Idaho General Form of Agreement to Incorporate

Description

How to fill out General Form Of Agreement To Incorporate?

Are you situated in a location where you frequently require documents for business or particular tasks nearly every working day.

There is a plethora of official document templates accessible online, yet locating reliable ones can be challenging.

US Legal Forms offers thousands of template forms, including the Idaho General Form of Agreement to Incorporate, designed to meet state and federal regulations.

Select a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can also obtain an additional copy of the Idaho General Form of Agreement to Incorporate at any time. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Idaho General Form of Agreement to Incorporate template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and verify it is for the correct state/region.

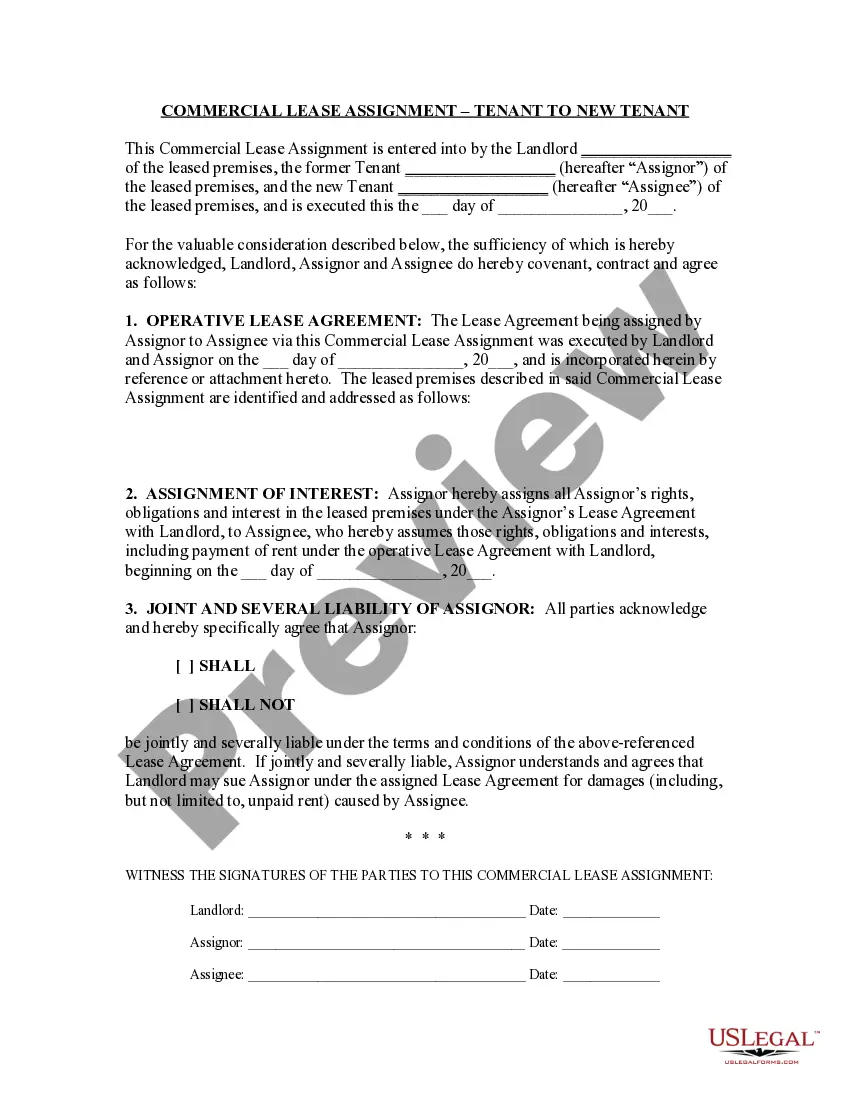

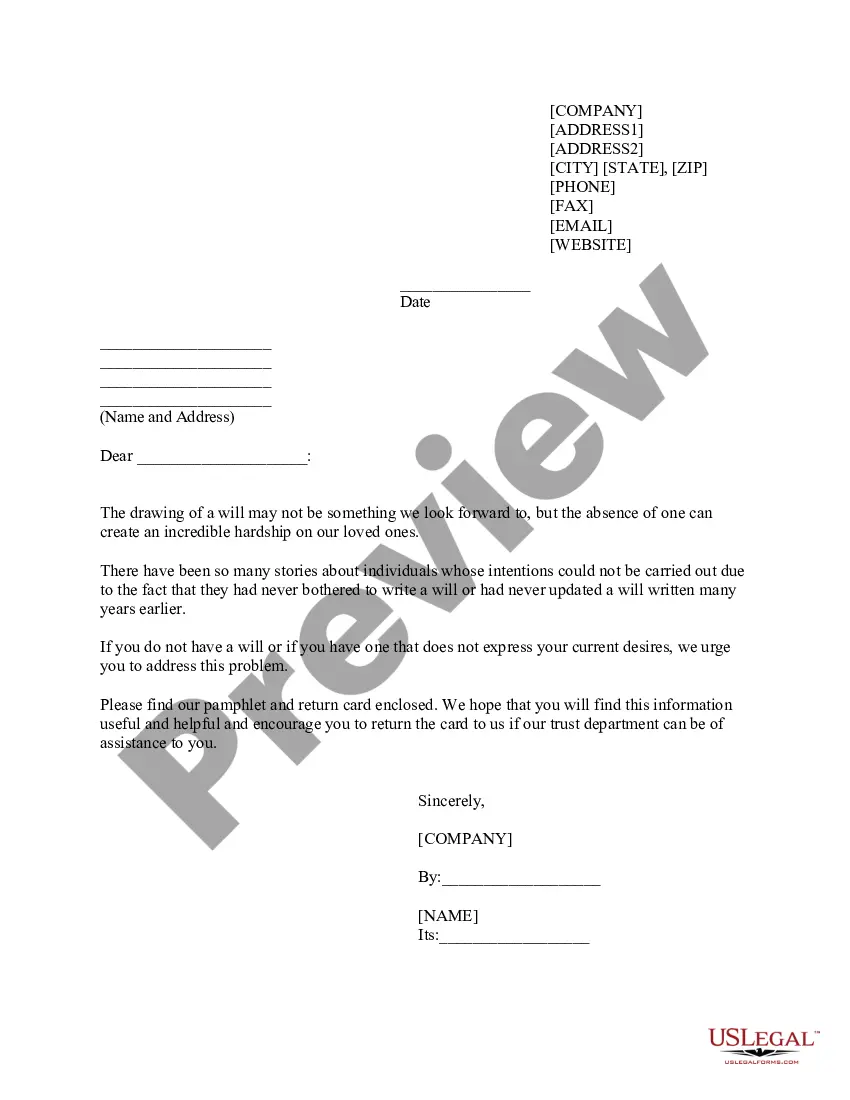

- 2. Use the Preview button to review the form.

- 3. Check the details to ensure you have selected the right form.

- 4. If the form is not what you are looking for, use the Search box to find the form that fits your requirements.

- 5. Once you find the correct form, click Buy now.

- 6. Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

As stated before, Idaho does not require LLCs to have an operating agreement. However, creating an Idaho General Form of Agreement to Incorporate is beneficial for outlining member roles and responsibilities. This document serves as a reference point, ensuring all members understand their investments and duties.

Yes, an LLC can operate without an operating agreement in Idaho, but it is not advisable. Without it, there can be confusion regarding management roles and profit sharing. An Idaho General Form of Agreement to Incorporate simplifies these matters and safeguards your business operations.

Filing for an S Corp in Idaho involves completing and filing the IRS Form 2553 after establishing your corporation. You need to ensure your corporation meets all eligibility requirements. It is also beneficial to have an operating framework in place, which can be detailed using an Idaho General Form of Agreement to Incorporate for clarity and compliance.

Idaho does not legally require LLCs to have an operating agreement. However, having an Idaho General Form of Agreement to Incorporate is a wise choice as it sets expectations among members and clarifies management roles. It also helps protect your limited liability status.

To start an LLC in Idaho, you need to file the Certificate of Organization with the Idaho Secretary of State. This involves providing your LLC name, registered agent, and the purpose of your business. It's also recommended to create an Idaho General Form of Agreement to Incorporate to outline your operating procedures and protect your interests.

Many states recommend or require an LLC to have an operating agreement, but it largely depends on your specific business and state laws. States like California, Delaware, and Nevada strongly encourage having one. On the other hand, Idaho does not specifically require an Idaho General Form of Agreement to Incorporate, but having one is beneficial for clarifying management structure and internal processes.

The processing time for LLC approval in Idaho typically ranges from a few days to a couple of weeks, depending on the filing method. If you file online, you may receive your approval faster than if you file by mail. To expedite your process, consider utilizing the Idaho General Form of Agreement to Incorporate, which streamlines your filing and enhances your chances of quick approval for your business.

Starting a small business in Idaho involves several key steps. First, you need to choose a business structure, such as an LLC, and register it with the state. Second, you should obtain the necessary licenses and permits tailored to your business type. Using the Idaho General Form of Agreement to Incorporate can provide a reliable framework for establishing your LLC, helping you navigate the initial stages effectively.

While Idaho law does not mandate an operating agreement for LLCs, it is highly advised to create one. An operating agreement outlines the management structure and operating procedures of your LLC, helping to prevent conflicts among members. Utilizing the Idaho General Form of Agreement to Incorporate can guide you in drafting this important document, ensuring your business operates smoothly from the start.

The key difference lies in liability protection and taxation. A sole proprietorship does not provide personal liability protection, meaning your personal assets may be at risk if the business incurs debt. An LLC, or Limited Liability Company, offers a shield against personal liability while also allowing for pass-through taxation. When you use the Idaho General Form of Agreement to Incorporate, you simplify the process of setting up your LLC and gain essential legal protections.