Idaho Sample Letter for Compromise on a Debt

Description

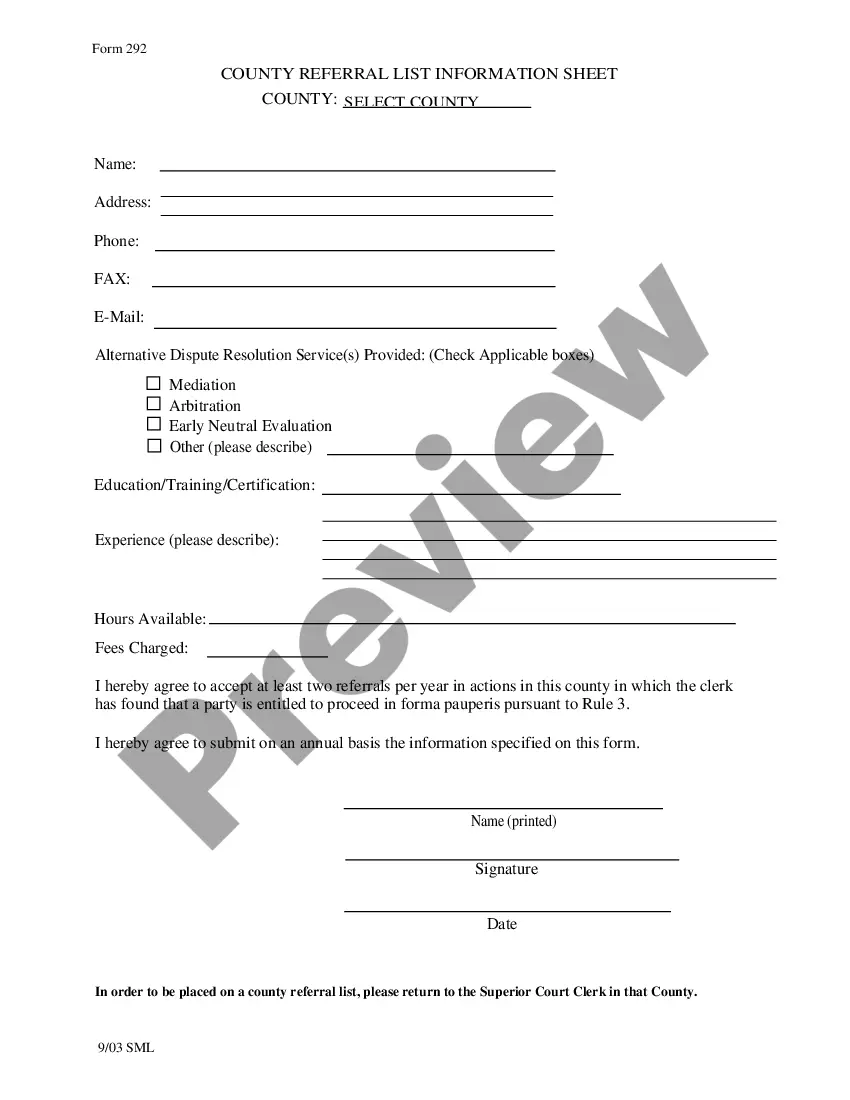

How to fill out Sample Letter For Compromise On A Debt?

If you require to finish, acquire, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site’s simple and convenient search to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. After you have found the form you want, click the Get now button. Choose your preferred pricing plan and enter your details to register for the account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Idaho Sample Letter for Compromise on a Debt in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click on the Download button to retrieve the Idaho Sample Letter for Compromise on a Debt.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s details. Remember to check the description.

- Step 3. If you are unsatisfied with the form, employ the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

You can obtain a debt validation letter by drafting one yourself or utilizing resources available online. It’s essential to include specific information like the account number and a request for proof of the debt. Using an Idaho Sample Letter for Compromise on a Debt simplifies this process and ensures you cover all necessary details. This approach increases your chances of receiving a valid response from the creditor.

Yes, debt validation letters can be an effective tool in managing your debt. When you send a letter that requests verification of the debt, it compels the creditor to provide documentation. This can lead to a review of your case, potentially revealing inaccuracies. Utilizing an Idaho Sample Letter for Compromise on a Debt can further enhance your negotiation process.

To write a letter to dispute a debt, start by clearly stating your intention to contest the validity of the debt. Include your name, contact information, and account details for easy reference. Use an Idaho Sample Letter for Compromise on a Debt as a guide; specify the reasons for your dispute and request documentation from the creditor to support their claim. This approach helps protect your rights and ensures a formal record of your communication.

The 777 rule for debt collectors lays out limits on how frequently they can contact consumers. The rule essentially states that a debt collector should limit their communications to no more than seven times over a span of seven days. Being aware of this rule can help you in negotiations, especially when drafting an Idaho Sample Letter for Compromise on a Debt.

Writing a good debt settlement letter involves clearly stating your circumstances and offering a specific amount for settlement. You should provide a brief explanation of why you're making this offer, focusing on your willingness to resolve the debt. An Idaho Sample Letter for Compromise on a Debt can serve as a great starting point, guiding you on language and structure.

To fill out a debt validation letter, you first need to clearly state your personal information, including your name and address, as well as the details of the debt. Next, request that the collector provide proof of the debt's validity. Using an Idaho Sample Letter for Compromise on a Debt as a template can streamline this process, ensuring that all necessary points are covered.

The 777 rule refers to a guideline that protects consumers from aggressive debt collection practices. It suggests that debt collectors should not contact you more than seven times within a seven-day period. Understanding the 777 rule is essential when negotiating debt, as it can empower you to use an Idaho Sample Letter for Compromise on a Debt more effectively.

A sample letter for a settlement offer should clearly outline your intention to settle the debt, including the proposed amount and terms. Include necessary details such as your account number and personal information. Using an Idaho Sample Letter for Compromise on a Debt not only streamlines your process but also enhances your credibility in the eyes of creditors.

An example of a dispute letter for a debt includes your personal details, a statement disputing the debt, and any supporting evidence. State why the debt is inaccurate and request verification from the creditor. For structured communication, you may refer to an Idaho Sample Letter for Compromise on a Debt to draft your dispute letter seamlessly.

The 7 7 7 rule for debt collection is a guideline that suggests you should not communicate with a debtor more than seven times in seven days. This rule aims to prevent harassment and ensures that collectors operate within legal limits. When drafting your Idaho Sample Letter for Compromise on a Debt, understanding this rule can help you maintain your rights while negotiating.