Idaho Lease of Restaurant

Description

How to fill out Lease Of Restaurant?

If you desire to accumulate, acquire, or create authentic document templates, utilize US Legal Forms, the largest repository of legal forms, accessible online.

Employ the site's user-friendly and convenient search feature to find the documents you require.

Numerous templates for commercial and personal applications are categorized by sections and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account for payment.

Step 6. Choose the format of your legal form and download it to your device.

- Utilize US Legal Forms to locate the Idaho Lease of Restaurant in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to acquire the Idaho Lease of Restaurant.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

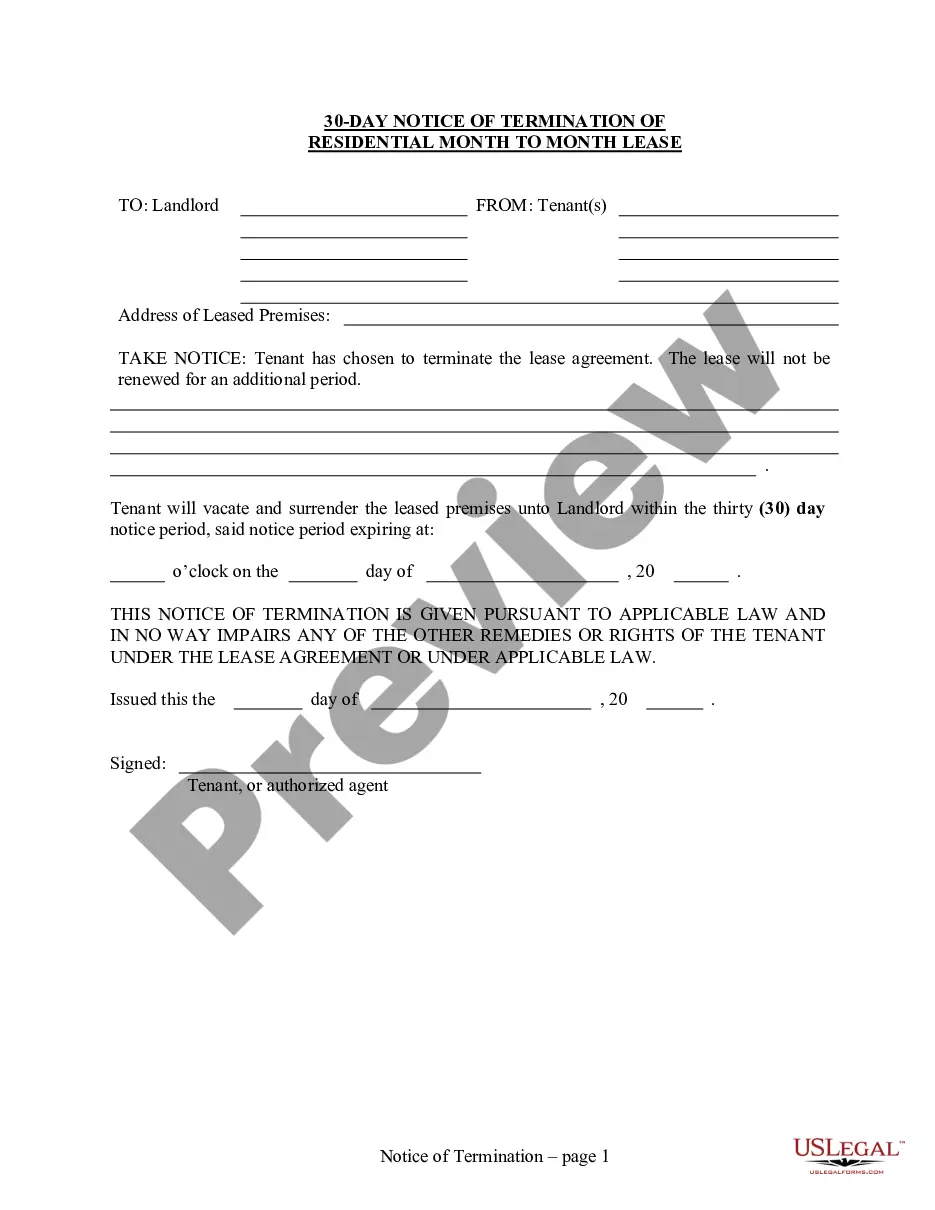

- Step 2. Utilize the Preview feature to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to locate alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose your preferred pricing plan and enter your information to register for an account.

Form popularity

FAQ

Idaho offers a balanced approach to landlord and tenant relations, promoting fair agreements. If you’re considering an Idaho Lease of Restaurant, understanding local laws and regulation is key. Many tenants find Idaho's laws reasonable, helping them establish solid working relationships. Resources like USLegalForms can assist you in crafting a lease that benefits all parties involved.

In Idaho, the taxability of leases can depend on the type of lease and the goods involved. Generally, leases are subject to sales tax unless they qualify for specific exemptions. When considering an Idaho Lease of Restaurant, understanding these nuances will help you navigate taxes effectively. Consulting a legal professional or resources like USLegalForms can provide clarity.

Restaurant tax in Idaho generally refers to sales tax applied to food and beverages sold in restaurants. This tax is a key consideration when drafting an Idaho Lease of Restaurant, as it affects overall operational costs. Awareness of these taxes can help better manage your budget and financial forecasts. For detailed information, consult tax professionals or resources like USLegalForms.

Currently, New York holds the title for the highest restaurant tax in the United States. For those exploring an Idaho Lease of Restaurant, it's helpful to understand how Idaho's tax rates compare. While Idaho's rates are lower, staying informed about tax obligations remains crucial. This understanding can influence location decisions for your restaurant.

The tax rate in Idaho varies based on income and type of goods sold. For an Idaho Lease of Restaurant, businesses should consider both sales tax and income tax rates. The state has a progressive income tax rate that can go up to 6.5%. It’s important to stay informed about these rates to ensure compliance and optimal financial planning.

To open a restaurant in Idaho, you need a solid business plan, funding, licenses, and a location. In addition, securing an Idaho Lease of Restaurant can help ensure you have the right space to serve your customers. Familiarizing yourself with local regulations can streamline your opening process.

Writing a lease involves specifying details such as the parties involved, property description, lease term, rent amount, and conditions for termination. Clarity is essential to avoid disputes, so drafting with precision is key. Utilizing templates from USLegalForms can simplify this process for your Idaho Lease of Restaurant.

The best type of lease for a restaurant often depends on your business model and location. Typically, a long-term lease offers stability, while a percentage lease can reduce initial costs during slow months. Regardless of the type, securing a well-defined Idaho Lease of Restaurant will protect your interests and adaptability.

Yes, in Idaho, most businesses must obtain a business license, though requirements can vary by city or county. It's important to check local regulations to ensure compliance. When establishing your Idaho Lease of Restaurant, acquiring the necessary business licenses will help you operate legally.

To get out of a lease in Idaho, you should carefully review the lease agreement for termination clauses and notice requirements. It's advisable to communicate with your landlord, as they may be willing to negotiate an early termination. If you're facing challenges, exploring options through resources like USLegalForms might help you understand your rights regarding your Idaho Lease of Restaurant.