Idaho Certificate of Trust for Successor Trustee

Description

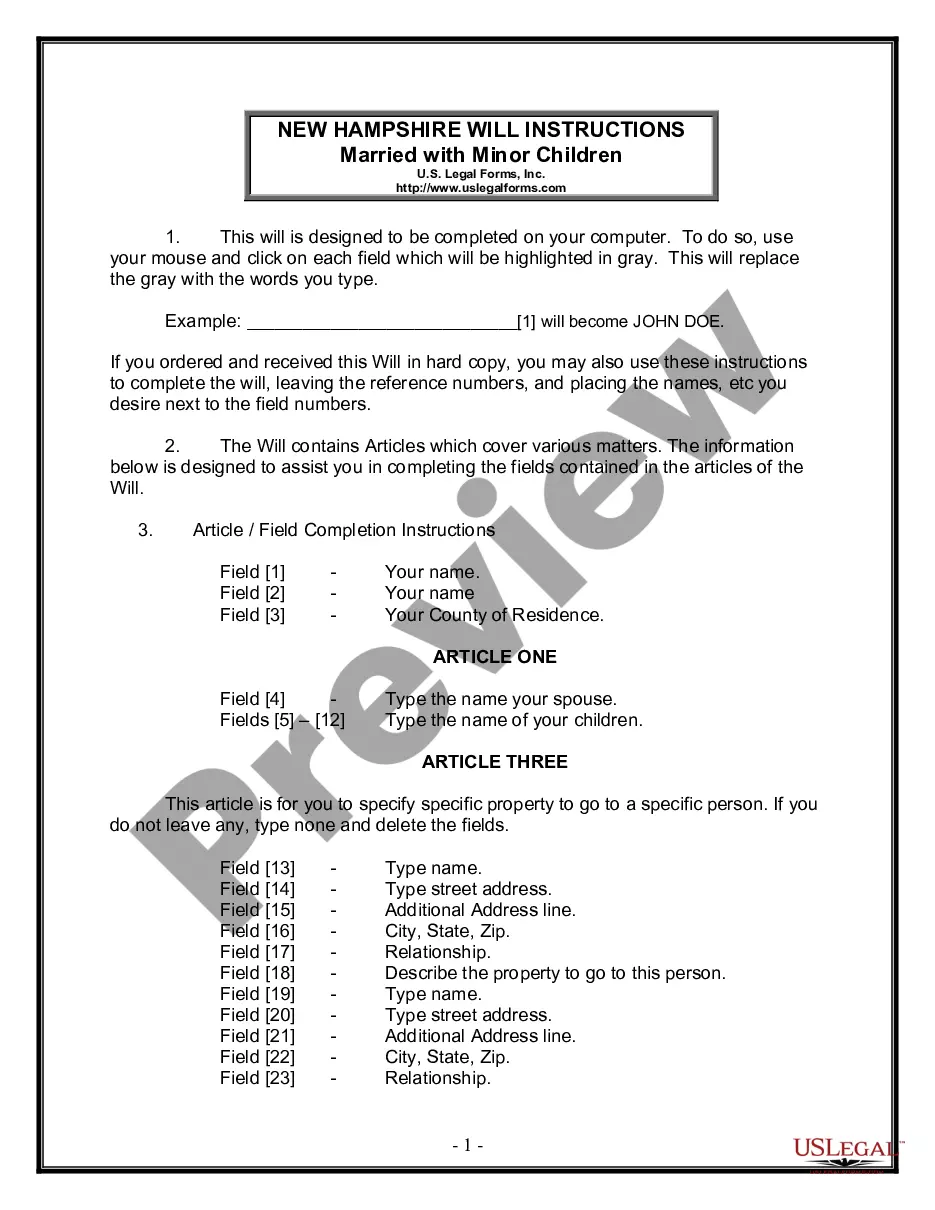

How to fill out Certificate Of Trust For Successor Trustee?

If you have to complete, obtain, or print legal papers web templates, use US Legal Forms, the most important variety of legal types, which can be found on-line. Use the site`s basic and hassle-free search to obtain the documents you require. Various web templates for organization and personal reasons are categorized by categories and states, or key phrases. Use US Legal Forms to obtain the Idaho Certificate of Trust for Successor Trustee in a couple of mouse clicks.

If you are currently a US Legal Forms consumer, log in in your bank account and click the Download key to get the Idaho Certificate of Trust for Successor Trustee. You can also entry types you earlier delivered electronically from the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for the right area/land.

- Step 2. Make use of the Preview option to examine the form`s information. Do not overlook to learn the outline.

- Step 3. If you are unhappy with the kind, take advantage of the Research area towards the top of the screen to locate other types of your legal kind web template.

- Step 4. After you have identified the shape you require, go through the Purchase now key. Select the costs strategy you choose and add your credentials to sign up to have an bank account.

- Step 5. Process the financial transaction. You may use your bank card or PayPal bank account to perform the financial transaction.

- Step 6. Choose the format of your legal kind and obtain it on the gadget.

- Step 7. Full, change and print or indication the Idaho Certificate of Trust for Successor Trustee.

Each legal papers web template you buy is the one you have eternally. You have acces to every kind you delivered electronically inside your acccount. Click the My Forms section and select a kind to print or obtain once more.

Be competitive and obtain, and print the Idaho Certificate of Trust for Successor Trustee with US Legal Forms. There are many expert and express-particular types you can utilize to your organization or personal demands.

Form popularity

FAQ

How to Get a Copy of a Trust Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

45-1502. Definitions ? Trustee's charge. As used in this act: (1) "Beneficiary" means the person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or his successor in interest, and who shall not be the trustee.

Registration shall be accomplished by filing a statement indicating the name and address of the trustee in which it acknowledges the trusteeship. The statement shall indicate whether the trust has been registered elsewhere.

To create a living trust in Idaho, you create and then sign a declaration of trust in front of a notary. You then transfer ownership of assets into the trust to fund it. At this point it becomes effective. A revocable living trust offers a variety of benefits that may appeal to you and fill your needs.

There are some important benefits to utilizing an irrevocable trust, including: Minimizing estate taxes. Protecting and sheltering assets. Helping a trust beneficiary qualify for government benefits.

Although about 60% of the US states are mortgage states, Idaho is considered a deed state. A deed of trust is an agreement between a beneficiary, grantor, and trustee. A deed is signed to a trustee as a form of security to ensure that the performance of obligation is fulfilled.

68-114. Presentation of a certification of trust in lieu of the trust instrument ? Effect ? Form. (1) A trustee may present a certification of trust to any person in lieu of a copy of any trust instrument to establish the existence or terms of the trust.

Duty to register trusts. The trustee of a trust having its principal place of administration in this state shall register the trust in the court of this state at the principal place of administration.