Idaho Business Plan Updating Checklist

Description

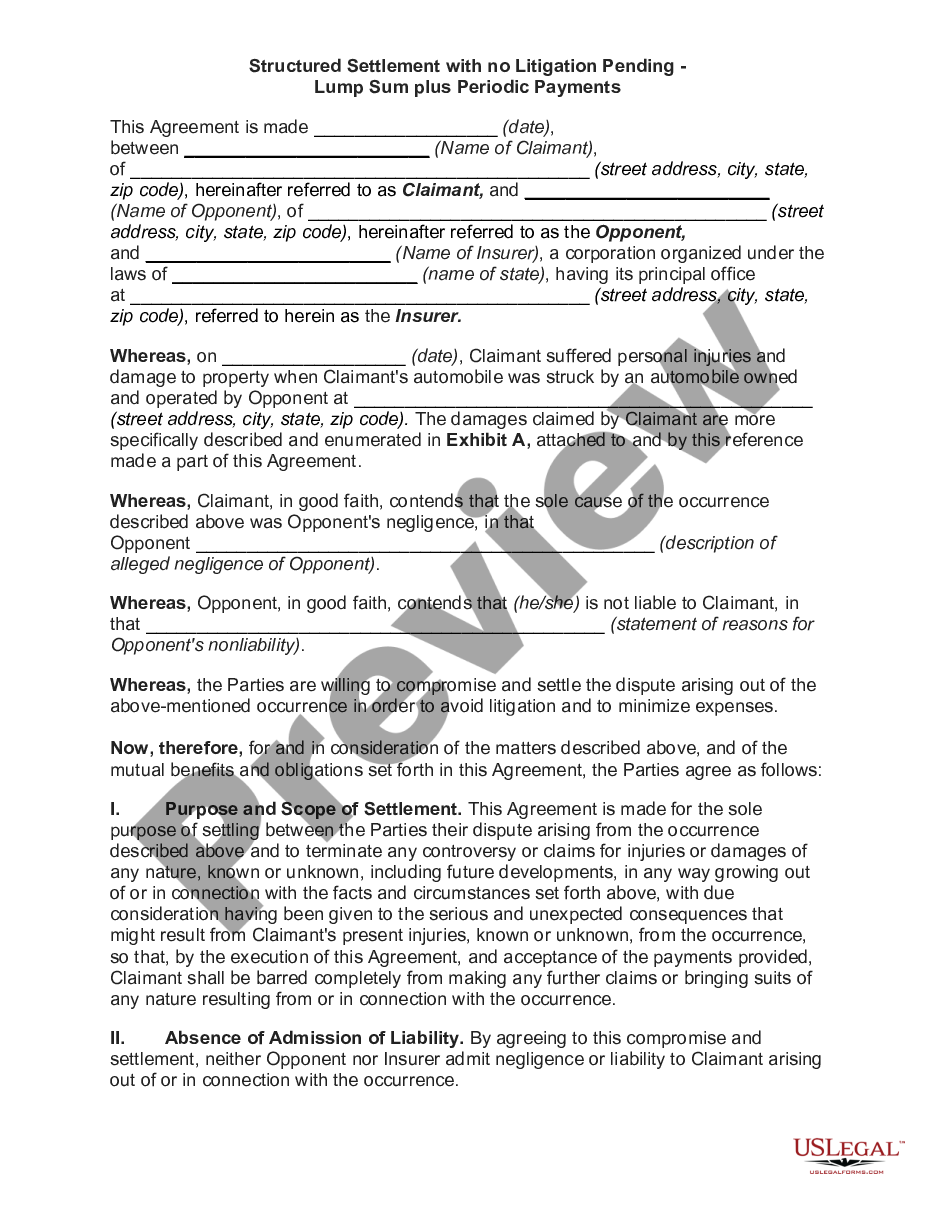

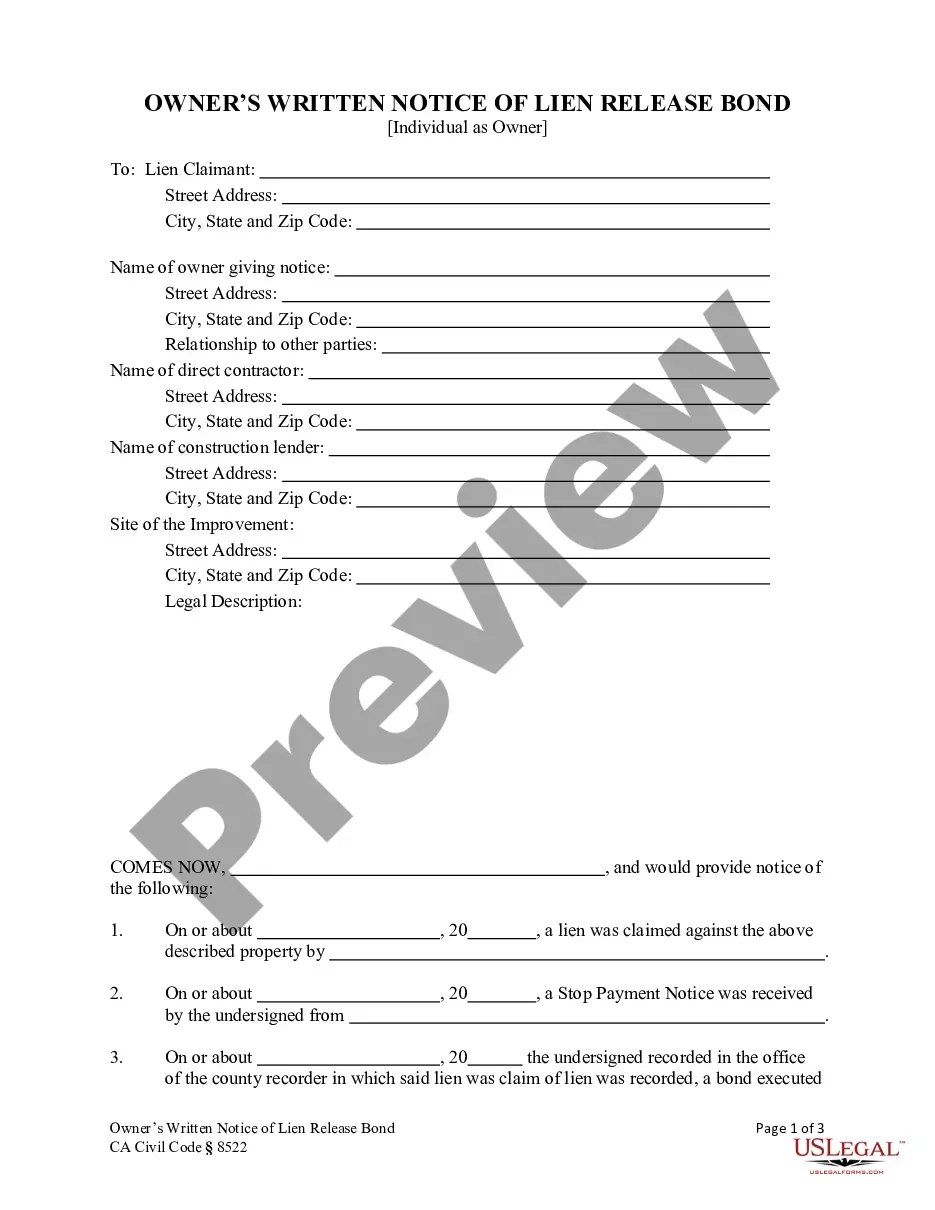

Executive Summary; Company Description (legal establishment, history, start-up plans, etc.); Product or Service (describing what you are selling and focusing on customer benefits); Market Analysis: (customer needs, where they are, how to reach them, etc.); Strategy and Implementation: (management responsibilities with dates and budgets);

Web Plan Summary: (discussion of website, development costs, operations, sales and marketing strategies);

Management Team: (the organization and the key management team member); and Financial Analysis: (e.g., profit and loss and cash flow tables).

How to fill out Business Plan Updating Checklist?

If you wish to finalize, obtain, or print legal form templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Make the most of the site's straightforward and effective search functionality to find the documents you require.

Countless templates for business and personal purposes are categorized by type and claims, or by keywords. Utilize US Legal Forms to access the Idaho Business Plan Updating Checklist with just a few clicks.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, review, and print or sign the Idaho Business Plan Updating Checklist. Each legal document template you purchase belongs to you indefinitely. You can access every form you downloaded within your account. Go to the My documents section to choose a form to print or download again. Stay competitive and download, and print the Idaho Business Plan Updating Checklist with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Get button to obtain the Idaho Business Plan Updating Checklist.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the right city/state.

- Step 2. Utilize the Preview feature to review the form's details. Remember to check the summary.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find other versions of the legal document template.

- Step 4. After locating the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To amend an Idaho tax return, you must complete Form 40 and indicate that it is an amended return. Be sure to include all necessary documentation that supports the changes you are making. It’s a good practice to keep this task updated in your Idaho Business Plan Updating Checklist to prevent issues with the tax authority.

In Idaho, you are not required to renew your LLC every year in a traditional sense. However, you do need to file an annual report to maintain compliance with state regulations. Missing this deadline can lead to penalties, so ensure this task is included in your Idaho Business Plan Updating Checklist for timely filing.

Yes, if you operate an LLC in Idaho, you need to file an annual report. This report helps keep your business in good standing and includes vital information such as your business's address and registered agent. Make sure to include this requirement in your Idaho Business Plan Updating Checklist to avoid any penalties.

Many states in the U.S. require annual reports, including Delaware, California, and Florida. Each state has its own specific requirements and deadlines for filing these reports. You should check your state's official website to ensure compliance. An updated Idaho Business Plan Updating Checklist can help you track these obligations effectively.

To look up a business license in Idaho, visit the Secretary of State's website where you can access a business entity search. This tool allows you to verify active licenses and check business status. If you're in the process of updating your business plan, using the Idaho Business Plan Updating Checklist can help you stay informed about your licensing and registration obligations.

Nexus refers to the degree of business activity that allows a state to impose tax obligations. In Idaho, having a physical presence, employees, or significant sales can create nexus. It’s essential to assess your situation correctly, and the Idaho Business Plan Updating Checklist can assist you in understanding your obligations and ensuring compliance.

To determine if you need a business license in Idaho, review the regulations specific to your locality and business type. Various factors, such as business activities and location, affect the licensing requirements. The Idaho Business Plan Updating Checklist serves as an excellent tool that walks you through the considerations needed to confirm whether licensing is necessary.

To contact the Secretary of State business office in Idaho, you can visit their official website or call them directly. They provide resources and assistance for business registration, licensing, and compliance. Remember, using the Idaho Business Plan Updating Checklist can also guide you through necessary steps to ensure your business is properly registered and compliant.

The primary difference between an employee and an independent contractor in Idaho relates to control and independence. Employees work under the direction of an employer, while independent contractors have more freedom to manage their work. Recognizing this distinction is crucial, and resources like the Idaho Business Plan Updating Checklist can provide further clarity on the implications for your workforce.

You do not necessarily need to set up a formal business entity to work as an independent contractor in Idaho. However, organizing your work as a business can provide liability protection and tax advantages. Consulting the Idaho Business Plan Updating Checklist can guide you on the best approach for your contracting services.