Idaho Aging of Accounts Receivable

Description

How to fill out Aging Of Accounts Receivable?

Locating the right sanctioned document template can be challenging.

Of course, there are numerous templates accessible online, but how do you find the sanctioned form you seek.

Utilize the US Legal Forms platform. This service provides thousands of templates, including the Idaho Aging of Accounts Receivable, which can be employed for business and personal needs.

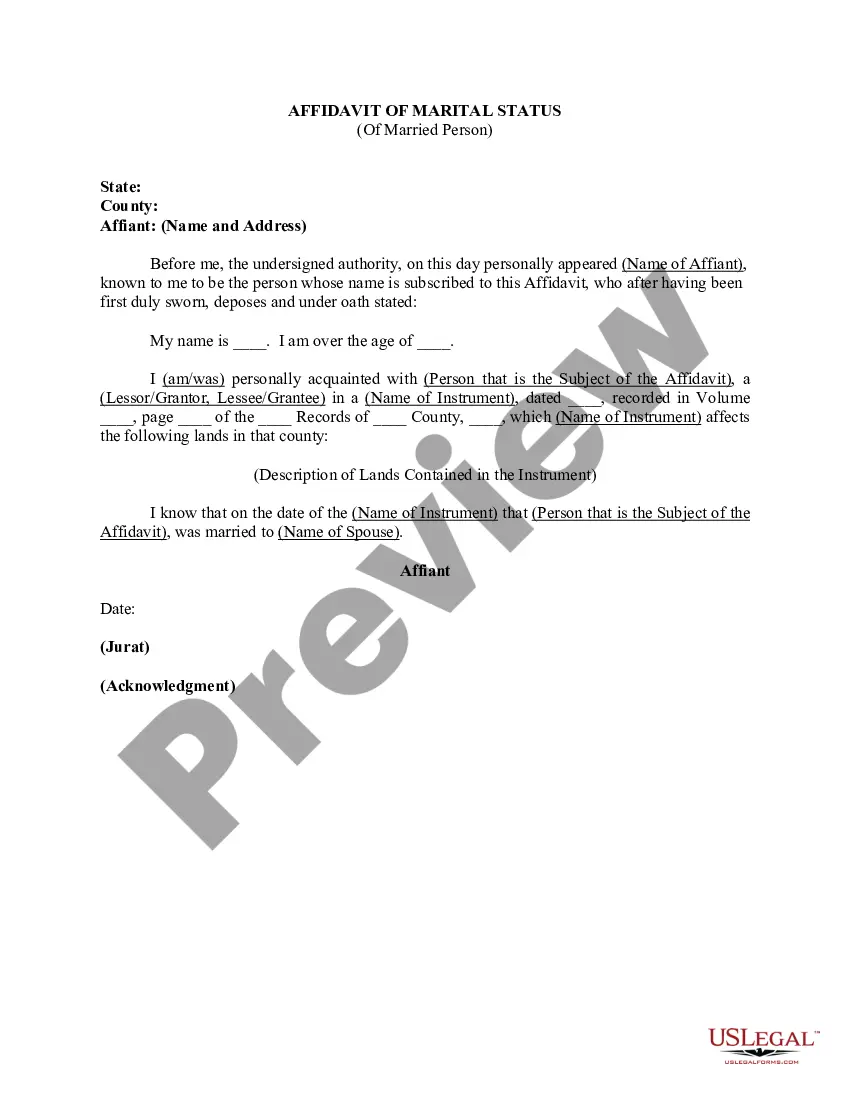

You can navigate through the form using the Preview button and read the form description to confirm it's right for you.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already a member, Log In to your account and press the Acquire button to obtain the Idaho Aging of Accounts Receivable.

- Use your account to view the sanctioned forms you have previously purchased.

- Go to the My documents section of your account and obtain another copy of the document you desire.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

- First, make sure you have selected the correct form for the region/state.

Form popularity

FAQ

Filing accounts receivable involves organizing your outstanding invoices systematically. You can categorize them by customer, date due, or amount owed. Keeping meticulous records through tools like US Legal Forms can enhance your Idaho Aging of Accounts Receivable process, ensuring that you have quick access to all necessary documentation for efficient collections.

To record aging accounts receivable effectively, you will need to maintain updated records of all customer invoices. Classify and document these invoices based on age, ensuring you regularly review outstanding accounts. Moreover, utilizing professional services like US Legal Forms can streamline the tracking process, thereby optimizing your Idaho Aging of Accounts Receivable management.

Running an accounts receivable aging report is essential for monitoring overdue payments. Start by pulling data from your accounting software, like QuickBooks, or utilizing platforms like US Legal Forms for a more tailored reporting template. Once you have your outstanding invoices categorized by age, you can analyze the data to develop a plan for following up with customers, improving your Idaho Aging of Accounts Receivable process.

The age of accounts receivable refers to how long it takes for your business to collect payments from customers. You can calculate this by looking at the total accounts receivable divided by your average daily sales, resulting in the average collection period. Understanding the age of accounts receivable, especially in the context of Idaho Aging of Accounts Receivable, empowers businesses to streamline their invoicing and collection strategies.

To create an accounts receivable aging report, you calculate the total amount owed by customers and break it down into specified aging periods. You will list the customer names, outstanding balances, and categorize these amounts based on how long the invoices have been unpaid. The Idaho Aging of Accounts Receivable report provides insights that help businesses identify trouble spots in their collections process, ultimately enhancing financial health.

To write an Idaho Aging of Accounts Receivable report, begin by gathering data on all customer accounts and their outstanding invoices. Next, organize the invoices by age, creating categories based on how overdue they are. Finally, compile this information into a clear report format, detailing each customer's balance and the age of their receivables. This comprehensive report can guide your collection strategies effectively.

An example of an Idaho Aging of Accounts Receivable report would list customer accounts alongside categories such as current, 30 days past due, 60 days past due, and 90+ days past due. Each category will show the outstanding balance for each customer, enabling you to see which accounts need your immediate attention. This structured approach allows for better organization and prioritization of collections.

An Idaho Aging of Accounts Receivable report provides valuable insights into overdue accounts, allowing you to identify which customers have outstanding payments and how long these debts have remained unpaid. This report also helps in assessing the effectiveness of your credit policies and monitoring customer payment behavior. Ultimately, it empowers you to make informed decisions about collections and credit extension.

To calculate Idaho Aging of Accounts Receivable, you typically begin by categorizing your accounts by the age of the outstanding invoices. You need to determine how long each invoice has been unpaid, then divide the total amount owed by the customers in each category. This process helps you analyze the overall health of your receivables and prioritize collection efforts.

You get aging receivables by reviewing your accounts ledger and identifying all unpaid invoices categorized by age. This information can often be extracted using your business accounting software, which simplifies the process. By analyzing aging receivables, you can prioritize your collection efforts based on how overdue accounts are. Embracing the Idaho Aging of Accounts Receivable principles will elevate your accounts management strategy.