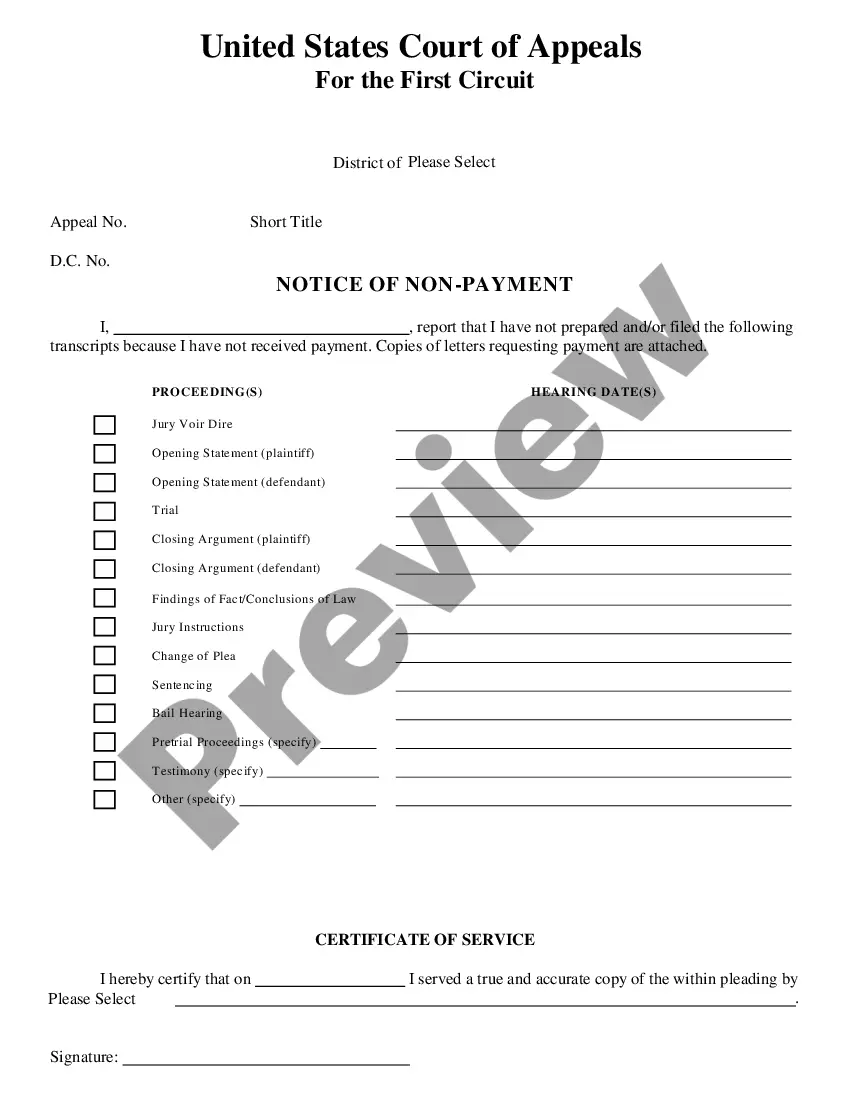

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Idaho Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Are you in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is challenging.

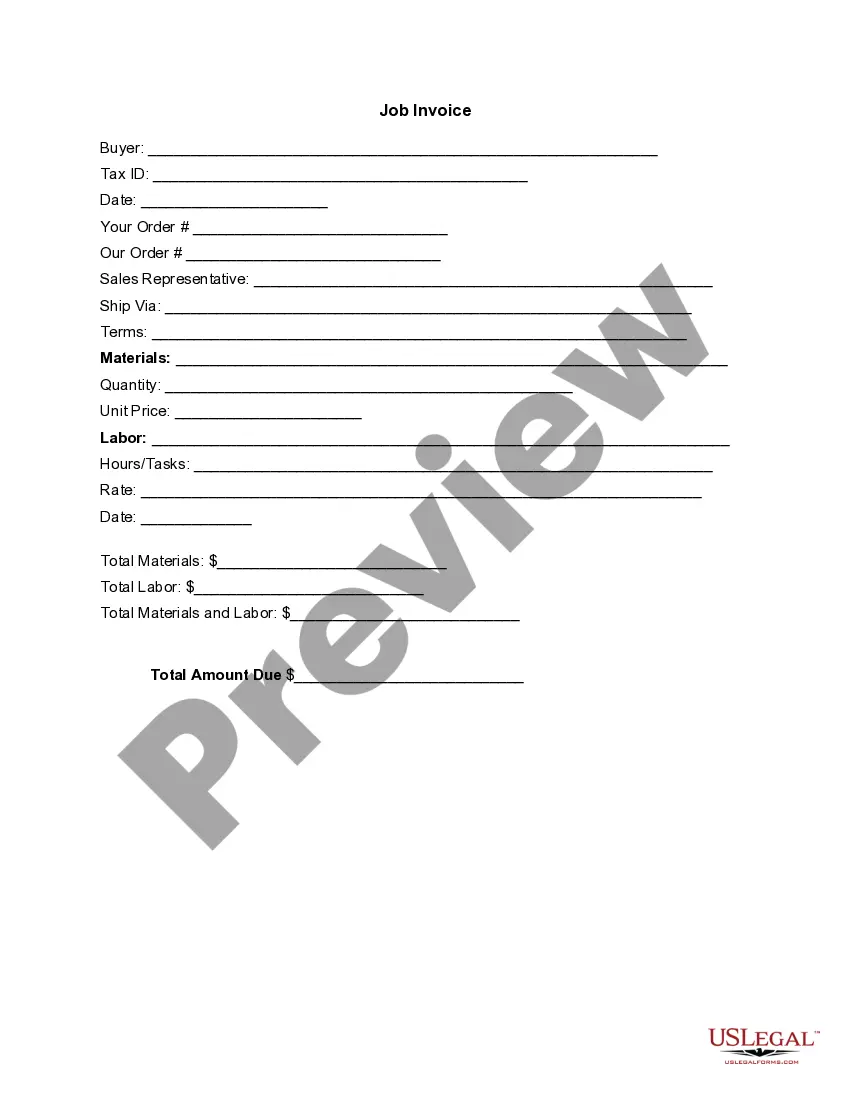

US Legal Forms offers thousands of form templates, such as the Idaho Notice of Default in Payment Due on Promissory Note, designed to meet federal and state requirements.

When you find the suitable form, click Get now.

Choose the pricing plan you prefer, enter the required information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Idaho Notice of Default in Payment Due on Promissory Note template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct city/region.

- Use the Review button to examine the form.

- Check the description to ensure that you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Yes, you can foreclose on a promissory note if the borrower defaults. This process starts with issuing an Idaho Notice of Default in Payment Due on Promissory Note, clearly outlining the debt owed. Legal guidance can help ensure that the foreclosure process is handled correctly and efficiently, protecting your interests.

If you default on a promissory note, the lender may choose to issue an Idaho Notice of Default in Payment Due on Promissory Note. This marks the beginning of potential legal actions, which could include foreclosure. It’s crucial to communicate with your lender if you anticipate defaulting, as they might offer alternatives to mitigate the situation.

Idaho's prompt payment law mandates that all parties comply with timely payment schedules for services rendered, including loans backed by promissory notes. This law helps protect creditors and ensures that borrowers understand their responsibilities. When failures occur, the Idaho Notice of Default in Payment Due on Promissory Note becomes a critical tool for enforcing these payment obligations.

Idaho Code 67-2302 addresses specific duties related to public records and financial disclosures. Understanding this code is essential for anyone involved in real estate or lending in Idaho. If you're navigating issues related to promissory notes, knowledge of this code can enhance your familiarity with local laws and regulations.

To foreclose on a promissory note in Idaho, you must first file a notice of default if the borrower has not made payments. After this, you may proceed with judicial or non-judicial foreclosure processes, depending on your situation. Engaging with a legal professional can simplify this process, ensuring that all legal steps are correctly followed to enforce your rights.

A notice of default in Idaho indicates that a borrower has not made timely payments on a promissory note. This document serves as a formal warning, outlining the missed payments and urging the borrower to take corrective measures. Receiving an Idaho Notice of Default in Payment Due on Promissory Note can lead to serious consequences if not addressed promptly, including potential foreclosure.

Rule 56 outlines summary judgment principles within the Idaho Rules of Civil Procedure. It allows for the expedited resolution of cases when there are no material facts in dispute. Understanding this rule can be essential if you are dealing with complex issues like an Idaho Notice of Default in Payment Due on Promissory Note.

The 45 1505 law in Idaho relates to the legal procedures for debt collection practices concerning secured transactions. This law is critical for lenders and borrowers as it governs how defaults can be addressed. Awareness of this law is beneficial in the context of receiving an Idaho Notice of Default in Payment Due on Promissory Note.

When a default judgment is set aside, the court reinstates the case to its status before the default. This means the parties can then present their arguments and evidence. Understanding this process is crucial for anyone navigating the complexities of an Idaho Notice of Default in Payment Due on Promissory Note.

Rule 55 A )( 1 specifically addresses the process for obtaining a default judgment in Idaho. It outlines how a party can move for default when another party does not respond or appear in court. Recognizing this rule can provide clarity if you encounter an Idaho Notice of Default in Payment Due on Promissory Note.