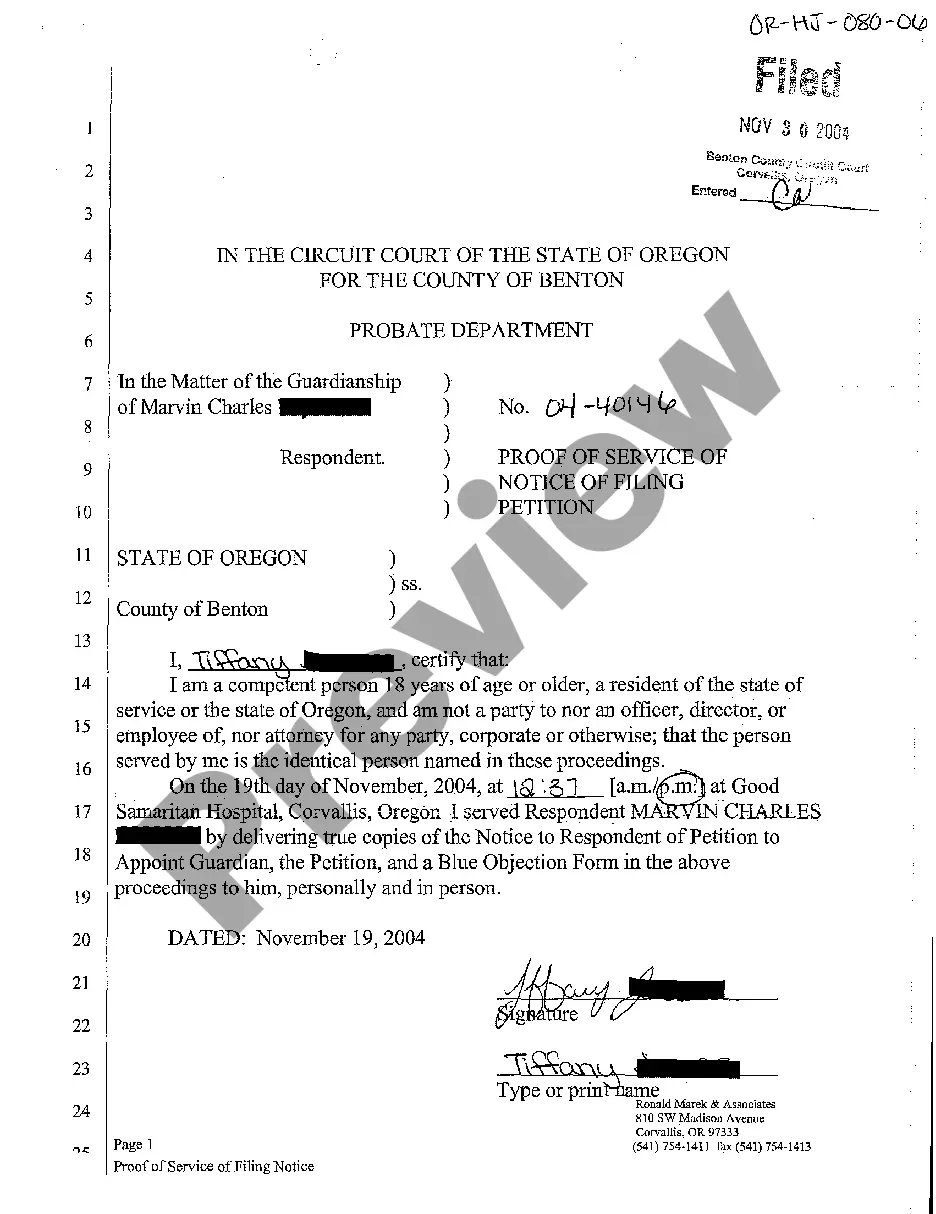

This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Idaho Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal file templates you can download or print. By using the site, you will find thousands of forms for business and personal needs, categorized by types, states, or keywords. You can access the latest versions of forms like the Idaho Application for Certificate of Discharge of IRS Lien within moments.

If you have a monthly subscription, Log In and download the Idaho Application for Certificate of Discharge of IRS Lien from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you begin: Ensure you have selected the correct form for your city/state. Click the Review button to check the form’s content. Read the form description to confirm you have chosen the right document. If the form doesn’t suit your requirements, use the Search field at the top of the page to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred payment method and provide your details to register for the account. Process the payment. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Idaho Application for Certificate of Discharge of IRS Lien. Every template you add to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Gain access to the Idaho Application for Certificate of Discharge of IRS Lien with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

If you need to change or amend an accepted Idaho State Income Tax Return for the current or previous Tax Year, you need to complete Form 40 (residents) or Form 43 (nonresidents and part-year residents). You can prepare a current tax year Idaho Tax Amendment on eFile.com, however you cannot submit it electronically.

Function:ID Tax Amendment Form 40 or 43. This Form can be used to file a: Tax Return, Tax Amendment, Change of Address. Check the "Amended Return" box on the Form. Description:Step 1: Download, Complete Form 40 (residents) or 43 (nonresidents and part-year residents) for the appropriate Tax Year below.

This requirement was further extended to September 30, 2023. Form 10F is a self-declaration required to be submitted by non-resident taxpayers as a covering of Tax Residency Certificate. It enables non-residents to get relief on TDS on income accruing from India.

If one is uncertain as to the status of the lien in question, our UCC Status Search may be used, or one may contact the UCC Division by calling 208-334-3191.

Non-resident taxes When you prepare your U.S. tax return, you'll use Form 1040NR.

The Idaho State Tax Commission may place a lien on all of the Idaho real and personal property of a delinquent taxpayer for any unpaid Idaho tax, penalty, or interest when a demand for payment is made.

Form 24 offers a yearly refund for some of the sales tax you pay on groceries. The form is for qualifying Idaho residents age 65 and older who aren't required to file an income tax return. The refund is $120 a person.

If you're a nonresident alien, you must file an Idaho return if your gross income from Idaho sources is more than $2,500. If you file Form 1040NREZ or Form 1040NR with the Internal Revenue Service (IRS), you must use Idaho Form 43. Mark your residency status on the return as ?Nonresident.?