the intent of the resolution. Start by defining the issue and stating the desired outcome succinctly. Incorporate elements that relate to the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, ensuring that your statement aligns with organizational values and objectives.

Writing a resolution for a non-profit involves outlining the specific issue at hand, making a clear declaration, and detailing any actions to be taken. Incorporate relevant information, such as the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, to ensure clarity about how the resolution supports the organization's objectives and goals.

To write a nonprofit board resolution, start by stating the purpose clearly. Include the date, location, and names of individuals involved in the resolution. Reference the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, ensuring that the resolution supports the organization's mission and compliance with state regulations.

When writing a testimonial for a non-profit organization, focus on specific benefits the organization provided to you or your community. Include personal anecdotes that highlight your experience and express gratitude for the positive impact. Ensure that your testimonial aligns with the vision of the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, emphasizing partnership and community growth.

A 501(c)(3) nonprofit organization is a tax-exempt entity recognized by the IRS, allowing it to receive tax-deductible donations. It must operate exclusively for charitable, religious, educational, or scientific purposes. Understanding the criteria for establishing a 501(c)(3) is crucial, particularly for those exploring the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association.

In Idaho, a nonprofit must have at least three directors on its board. This ensures adequate representation and governance of the organization. Following the guidelines of the Idaho Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association is essential in setting up your board structure.