A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, since the beneficiary of a trust has disclaimed any rights he has in the trust, the trustor and trustee are terminating the trust.

Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary

Description

How to fill out Agreement Between Trustor And Trustee Terminating Trust After Disclaimer By Beneficiary?

US Legal Forms - one of the finest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By using the website, you will access thousands of forms for business and personal purposes, categorized by classes, states, or keywords. You can find the most recent versions of forms like the Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary in just a few minutes.

If you possess a registration, Log In and download the Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary through the US Legal Forms repository. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. Each template you stored in your account does not have an expiry date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

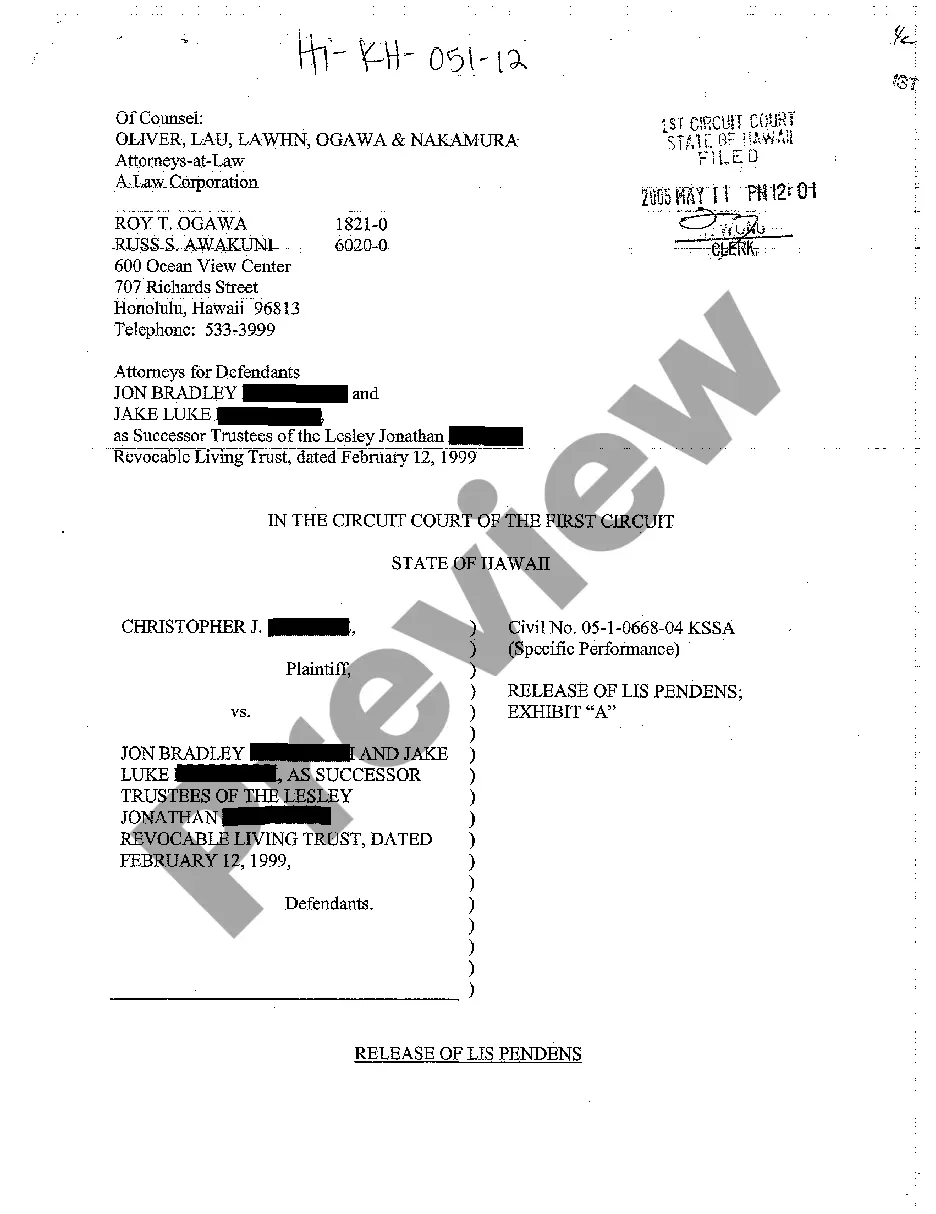

- Click the Review button to examine the content of the form.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Section 45 1504 in Idaho governs the specific conditions under which trusts can be disclaimed. This section is particularly relevant when considering the Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary. Understanding this section is vital for beneficiaries who wish to explore their options regarding trust interests, ensuring they comply with state laws safeguarding their rights.

Yes, a beneficiary can pursue the removal of a trustee, but they typically must present valid legal reasons for doing so. The Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can outline circumstances that might justify a trustee's removal, such as misconduct or failure to adhere to the trust’s terms. It is essential for beneficiaries to follow legal procedures and consult with an attorney to ensure the process is handled correctly.

To dissolve a trust, you need to follow the guidelines set forth in the trust agreement, which may outline specific conditions for termination. Representing the interests of the beneficiaries, the Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary can provide clarity on the process. Generally, the trustee, with the agreement of the beneficiaries, will distribute the assets of the trust to fulfill its obligations before formally dissolving the trust.

A trust can typically be terminated in three primary ways: by the consent of the beneficiaries, by the express terms stated in the trust document, or by court order. In the case of the Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, beneficiary consent plays a crucial role in the termination process. Understanding these methods can help beneficiaries effectively navigate the complexities of trust termination.

A beneficiary can initiate the termination of a trust by submitting a proper disclaimer. This process, outlined in the Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, involves formally rejecting their interest in the trust. When a beneficiary disclaims their interest, it allows for the trust to dissolve and assets to be redistributed according to the trust's terms. It is advisable to consult legal advice to ensure compliance with Idaho's specific legal requirements.

Yes, a trust can terminate if all beneficiaries mutually agree to do so, provided they comply with Idaho laws governing trust termination. This consensus allows for a clean dissolution of the trust and ensures that all parties are on the same page. When navigating an Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, understanding the termination process is vital for a smooth conclusion.

Spousal abandonment in Idaho occurs when one spouse leaves or stops supporting the other without justification. This can lead to various legal implications, especially in divorce or property distribution cases. When drafting an Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, it is crucial to understand how abandonment may affect trust terms.

Section 68-106 in Idaho addresses types of property that can be included in a trust. This code helps clarify what assets beneficiaries may be entitled to. When you formulate an Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, knowing this section can guide effective asset management.

Possession with intent to distribute in Idaho refers to holding illegal substances with the plan to sell or distribute them. This legal definition is significant in criminal cases and can have serious consequences. While this topic may seem unrelated, understanding Idaho's legalities can be beneficial when considering agreements like the Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary.

Idaho Code 15-7-303 deals with the powers and duties of trustees. It specifies how trustees must act in the best interests of the beneficiaries while managing trust assets. This legal framework is important when exploring an Idaho Agreement between Trustor and Trustee Terminating Trust after Disclaimer by Beneficiary, as it impacts decision-making for trusts.