Idaho Sample Letter for Withheld Delivery

Description

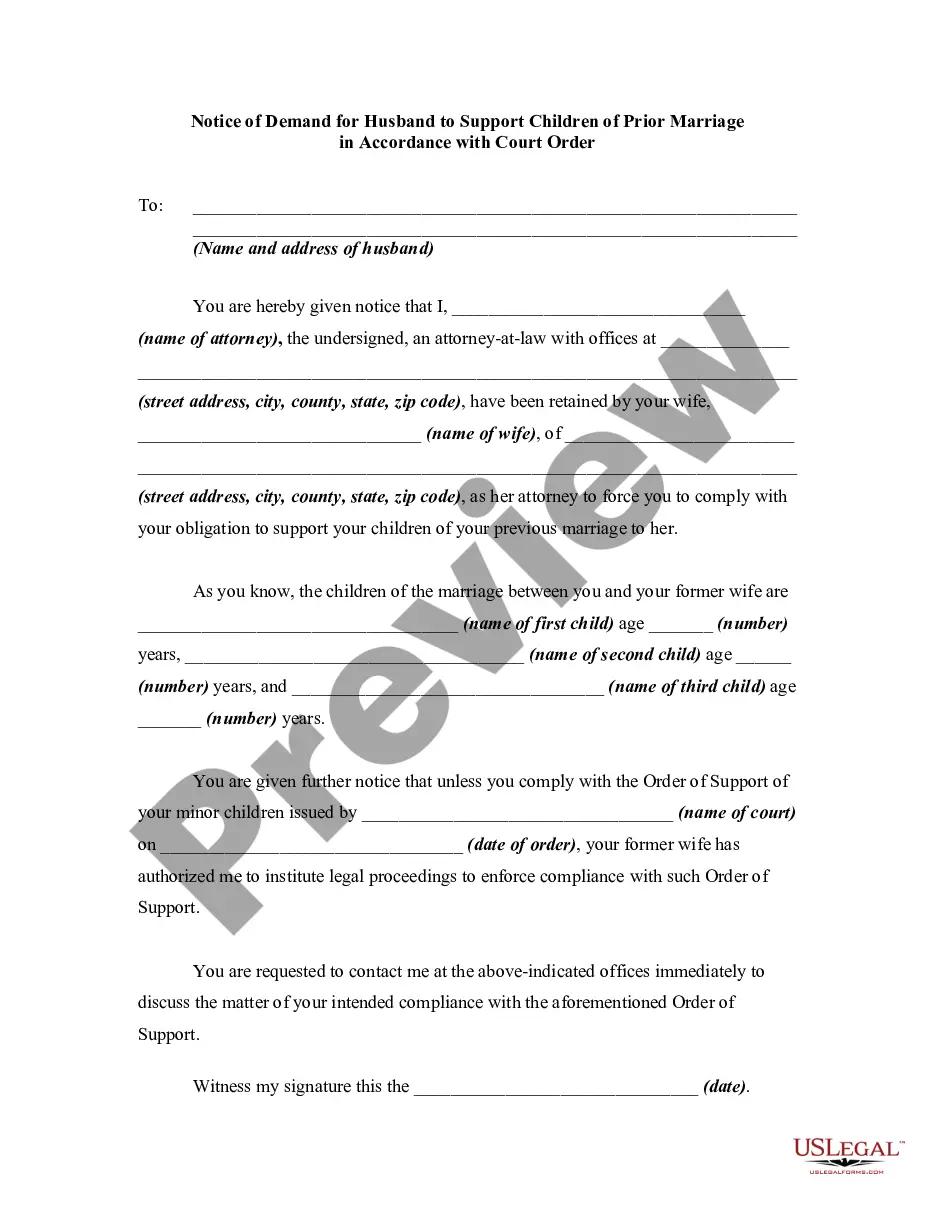

How to fill out Sample Letter For Withheld Delivery?

You can invest time online trying to locate the authentic document template that meets the federal and state criteria you need.

US Legal Forms offers a wide variety of official forms that are reviewed by experts.

It is easy to obtain or print the Idaho Sample Letter for Withheld Delivery from our service.

If you wish to find another version of the form, use the Search field to locate the template that fits your requirements and needs. After you have found the template you desire, click Buy now to proceed. Choose the pricing plan you want, enter your details, and register for a free account on US Legal Forms. Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the official form. Select the format of the document and download it to your device. Make adjustments to your document if needed. You can complete, modify, sign, and print the Idaho Sample Letter for Withheld Delivery. Access and print a multitude of document templates through the US Legal Forms website, which provides the largest selection of official forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Then, you can complete, modify, print, or sign the Idaho Sample Letter for Withheld Delivery.

- Every official document template you buy is yours permanently.

- To get another copy of the purchased form, navigate to the My documents section and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Check the form details to confirm you have picked the accurate form.

Form popularity

FAQ

Idaho form 910 is used to report state withholding information for various types of income, including wages and other payments. It helps both employers and the state keep track of income tax withholdings accurately. Prompt and accurate filing of this form is vital for compliance with Idaho tax law. To streamline your reporting, an Idaho Sample Letter for Withheld Delivery could provide useful guidance.

The state withholding tax form in Idaho is primarily used by employers to report taxes withheld from employee wages. This form is essential for accurate financial reporting and compliance with state regulations. Employers must ensure they submit the form as required to avoid penalties. Consider using an Idaho Sample Letter for Withheld Delivery for any correspondence related to your filings.

To obtain an Idaho withholding account number, you must register with the Idaho State Tax Commission. This can be done online or through a paper application, depending on your preference. Upon successful registration, you will receive your account number, which is crucial for employer tax filings. Utilizing an Idaho Sample Letter for Withheld Delivery can aid in effectively communicating with the tax commission during this process.

Yes, Idaho has its own W-4 form, which employees use to indicate their state income tax withholding preferences. It allows individuals to adjust the amount withheld based on their personal financial situation. It is essential for accurate payroll processing and compliance with state tax laws. An Idaho Sample Letter for Withheld Delivery can help in clearly communicating any changes or requests related to this form.

A 967 form in Idaho is used to report adjustments to the state withholding for various situations, such as correcting previously reported figures. This form helps ensure accurate withholding records are maintained by the Idaho State Tax Commission. Proper usage of the form is vital to avoid discrepancies with your tax obligations. You may want to use an Idaho Sample Letter for Withheld Delivery to guide your submissions.

You can find state withholding on your W-2 form in Box 17, which details the total wages subjected to state income tax and the amount withheld. This information is essential when preparing your state tax return. Make sure to check this box carefully, as accurate reporting ensures compliance with Idaho tax regulations. If you need to provide clarity in your communication, an Idaho Sample Letter for Withheld Delivery can be beneficial.

Yes, Idaho has a state withholding form that employers must complete to report taxes withheld from employee wages. This form reflects how much state income tax has been deducted throughout the year. It's essential to keep accurate records to maintain compliance and avoid potential issues. Referencing an Idaho Sample Letter for Withheld Delivery can provide clarity when moving through the paperwork.

Idaho form 910 is primarily used for reporting state income tax withheld from employees and certain payments. It serves as a formal declaration of your withholding obligations to the state. Accurate completion of this form is crucial to avoid penalties and ensure compliance. An Idaho Sample Letter for Withheld Delivery may assist in organizing the submission details.

To file Idaho 967, begin by obtaining the form from the Idaho State Tax Commission's website. Fill in the required details accurately, ensuring you follow the instructions provided. Once completed, submit the form via mail or online depending on your preference. Utilizing an Idaho Sample Letter for Withheld Delivery can also simplify the submission process.

If you are an independent contractor or business owner in Idaho, you may need to file the 1099-NEC form to report payments of $600 or more made to non-employees. This filing requirement applies if you are engaging with other individuals or businesses as part of your operations. In situations where delivery is withheld due to incomplete or missing tax information, using an Idaho Sample Letter for Withheld Delivery can clarify the matter instead of causing confusion. Make sure to stay informed about the deadlines for submitting the 1099-NEC to avoid penalties.