Idaho Direct Deposit Form for OAS

Description

How to fill out Direct Deposit Form For OAS?

US Legal Forms - one of the largest collections of legal documents in the country - offers a broad selection of legal template records that you can download or print.

By utilizing the website, you can discover thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent versions of forms like the Idaho Direct Deposit Form for OAS within minutes.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

If you're satisfied with the form, confirm your choice by clicking the Buy Now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- If you have a subscription, Log In to download the Idaho Direct Deposit Form for OAS from the US Legal Forms database.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/county.

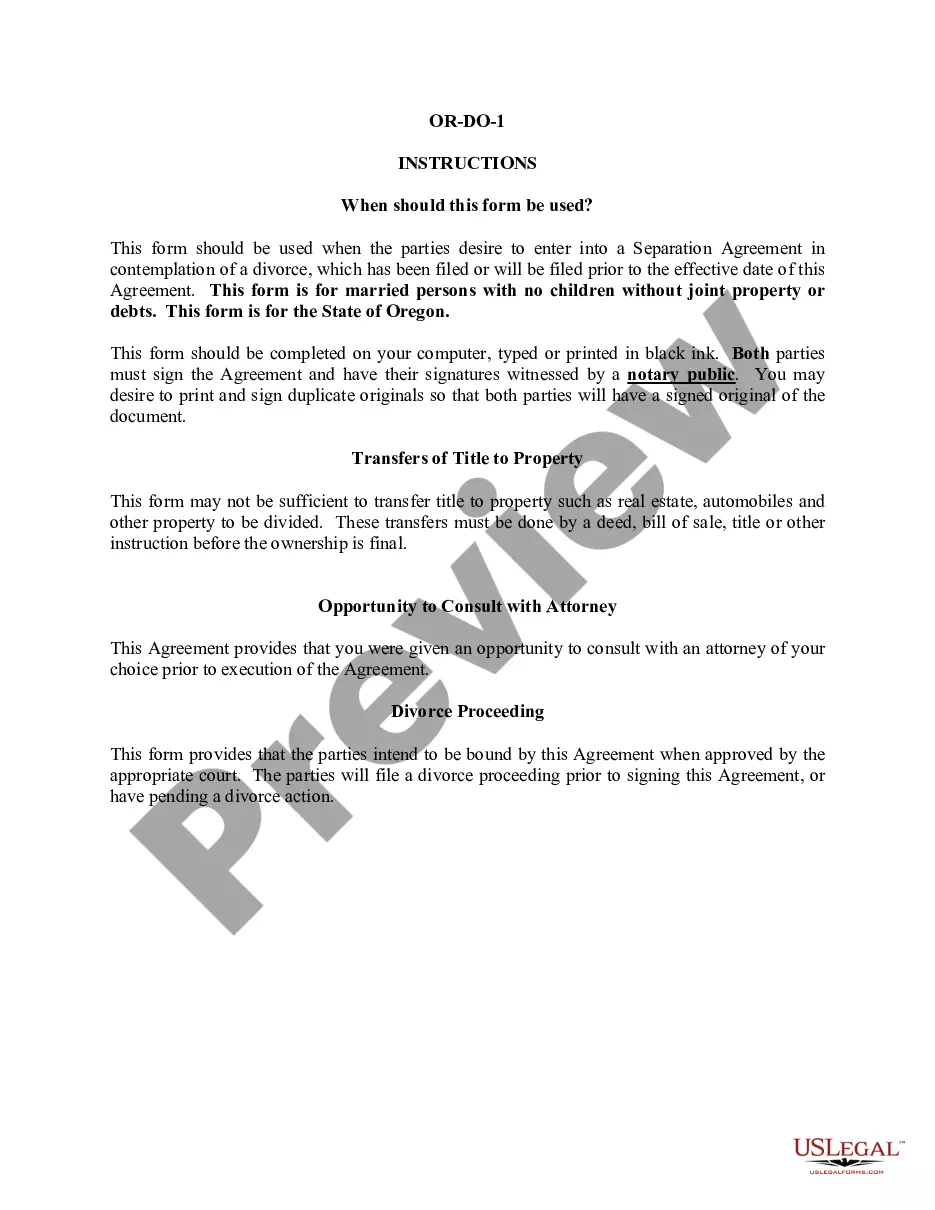

- Click the Review button to examine the content of the form.

Form popularity

FAQ

You can easily obtain the Idaho Direct Deposit Form for OAS online. Visit the Idaho State Department of Health and Welfare website where you can download and print the form. This method allows you to complete the necessary information from the comfort of your home, saving you time. If you need assistance, uslegalforms offers resources that can guide you through the process.

You should mail your Idaho tax return to the Idaho State Tax Commission at the designated address outlined on their official website. Depending on whether you are expecting a refund or need to make a payment, the address may vary. Be sure to use the correct address to ensure your return is processed without issues. Confirm the mailing timelines to avoid any missed deadlines.

To submit your Idaho Direct Deposit Form for OAS, you should complete the form and gather any necessary documents. After that, you can either mail it to the designated state office or submit it electronically if an option is provided on their platform. Make sure to follow the submission guidelines to ensure timely processing. Confirm your submission method to avoid any delays in receiving your funds.

Whether you need to file an Idaho tax return primarily depends on your income and filing status. If you have received any income subject to Idaho tax, it is advisable to file a return. Failure to do so may result in penalties. If you have further questions about your specific situation, consider consulting a tax professional to clarify your responsibilities.

You can send your Idaho Direct Deposit Form for OAS directly to the Idaho State Department of Health and Welfare. Make sure to check their website for the most current address to avoid any delays. Sending your form by certified mail can provide you with tracking for your records. It is essential to double-check the details before sending to ensure everything is accurate.

Yes, you can set up direct deposit without visiting a bank, thanks to online services. Many employers and benefit providers allow you to submit your Idaho Direct Deposit Form for OAS digitally, making it simple and efficient. Just make sure you have the right account information ready, and you can complete the process from the comfort of your home.

Unfortunately, you cannot set up direct deposit without a bank account—direct deposit relies on your bank details to complete the transaction. However, you can explore alternative solutions such as prepaid cards that accept direct deposits. Make sure to check if your provider accepts these options, as some may offer flexibility even without a traditional bank account.

Filling out direct deposit information involves providing details like your bank account number, routing number, and your personal identification. The Idaho Direct Deposit Form for OAS typically includes these fields, making it easy for you to provide accurate information. Double-check all entries to ensure that your funds are deposited correctly and on time.

To change your direct deposit from one bank to another, you will need to fill out a new direct deposit enrollment form with your new bank's details. Notify your employer or benefits provider and provide them with the updated Idaho Direct Deposit Form for OAS. It’s essential to ensure that you complete this task before the next payment cycle to prevent any interruptions in your deposits.

You can make a deposit without going to the bank by using mobile banking apps or online banking features. Many banks allow you to upload checks through their app, or you can set up direct deposit to receive your payments automatically. Using the Idaho Direct Deposit Form for OAS means you can streamline your deposits and avoid trips to the bank altogether.