US Legal Forms - one of several biggest libraries of lawful varieties in the USA - offers a variety of lawful document layouts it is possible to down load or print. Using the web site, you may get 1000s of varieties for organization and individual uses, categorized by classes, claims, or keywords.You can get the newest types of varieties just like the Idaho Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement within minutes.

If you have a monthly subscription, log in and down load Idaho Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement from the US Legal Forms catalogue. The Obtain key can look on each kind you look at. You have accessibility to all previously downloaded varieties from the My Forms tab of your own account.

In order to use US Legal Forms the first time, listed here are easy instructions to obtain started:

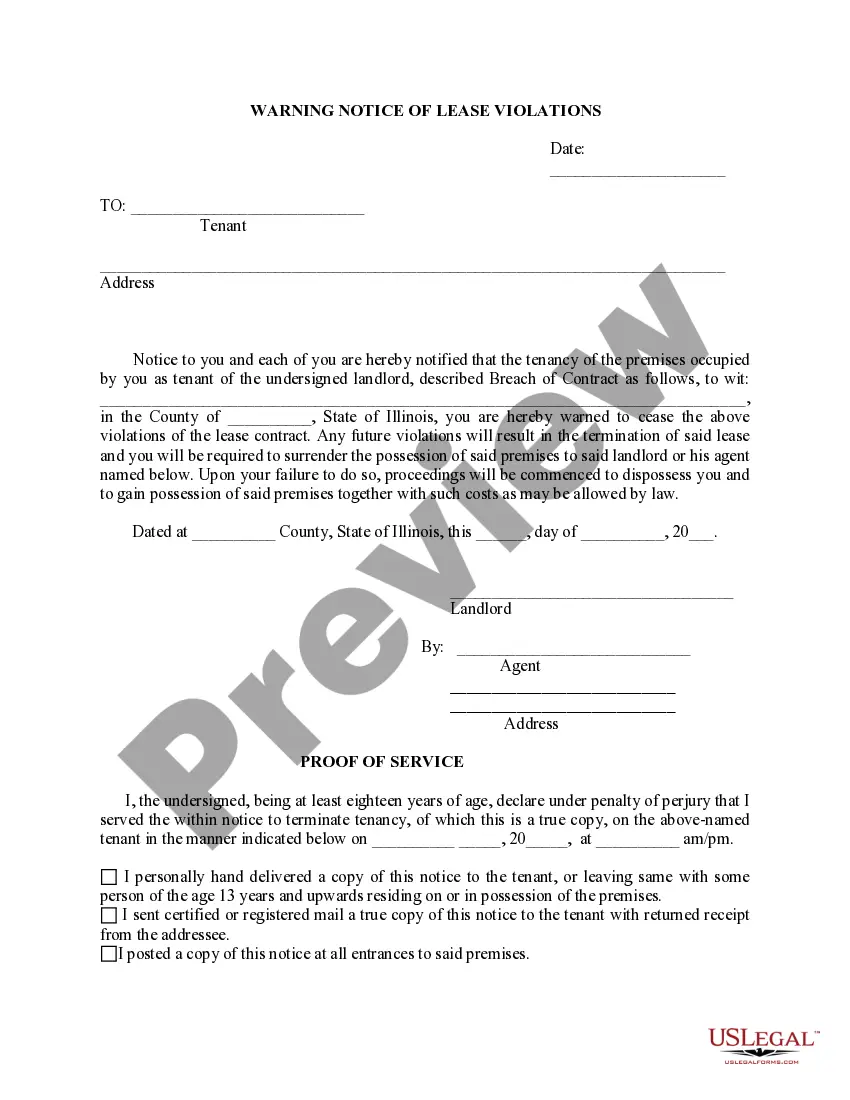

- Be sure you have selected the proper kind for the city/county. Click the Preview key to examine the form`s content material. Read the kind information to actually have selected the appropriate kind.

- If the kind does not suit your needs, use the Search industry at the top of the monitor to discover the one who does.

- When you are satisfied with the shape, verify your choice by clicking on the Purchase now key. Then, select the pricing prepare you want and supply your references to sign up for an account.

- Procedure the purchase. Use your credit card or PayPal account to complete the purchase.

- Pick the structure and down load the shape in your device.

- Make alterations. Fill up, edit and print and sign the downloaded Idaho Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Each and every design you included in your account lacks an expiration particular date and it is yours eternally. So, if you want to down load or print one more version, just proceed to the My Forms segment and click on the kind you need.

Obtain access to the Idaho Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms, probably the most comprehensive catalogue of lawful document layouts. Use 1000s of professional and condition-specific layouts that meet up with your organization or individual requires and needs.