Idaho Offer to Purchase Assets of a Corporation

Description

Pursuant the Model Business Corporation Act, a sale of all of the assets of a corporation requires approval of the corporation's shareholders if the disposition would leave the corporation without a significant continuing business activity.

How to fill out Offer To Purchase Assets Of A Corporation?

Are you presently in a placement that you need documents for sometimes business or personal purposes virtually every time? There are tons of legitimate papers web templates available on the Internet, but finding kinds you can trust is not easy. US Legal Forms provides a large number of form web templates, just like the Idaho Offer to Purchase Assets of a Corporation, which are composed to satisfy state and federal demands.

If you are previously knowledgeable about US Legal Forms site and also have a merchant account, merely log in. Following that, you may down load the Idaho Offer to Purchase Assets of a Corporation format.

Unless you have an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you want and ensure it is to the right area/state.

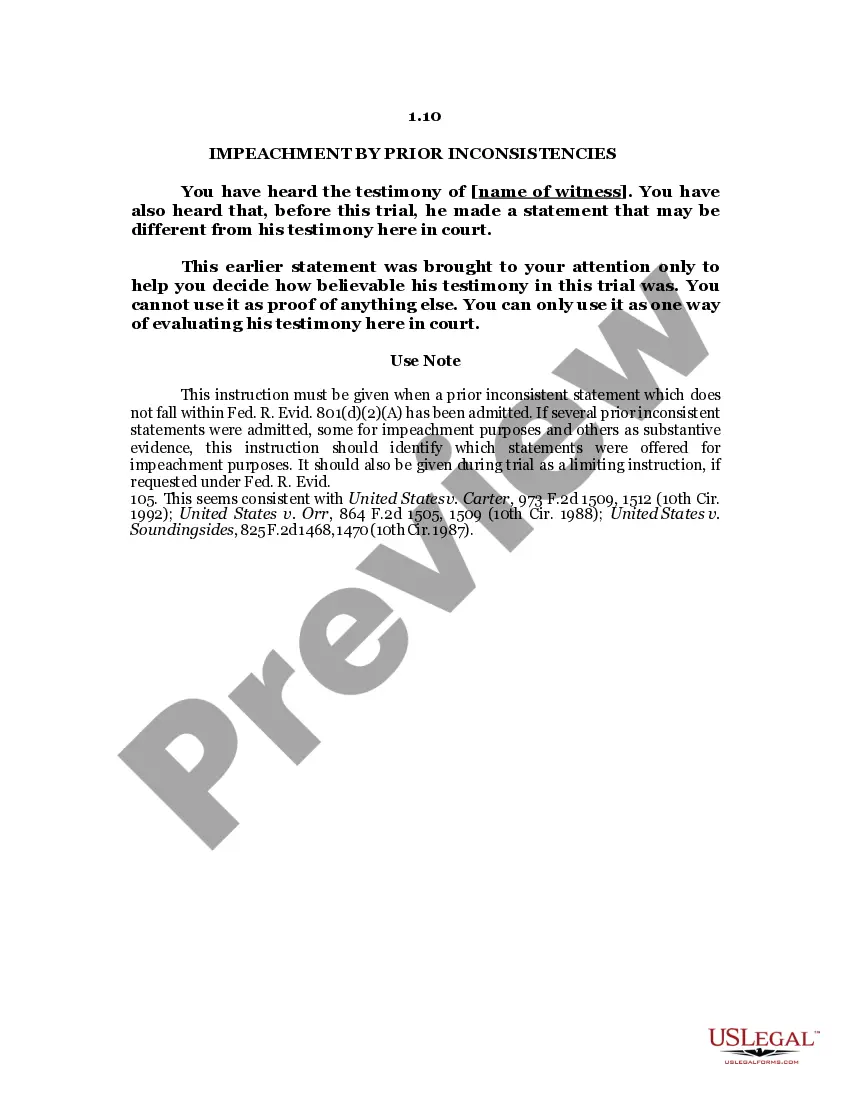

- Make use of the Review option to examine the shape.

- See the outline to ensure that you have selected the proper form.

- In the event the form is not what you`re seeking, take advantage of the Lookup discipline to obtain the form that meets your needs and demands.

- Once you get the right form, click Acquire now.

- Choose the pricing plan you need, fill in the required details to make your account, and pay for an order with your PayPal or Visa or Mastercard.

- Decide on a handy document structure and down load your backup.

Get each of the papers web templates you might have purchased in the My Forms food selection. You may get a extra backup of Idaho Offer to Purchase Assets of a Corporation at any time, if possible. Just click on the required form to down load or printing the papers format.

Use US Legal Forms, the most extensive selection of legitimate kinds, to conserve time as well as avoid errors. The support provides skillfully made legitimate papers web templates which can be used for a selection of purposes. Create a merchant account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

Idaho does not have a state business license. Registering your business is a registration, not a license. Sales Tax Permit, Withholding, Unemployment Insurance and Lodging Tax Accounts: If your business sells a product, has employees, or is engaged in the lodging industry, you will need to complete form IBRS.

Idaho follows the US Small Business Administration's definition, which defines small businesses by firm revenue (ranging from $1 million to over $40 million) and by employment (from 100 to over 1,500 employees).

In fact, the Idaho Supreme Court has ruled that self-represented individuals should be held to the same standard as attorneys. Thus, while any individual can represent himself or herself in court (business entities cannot), it may not be a good idea.

All businesses, including home based ones, need to register their name and entity type with the Idaho Secretary of State before engaging in business. The exception is sole proprietors who use their full name as part of the business name. Those who use only their last name must register.

Search Idaho Statutes. 54-2051. Offers to purchase. (1) A broker or sales associate shall, as promptly as practicable, tender to the seller every written offer to purchase obtained on the real estate involved, up until time of closing.

State law gives little guidance on what specifically constitutes ?doing business,? but we know from other state and tax laws that an LLC is typically considered to be ?doing business? and required to foreign qualify if: It has offices, warehouses, stores, or other physical presences in the state.

Yes, it is legal to run a business from your home in Idaho. You'll be subject to the same permit and license regulations as a commercial outlet. You may also require additional licenses or permits from your local government.