Idaho Acknowledgment by Debtor of Correctness of Account Stated

Description

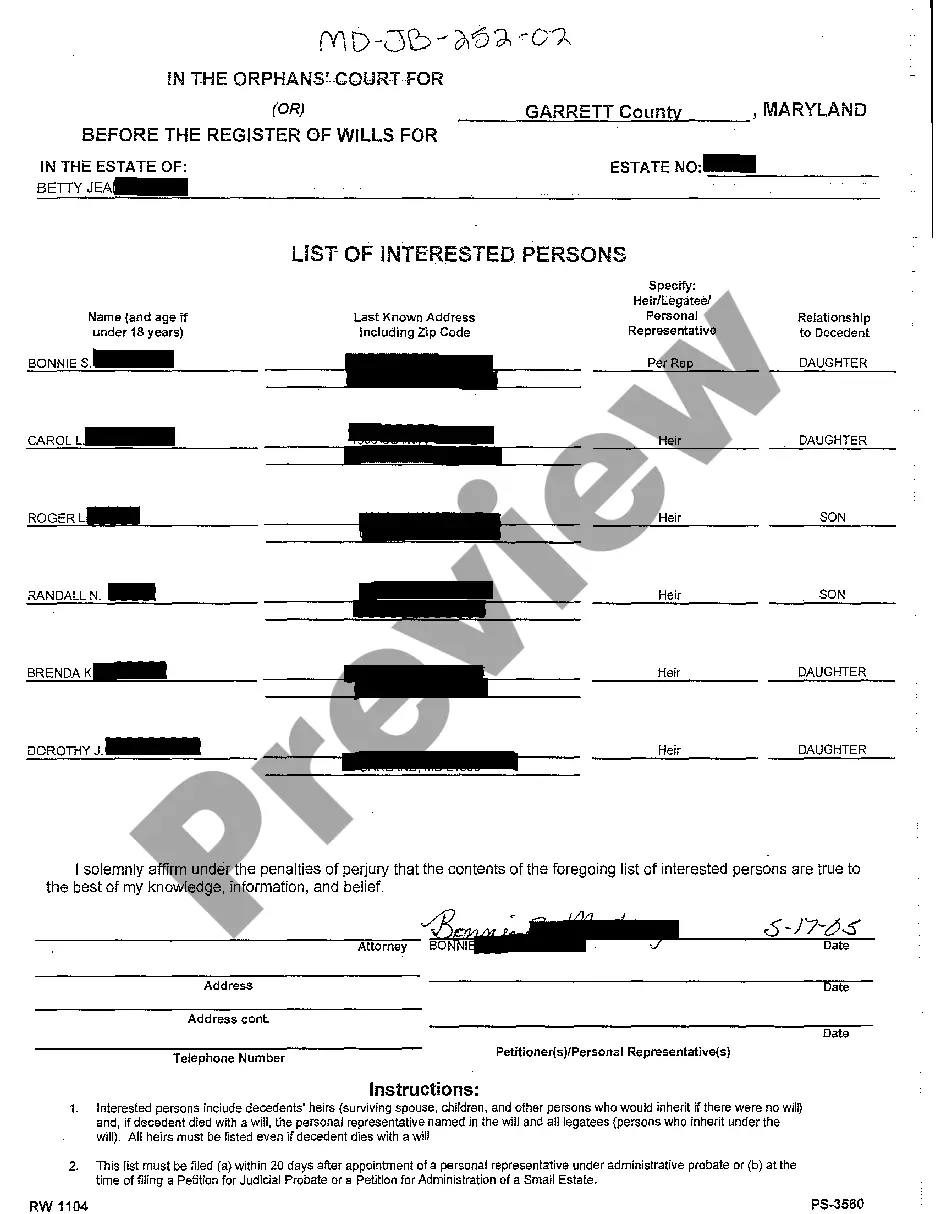

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

If you desire to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly search feature to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you require, click the Purchase now button. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Idaho Acknowledgment by Debtor of Correctness of Account Stated in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Idaho Acknowledgment by Debtor of Correctness of Account Stated.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

An Acknowledgment of Debt is a contract which both a debtor and creditor sign acknowledging that a debtor is indebted to the creditor and for how much as well as setting out the payment terms of paying off the debt owed.

For most types of debt in England, Wales and Northern Ireland, the limitation period is six years. This applies to most common debt types such as credit or store cards, personal loans, gas or electric arrears, council tax arrears, benefit overpayments, payday loans, rent arrears, catalogues or overdrafts.

In it the debtor acknowledges that he or she owes a particular sum of money to the creditor and undertakes to repay what is owing. An AOD requires no more than this in order for it to be legally valid and binding on the signatory.

An acknowledgment of a debt or liability by a debtor in writing or a partial payment of the outstanding dues, during the subsisting period of limitation, extends the period of limitation. There are several cases pending before the Supreme Court in which these issues have cone up for consideration.

A Debt Acknowledgment Letter is a document signed by one primary party, the debtor, as an acknowledgment of a specific amount of money owed to another party, the creditor.

The Creditor's claim will only prescribe after the period of three years have lapsed from the date of the acknowledgement of debt, even if the debt was admitted without prejudice.

'In principle, . . .a document is liquid if it demonstrates, by' its terms, an unconditional acknowledgement of indebtedness in a fixed or ascertainable amount of money due to the plaintiff.

Time limitations The Statute of Limitation is three years in South Africa. Once this time period has elapsed the debtor can refuse to pay the outstanding account, unless summons has been issued by the courts prior to the expiration date.

Acknowledgement of Debt. Section 18 of the limitation act covers acknowledgement of debt and thus the fresh start of the limitation period. It is a tool which always plaintiff uses to say that his suit is within the limitation period as there is an acknowledgement as per s.

Do hereby acknowledge that I am truly and lawfully indebted to 202620262026202620262026202620262026202620262026202620262026202620262026202620262026 I hereby bind myself to pay the full amount of the said capital by not later than 202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026 (insert final date of repayment) Interest will be charged should payment not be received on the due date.