Idaho Irrevocable Letter of Credit

Description

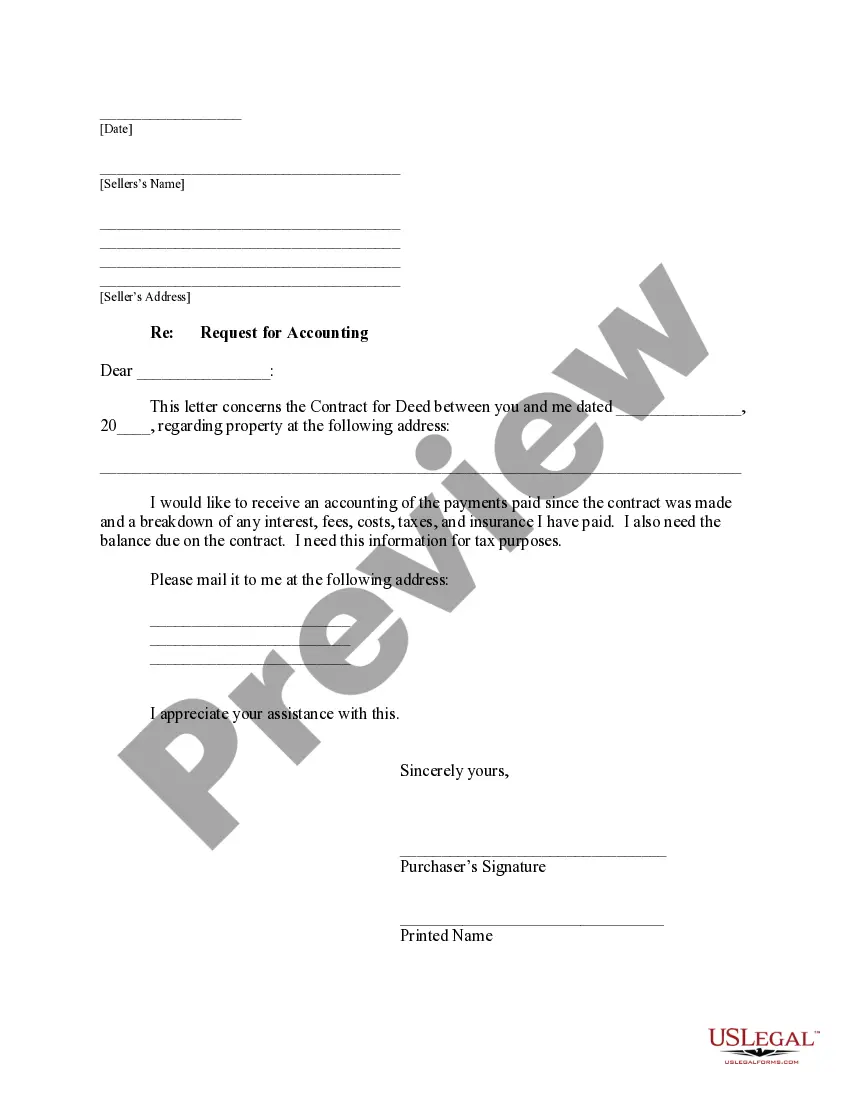

How to fill out Irrevocable Letter Of Credit?

US Legal Forms - one of many largest libraries of legitimate forms in the United States - offers an array of legitimate record layouts you are able to download or produce. While using internet site, you can get thousands of forms for organization and individual reasons, sorted by categories, states, or key phrases.You will discover the latest versions of forms such as the Idaho Irrevocable Letter of Credit in seconds.

If you already possess a registration, log in and download Idaho Irrevocable Letter of Credit from the US Legal Forms library. The Download switch will appear on every form you perspective. You have accessibility to all previously delivered electronically forms in the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, allow me to share basic recommendations to get you began:

- Be sure to have selected the proper form to your town/county. Go through the Review switch to check the form`s content. Browse the form outline to actually have selected the proper form.

- When the form doesn`t match your specifications, take advantage of the Lookup field near the top of the screen to obtain the one that does.

- When you are content with the form, validate your option by clicking the Get now switch. Then, pick the rates plan you want and supply your accreditations to register to have an bank account.

- Method the transaction. Use your credit card or PayPal bank account to finish the transaction.

- Choose the format and download the form on the product.

- Make adjustments. Load, revise and produce and indication the delivered electronically Idaho Irrevocable Letter of Credit.

Every web template you included in your bank account does not have an expiry time which is the one you have for a long time. So, if you wish to download or produce an additional duplicate, just check out the My Forms section and then click on the form you will need.

Gain access to the Idaho Irrevocable Letter of Credit with US Legal Forms, the most comprehensive library of legitimate record layouts. Use thousands of expert and express-certain layouts that meet your business or individual requires and specifications.

Form popularity

FAQ

What Is a Letter of Credit? A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount.

An irrevocable letter of credit should always be obtained from a commercial bank and not drafted by the importer or exporter.

Disadvantages of a letter of credit: Usually covers single transactions for a single buyer, meaning you need a different letter of credit for each transaction. Expensive, tedious and time consuming in terms of absolute cost, working capital, and credit line usage.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

For a secured revocable letter of credit, the buyer has to give a personal guarantee or mortgage security. For an unsecured revocable letter of credit, the bank checks the creditworthiness of the buyer. Please note in both instances, the bank can revoke the LC.

A clean LC is a mechanism through which the beneficiary of the credit can draw a bill of exchange that too without any extra documentation. A clean LC is irrevocable till the period of review begins.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

Inland letter of credit is an obligation of the bank that opens the letter of credit (the issuing bank) to pay the agreed amount to the seller on behalf of the buyer, upon receipt of the documents specified in the letter of credit under domestic business transaction.